- United States

- /

- Electrical

- /

- NasdaqCM:OESX

3 Penny Stocks On US Exchange With Market Caps Over $3M

Reviewed by Simply Wall St

As the U.S. market looks to rebound from a Fed-fueled sell-off, investors are exploring diverse opportunities to capitalize on potential growth. Penny stocks, despite their somewhat outdated moniker, continue to capture interest due to their potential for high returns when backed by strong financials. For those willing to explore beyond well-known names, these smaller or newer companies can offer promising prospects with a blend of value and growth that larger firms may not provide.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $3.95 | $1.93B | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.905 | $6.59M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $108.87M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.78 | $87.36M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.21 | $8.8M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.445 | $47.52M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.9632 | $17.69M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.80 | $77.26M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.58 | $381.2M | ★★★★☆☆ |

Click here to see the full list of 739 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Orion Energy Systems (NasdaqCM:OESX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Orion Energy Systems, Inc. is involved in the research, design, development, manufacturing, marketing, sales, installation, and implementation of energy management systems for various sectors including commercial office and retail lighting across North America and Germany with a market cap of $27.14 million.

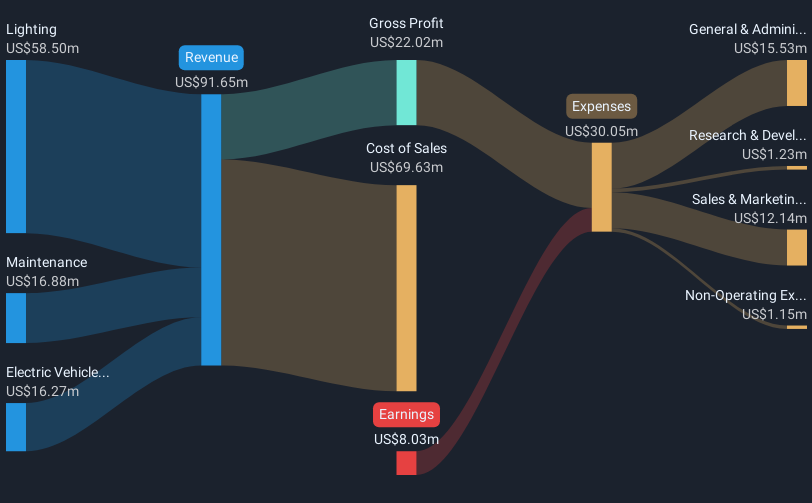

Operations: The company's revenue is primarily derived from its Lighting segment at $58.50 million, followed by Maintenance at $16.88 million, and Electric Vehicle Charging at $16.27 million.

Market Cap: $27.14M

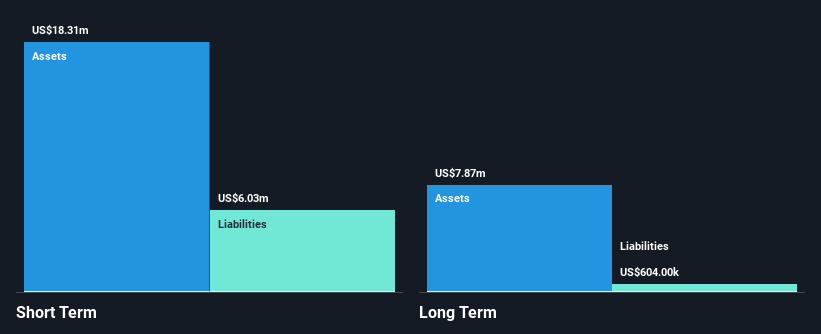

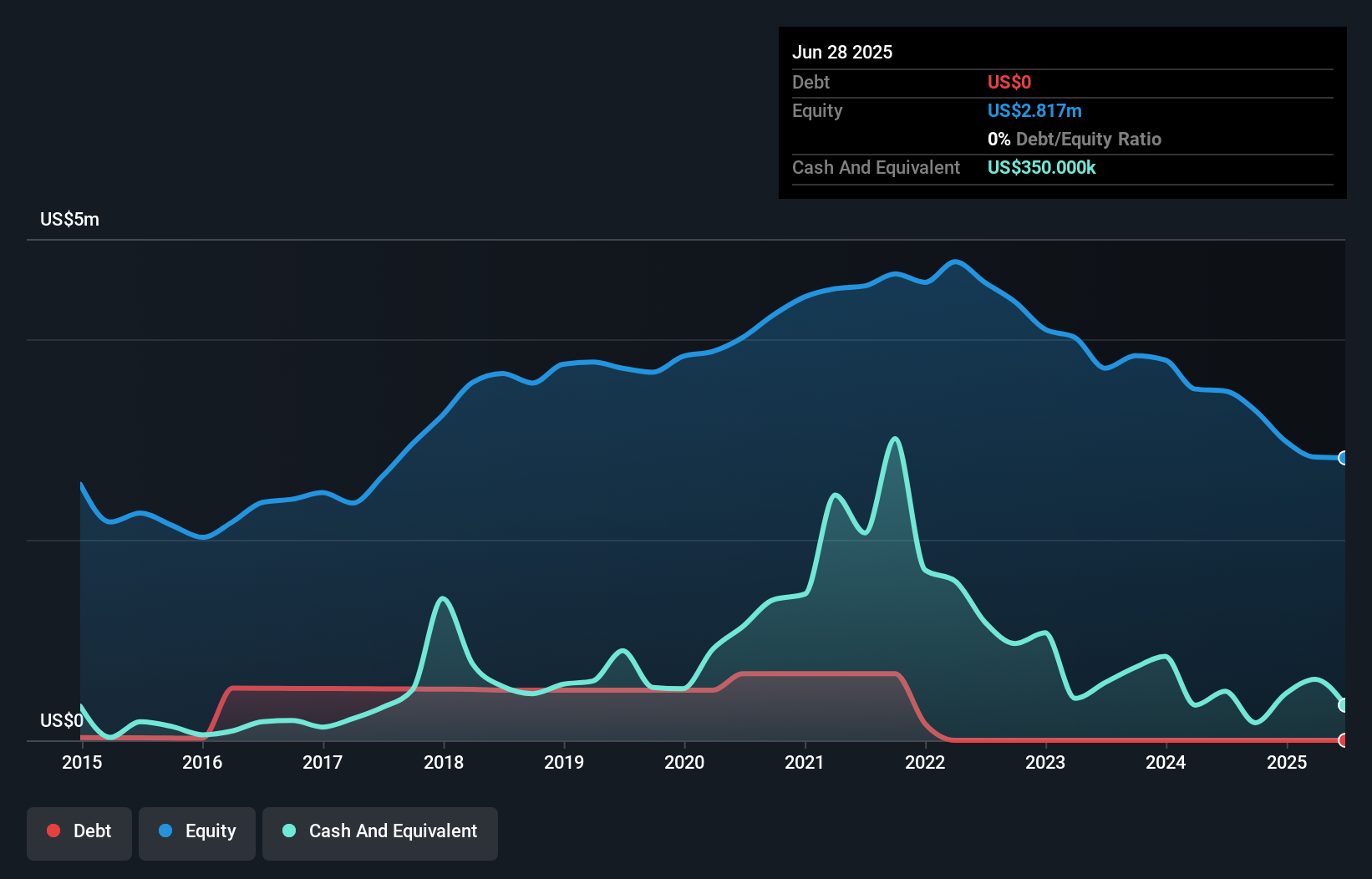

Orion Energy Systems, Inc., with a market cap of US$27.14 million, is navigating challenges and opportunities typical for companies in the penny stock category. Recent strategic partnerships, including a three-year contract with an ESCO partner and a new relationship with an energy management service provider, are expected to generate significant annual revenues starting in 2025. Despite these developments, Orion faces financial hurdles; it remains unprofitable with increasing debt levels and has received a Nasdaq compliance notice regarding its share price. The company is focused on revenue growth to address these issues while maintaining sufficient cash runway for operations.

- Click to explore a detailed breakdown of our findings in Orion Energy Systems' financial health report.

- Review our growth performance report to gain insights into Orion Energy Systems' future.

Integrated BioPharma (OTCPK:INBP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Integrated BioPharma, Inc. and its subsidiaries focus on the manufacturing, distributing, marketing, and sale of vitamins, nutritional supplements, and herbal products mainly in the United States and Luxembourg with a market cap of $9.09 million.

Operations: The company's revenue is primarily derived from Contract Manufacturing, contributing $49.10 million, and Other Nutraceutical Businesses, which add $1.92 million.

Market Cap: $9.09M

Integrated BioPharma, Inc., with a market cap of US$9.09 million, has shown signs of financial improvement typical for penny stocks. The company reported a net income of US$0.259 million for the first quarter ended September 30, 2024, marking its transition to profitability after previous losses. Despite high earnings quality and no debt burden, its return on equity is low at 2.2%, and share price volatility remains high over recent months. With short-term assets significantly exceeding liabilities and a seasoned management team in place, Integrated BioPharma is positioned to navigate the challenges inherent in this investment category effectively.

- Click here to discover the nuances of Integrated BioPharma with our detailed analytical financial health report.

- Gain insights into Integrated BioPharma's past trends and performance with our report on the company's historical track record.

Tofutti Brands (OTCPK:TOFB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tofutti Brands Inc. is involved in the development, production, and marketing of plant-based, dairy-free vegan frozen desserts, cheeses, and other food products under the TOFUTTI brand across various regions including the United States, Europe, the Middle East, Asia Pacific, and Africa with a market cap of $3.56 million.

Operations: The company's revenue is primarily derived from its food processing segment, totaling $8.83 million.

Market Cap: $3.56M

Tofutti Brands Inc., with a market cap of US$3.56 million, faces challenges typical of penny stocks, including recent financial performance issues and operational hurdles. The company reported a net loss for the third quarter and nine months ended September 28, 2024, reflecting declining sales compared to the previous year. Despite being debt-free and having short-term assets exceeding both short- and long-term liabilities, Tofutti struggles with profitability and has less than a year of cash runway if current cash flow trends continue. Delayed SEC filings further complicate its financial outlook amidst an experienced board's oversight.

- Unlock comprehensive insights into our analysis of Tofutti Brands stock in this financial health report.

- Evaluate Tofutti Brands' historical performance by accessing our past performance report.

Make It Happen

- Get an in-depth perspective on all 739 US Penny Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OESX

Orion Energy Systems

Researches, designs, develops, manufactures, markets, sells, installs, and implements energy management systems for commercial office and retail, area lighting, industrial applications, and government in North America and Germany.

Reasonable growth potential with adequate balance sheet.