- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:ISSC

Here's Why Innovative Solutions and Support (NASDAQ:ISSC) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Innovative Solutions and Support (NASDAQ:ISSC). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Innovative Solutions and Support

Innovative Solutions and Support's Improving Profits

In the last three years Innovative Solutions and Support's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, Innovative Solutions and Support's EPS grew from US$0.20 to US$0.39, over the previous 12 months. Year on year growth of 100% is certainly a sight to behold.

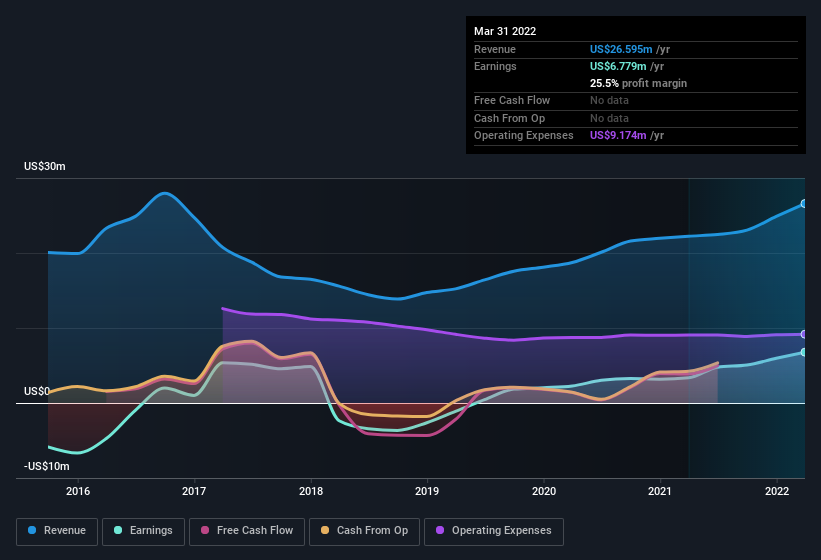

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Innovative Solutions and Support shareholders is that EBIT margins have grown from 15% to 24% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Innovative Solutions and Support is no giant, with a market capitalisation of US$114m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Innovative Solutions and Support Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that Innovative Solutions and Support insiders have a significant amount of capital invested in the stock. Indeed, they hold US$13m worth of its stock. This considerable investment should help drive long-term value in the business. Those holdings account for over 11% of the company; visible skin in the game.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. For companies with market capitalisations under US$200m, like Innovative Solutions and Support, the median CEO pay is around US$787k.

The CEO of Innovative Solutions and Support only received US$306k in total compensation for the year ending September 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Innovative Solutions and Support Deserve A Spot On Your Watchlist?

Innovative Solutions and Support's earnings have taken off in quite an impressive fashion. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The strong EPS improvement suggests the businesses is humming along. Innovative Solutions and Support is certainly doing some things right and is well worth investigating. Before you take the next step you should know about the 2 warning signs for Innovative Solutions and Support that we have uncovered.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ISSC

Innovative Solutions and Support

A systems integrator, designs, develops, manufactures, sells, and services flight guidance, autothrottles, and cockpit display systems in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives