- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:LUNR

Is There an Opportunity in Intuitive Machines After Its Recent 55% Year-To-Date Drop?

Reviewed by Simply Wall St

Trying to decide what to do with Intuitive Machines stock? You are not alone. There has been a lot of buzz around this name after its eye-catching run in the past year, and naturally, investors are wondering if the story still has room to run. Over the past twelve months, LUNR’s share price climbed over 62%. However, if you zoom in, the picture is a little less rosy, with a more than 23% pullback in the last month and a dramatic drop of nearly 55% year-to-date. That combination creates both opportunity and risk.

What is driving all the action? The market seems to be recalibrating its expectations after the company made headlines for its moon landing aspirations and announced significant revenue growth. The annual revenue jumped 23%, and net income soared from a negative base with annual growth of over 87%. These numbers have kept Intuitive Machines on traders’ radar, but questions about sustainability and profitability remain.

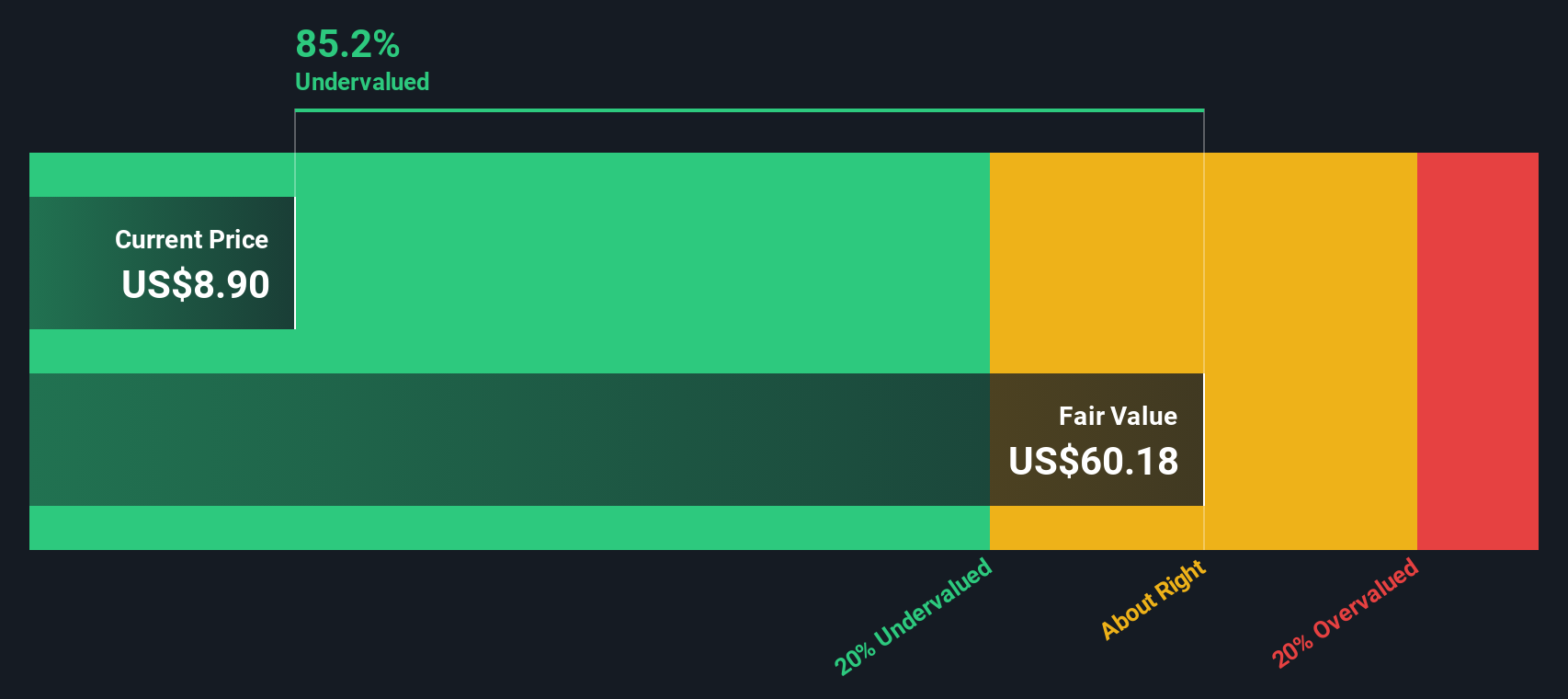

If you are eyeing that hefty 85.7% discount to its analyst price target and the 86% discount to its calculated intrinsic value, it is easy to see why valuation is top of mind. By our standard checklist, Intuitive Machines scores a 2 out of 6 for being undervalued, so there is some support for the bullish camp, but not enough for an unqualified green light. In the next section, we will examine the different valuation approaches used to analyze LUNR, and later on, reveal a smarter way to assess whether the current price is truly a bargain.

Intuitive Machines delivered 62.4% returns over the last year. See how this stacks up to the rest of the Aerospace & Defense industry.Approach 1: Intuitive Machines Cash Flows

A Discounted Cash Flow (DCF) model estimates a company’s true worth by forecasting its future cash flows and then discounting them back to today’s value. This method helps to determine if a stock is priced attractively.

Currently, Intuitive Machines is generating negative Free Cash Flow (FCF), with the latest twelve months showing an outflow of about $51 million. Despite this challenging starting point, analysts project a dramatic turnaround over the next decade. They forecast that annual FCF will swing to a positive $819 million in 2035. This projection depends on ambitious revenue scaling and the assumption that the company delivers on its innovation goals.

Based on these forecasts, the 2 Stage Free Cash Flow to Equity model calculates Intuitive Machines’ intrinsic value at $60.36 per share. When compared to its current market price, this suggests the stock is 85.7% undervalued. This points to significant potential upside if management successfully executes growth plans.

Result: UNDERVALUED

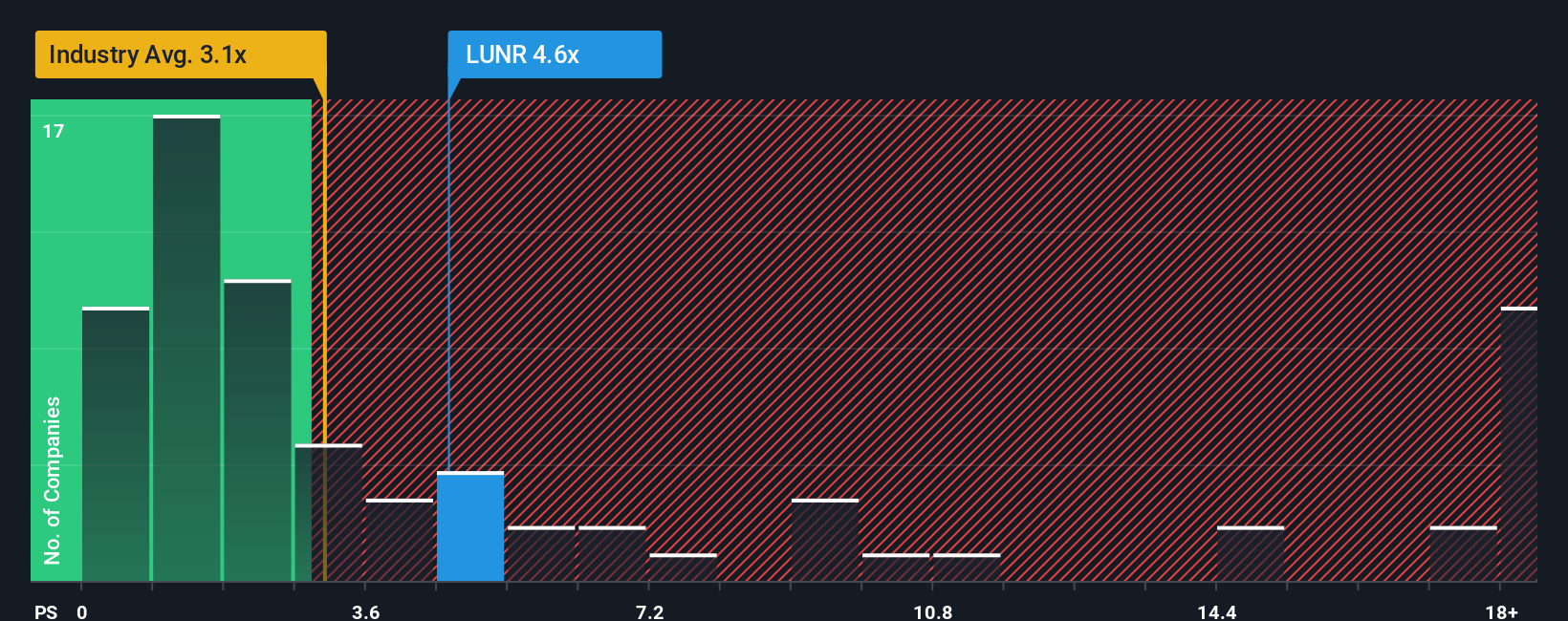

Approach 2: Intuitive Machines Price vs Sales

For early-stage or rapidly growing companies where profits may be inconsistent or negative, the Price-to-Sales (P/S) ratio is often a more reliable valuation tool than earnings-based ratios. The P/S multiple helps investors focus on how much they are paying for each dollar of revenue. This approach is especially useful when companies are scaling up and reinvesting for future growth.

Growth prospects and risk levels play a big role in determining what counts as a “normal” or fair P/S multiple. Higher growth and a healthier industry outlook can justify a premium, while greater risk or uncertain profitability may lower the appropriate multiple.

Currently, Intuitive Machines trades at a P/S ratio of 4.50x. This is notably above both the Aerospace & Defense industry average of 3.08x and the peer average of 2.11x. Simply Wall St's proprietary Fair Ratio model sets the fair multiple for LUNR slightly lower at 1.33x, after accounting for the company's growth profile, margins, and risk factors. Since the current P/S is substantially above the calculated fair value, this suggests the stock is overvalued based on its sales fundamentals.

Result: OVERVALUED

Upgrade Your Decision Making: Choose Your Intuitive Machines Narrative

Narratives offer a smarter way to make investing decisions by connecting a company’s story, including your perspective and expectations, with its financial forecasts and fair value. This approach helps you understand not just what the numbers are, but what they mean for you.

Simply put, a Narrative explains why you believe Intuitive Machines will succeed (or not) and translates that belief into easy-to-follow numbers such as your estimates for future revenue, profit margins, and a resulting fair value per share.

On the Simply Wall St platform, Narratives are simple to create and refine. Millions of investors share, update, and debate their views, making it easy to see different perspectives and test your own thinking.

Narratives are especially useful because they update automatically as new data arrives, such as fresh news or earnings reports. This allows investors to quickly compare their fair value to the current share price and decide when to buy, hold, or sell.

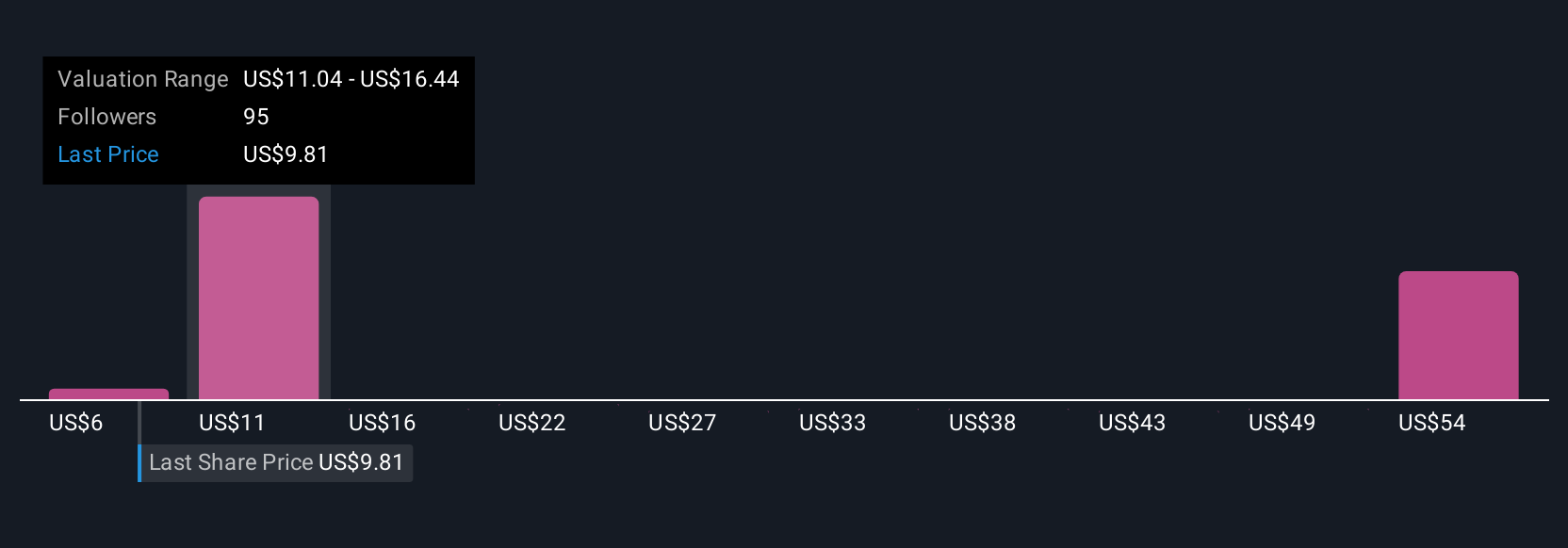

For example, some investors see Intuitive Machines as a future leader in lunar infrastructure and assign a fair value over $19.00. Others, focusing on execution risks and competition, see fair value closer to $10.50. This illustrates there are as many investment stories as there are investors.

Do you think there's more to the story for Intuitive Machines? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LUNR

Intuitive Machines

Designs, manufactures, and operates space products and services in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives