- United States

- /

- Trade Distributors

- /

- NasdaqCM:HDSN

Discover December 2025's Undervalued Small Caps With Insider Actions Across Regions

Reviewed by Simply Wall St

As December 2025 unfolds, the U.S. stock market is experiencing a rebound with major indexes like the tech-heavy Nasdaq, blue-chip Dow Jones Industrial Average, and benchmark S&P 500 posting gains amid renewed investor confidence in tech and crypto-related stocks. In this dynamic environment, identifying promising small-cap stocks requires a keen understanding of market trends and insider actions that may signal potential opportunities for growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Merchants Bancorp | 7.6x | 2.5x | 49.65% | ★★★★★★ |

| Shore Bancshares | 10.2x | 2.7x | 42.02% | ★★★★★☆ |

| Business First Bancshares | 10.2x | 2.6x | 49.29% | ★★★★★☆ |

| Wolverine World Wide | 15.6x | 0.7x | 41.80% | ★★★★★☆ |

| Peoples Bancorp | 10.3x | 1.9x | 44.89% | ★★★★★☆ |

| First United | 9.9x | 3.0x | 45.10% | ★★★★★☆ |

| S&T Bancorp | 11.4x | 3.9x | 37.36% | ★★★★☆☆ |

| Farmland Partners | 6.4x | 7.9x | -86.94% | ★★★★☆☆ |

| Citizens & Northern | 13.3x | 3.3x | 32.54% | ★★★☆☆☆ |

| CNB Financial | 17.8x | 3.4x | 46.30% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

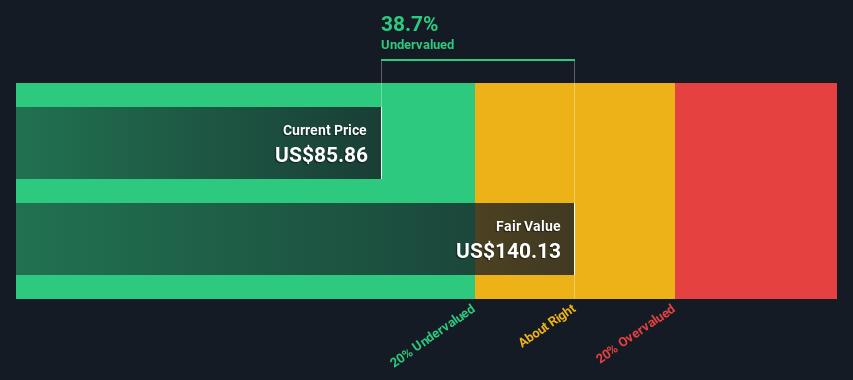

Hudson Technologies (HDSN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hudson Technologies is a company that specializes in refrigerant services and solutions, with operations focused on the wholesale distribution of miscellaneous products, and has a market cap of approximately $0.9 billion.

Operations: The company generates revenue primarily from its wholesale segment, with a notable focus on managing costs of goods sold (COGS) which significantly impacts gross profit margins. The gross profit margin has shown variability, reaching as high as 52.15% in recent periods before declining to 27.16%. Operating expenses are consistently a significant portion of the company's cost structure, with general and administrative expenses being a major component. Non-operating expenses also play a role in influencing net income outcomes over time.

PE: 14.0x

Hudson Technologies, a company in the refrigerants and specialty chemicals sector, recently announced an expansion of its buyback plan by US$10 million, now totaling US$30 million, signaling insider confidence. The appointment of Kenneth Gaglione as CEO and Chairman brings leadership with deep industry expertise. Despite challenges like forecasted earnings decline at 5.9% annually over three years, Hudson's recent contract with the U.S. Defense Logistics Agency worth $210 million offers potential for stable revenue streams.

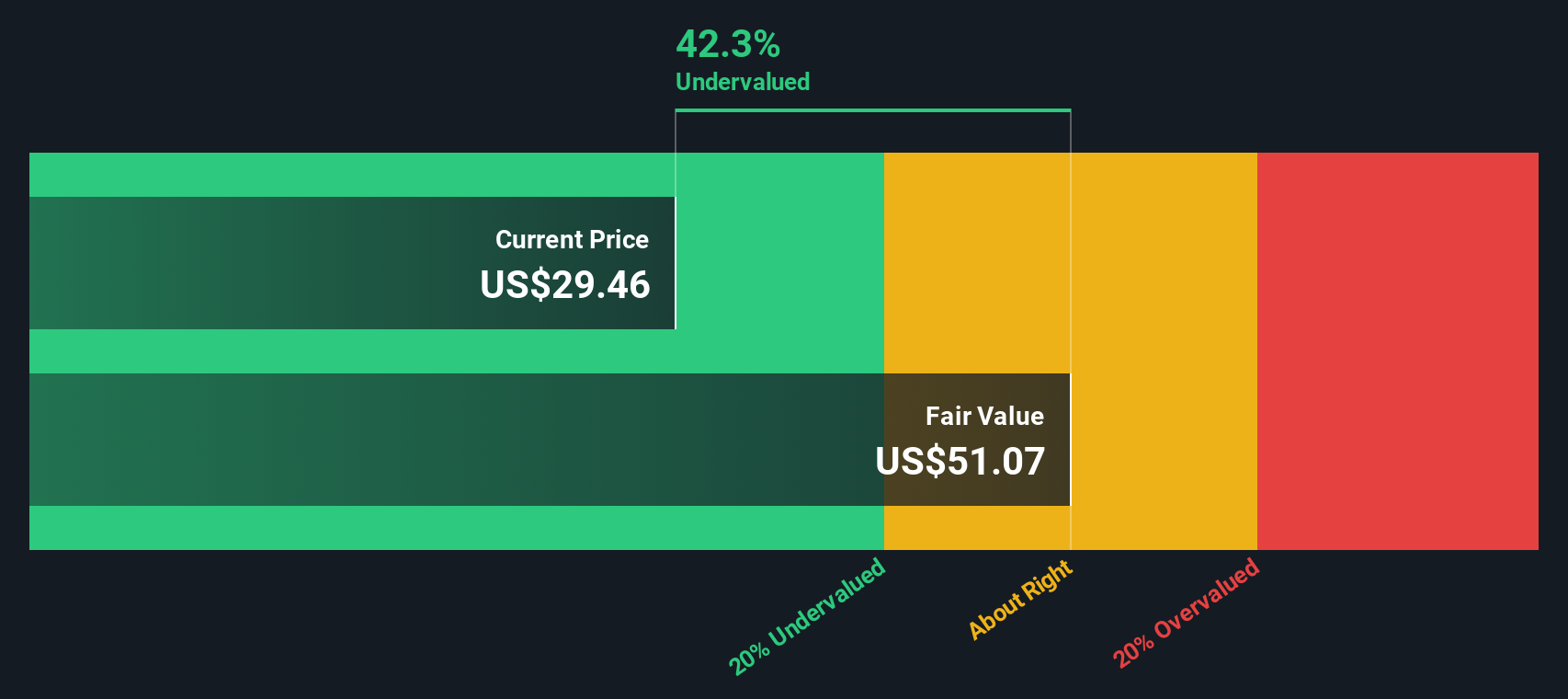

ICF International (ICFI)

Simply Wall St Value Rating: ★★★★★☆

Overview: ICF International provides professional services to a broad array of clients and has a market cap of approximately $2.39 billion.

Operations: ICF International generates revenue primarily from professional services, with recent figures reaching $2 billion. The company's cost of goods sold (COGS) is significant, impacting its gross profit margin, which was 37.23% as of the latest data point. Operating expenses are a major component of costs, with general and administrative expenses consistently forming a large part of these outlays. Net income margins have shown variability over time but recently stood at 5.13%.

PE: 15.2x

ICF International, a smaller U.S. company, is navigating challenges with a high debt level and reliance on external borrowing. Despite these hurdles, insider confidence is evident as executives have been purchasing shares recently. The company's innovative energy solutions like Sightline® are enhancing utility efficiency and customer engagement amid rising energy demands. Leadership changes aim to bolster growth, though recent earnings show declining sales and profits due to government client transitions and shutdown impacts.

Univest Financial (UVSP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Univest Financial operates as a diversified financial services company providing banking, insurance, and wealth management services with a market capitalization of approximately $0.76 billion.

Operations: The company generates revenue primarily from its banking segment, with additional contributions from insurance and wealth management. Operating expenses are a significant cost factor, with general and administrative expenses being the largest component. The net income margin has shown variability over time, reaching 28.13% in recent periods.

PE: 10.7x

Univest Financial, a smaller company in the financial sector, recently issued $50 million in subordinated notes to refinance existing debt and support corporate activities. This strategic move highlights their proactive financial management. Insider confidence is evident as key figures have increased their share purchases over recent months. For Q3 2025, Univest reported net income of US$25.64 million, up from US$18.58 million a year ago, indicating strong operational performance despite market challenges.

Turning Ideas Into Actions

- Navigate through the entire inventory of 79 Undervalued US Small Caps With Insider Buying here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hudson Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:HDSN

Hudson Technologies

Through its subsidiary, Hudson Technologies Company, provides solutions to recurring problems within the refrigeration industry in the United States.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026