- United States

- /

- Machinery

- /

- NasdaqCM:LIQT

Investors Continue Waiting On Sidelines For LiqTech International, Inc. (NASDAQ:LIQT)

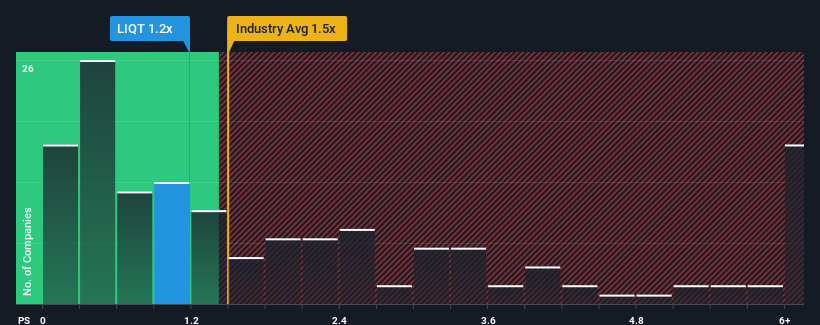

It's not a stretch to say that LiqTech International, Inc.'s (NASDAQ:LIQT) price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" for companies in the Machinery industry in the United States, where the median P/S ratio is around 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for LiqTech International

How LiqTech International Has Been Performing

LiqTech International hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LiqTech International.Is There Some Revenue Growth Forecasted For LiqTech International?

LiqTech International's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. This means it has also seen a slide in revenue over the longer-term as revenue is down 6.7% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 33% per annum as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 3.2% per annum, which is noticeably less attractive.

In light of this, it's curious that LiqTech International's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, LiqTech International's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with LiqTech International (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LIQT

LiqTech International

A clean technology company, manufactures and markets specialized filtration products and systems in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Moderate risk with adequate balance sheet.

Market Insights

Community Narratives