- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:FLY

Can Firefly Aerospace Recover After Shares Plunge 32.5% This Month?

Reviewed by Bailey Pemberton

If you are watching Firefly Aerospace and weighing your next move, you are certainly not alone. The stock has had a rough ride lately, with shares dropping 4.5% over the last week, tumbling a staggering 32.5% in the past month, and down an even steeper 51.0% year-to-date. These are numbers that make investors sit up and ask, is this the time to buy, hold, or walk away?

There is no question that recent market developments have fueled much of this volatility. With uncertainty swirling around the broader space industry, sentiment has shifted rapidly, and Firefly's valuation is suddenly in the spotlight. Yet, while risk perceptions are rising, some market watchers see the beaten-down stock price as a signal that growth potential may be simmering just beneath the surface.

Of course, a fair question to ask is whether all of this movement means Firefly Aerospace is now undervalued. To help answer that, we run the company through six key valuation checks. Firefly only passes one out of six, giving it a valuation score of 1. Does that mean you should write the story off right here? Not so fast. In the next section, we will break down each valuation approach, and later we will explore a more nuanced way to understand what the numbers truly mean for long-term investors.

Firefly Aerospace scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Firefly Aerospace Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by forecasting its future cash flows and discounting them back to present value. For Firefly Aerospace, this involves extrapolating future cash flows based on analyst estimates and forward-looking assumptions.

Currently, Firefly Aerospace reports a Free Cash Flow (FCF) of -$161.5 Million, meaning the company is currently burning cash. According to analyst projections, FCF could grow sharply, reaching $239.5 Million by 2029. Analysts provide detailed estimates for up to 5 years, and projections beyond that come from external sources, which becomes more speculative the further out you look.

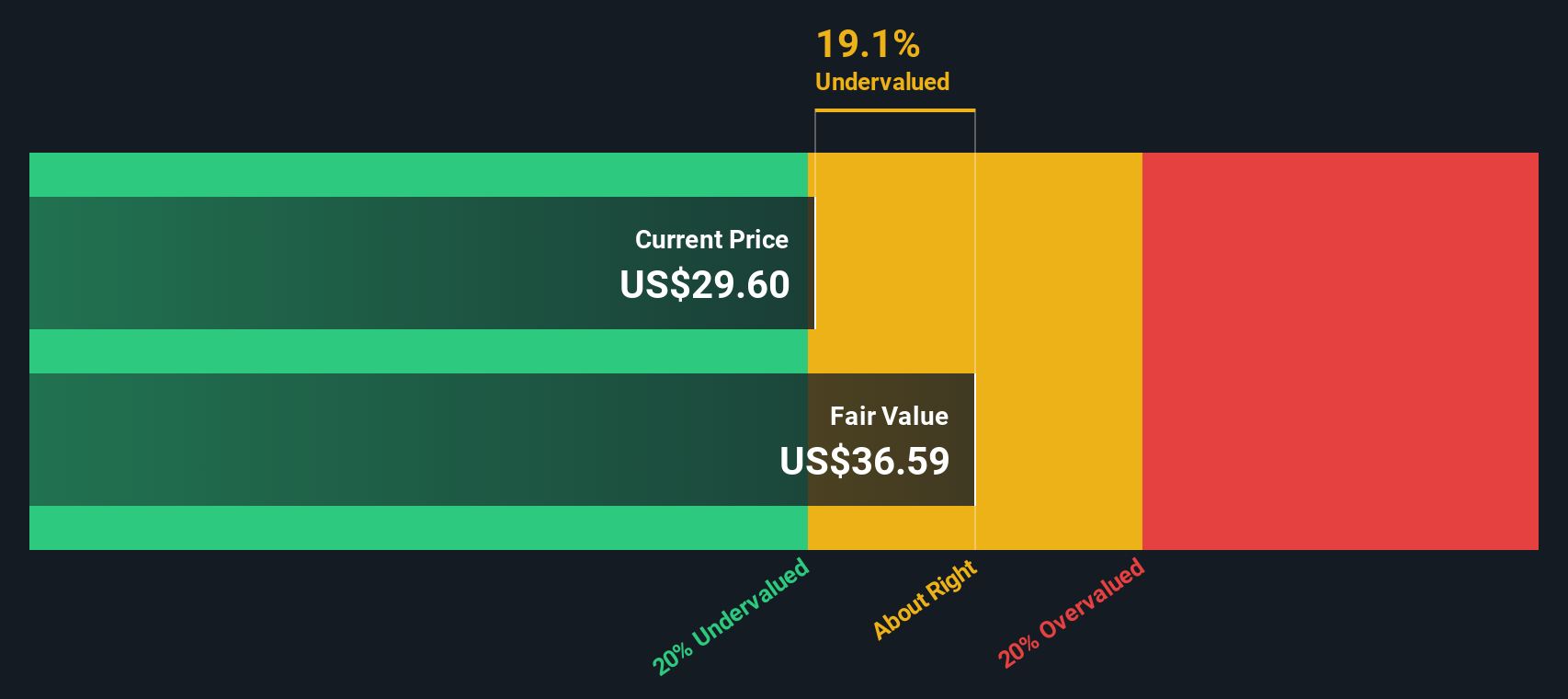

Based on these calculations, the DCF analysis gives Firefly Aerospace an intrinsic value of $36.59 per share. This model suggests the stock trades at a 19.1% discount to its estimated fair value and indicates it could be undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Firefly Aerospace is undervalued by 19.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Firefly Aerospace Price vs Sales (P/S)

The Price-to-Sales (P/S) ratio is often used for valuing companies that have yet to reach profitability, making it especially relevant for high-growth, early-stage businesses like Firefly Aerospace. Because earnings can be negative or unstable during a company’s rapid expansion phase, the P/S ratio offers a more stable metric for comparison and focuses on the revenue-generating ability of the business.

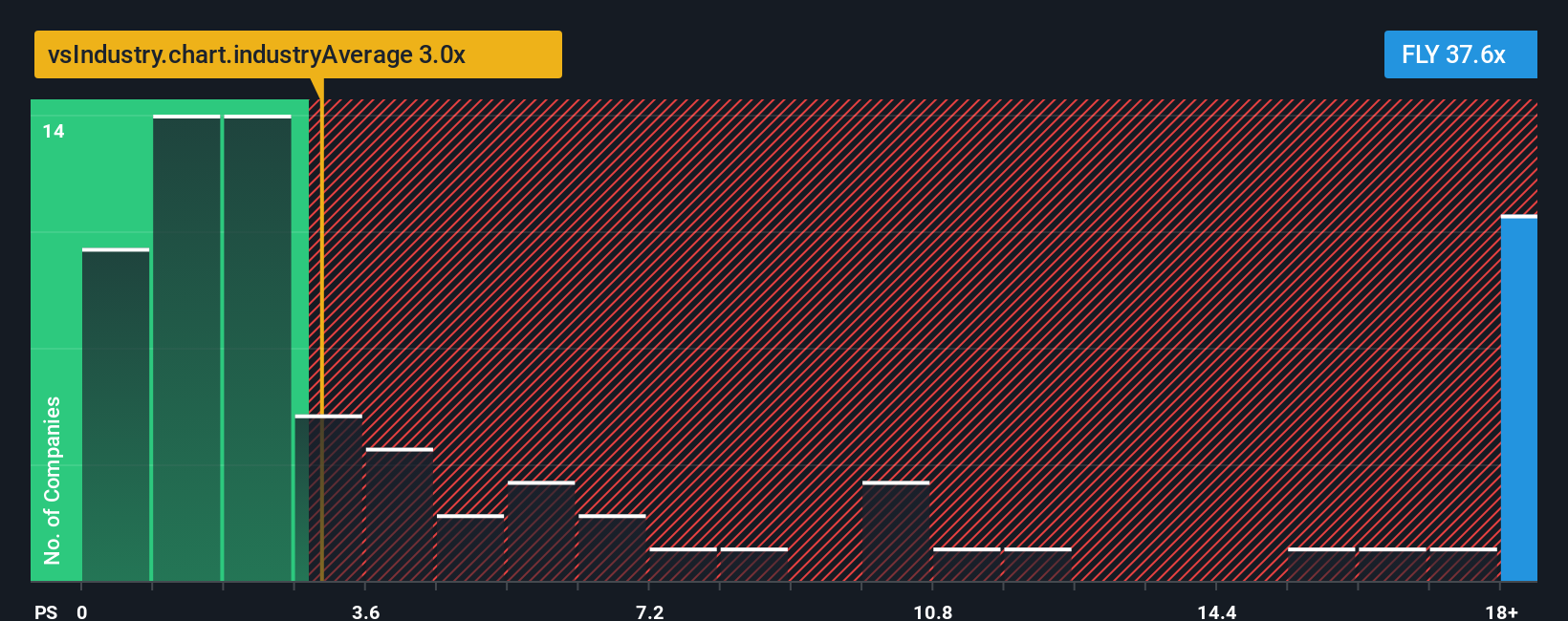

Just like with other valuation multiples, what qualifies as a “normal” or “fair” P/S ratio depends on both growth expectations and perceived risk. Companies with higher growth prospects or lower risk tend to command higher multiples, while sluggish growth or heightened risks often bring the average down. For context, Firefly Aerospace currently trades at a striking P/S ratio of 42.19x, which is considerably higher than the aerospace and defense industry average of 3.13x and well above its peer group’s 2.78x.

Simply Wall St’s proprietary “Fair Ratio” aims to improve on these traditional comparisons. Unlike industry or peer averages, the Fair Ratio adjusts for factors such as Firefly’s revenue growth, unique risk profile, profit margins, market capitalization, and specific industry dynamics. This approach offers a more nuanced, company-specific view of what investors should reasonably pay, rather than relying solely on broad benchmarks that may not capture Firefly’s distinct characteristics.

In this case, the actual P/S ratio sits so far above any reasonable expectation that, even after considering growth and other factors through the Fair Ratio, the stock appears significantly overvalued on this metric.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Firefly Aerospace Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives make investing personal by letting you frame a company's story in your own words, then connect that story directly to your financial forecast and estimate of fair value. Instead of just number crunching, Narratives help you bring together your expectations for things like revenue growth, margins, and market trends, painting a complete picture of what you believe the company’s future holds.

On Simply Wall St’s platform, Narratives are easy to create and use, and investors worldwide are already sharing them within the Community page. As new information comes in, such as news, earnings, or company updates, each Narrative automatically updates forecasts and fair values. This makes it simple to see when your view of fair value is above or below Firefly Aerospace’s current share price, guiding your investment decisions with greater confidence.

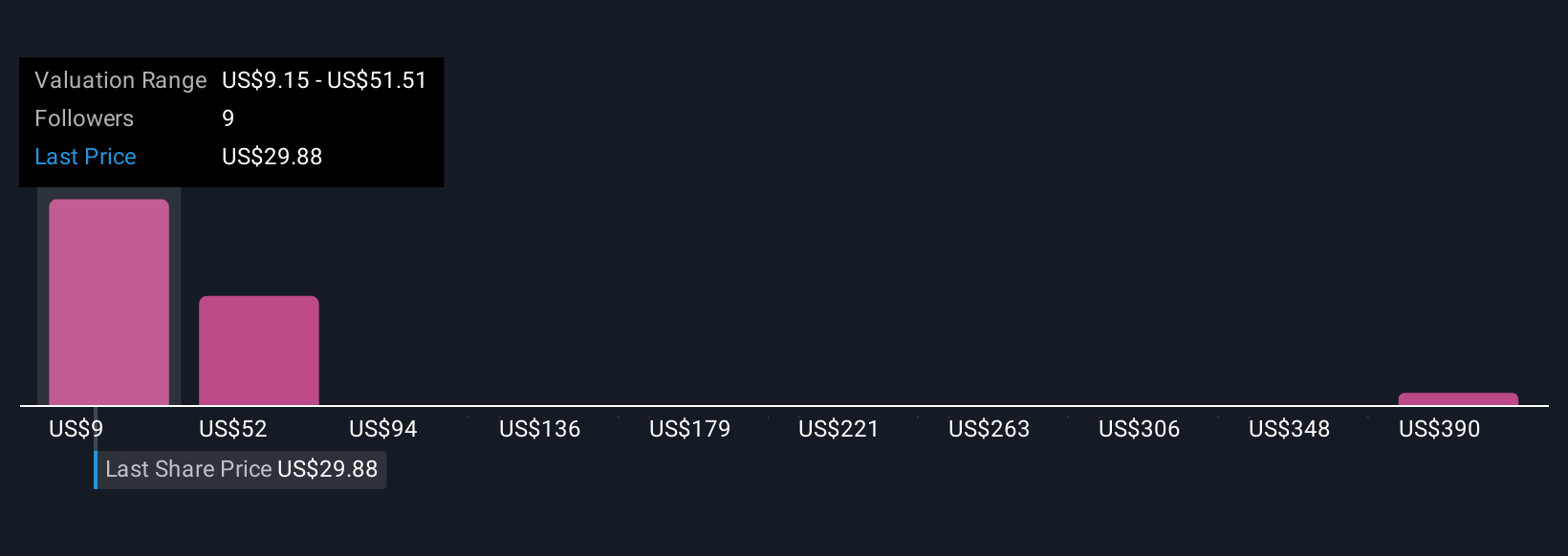

For example, some investors expect explosive revenue growth and assign Firefly a fair value of over $50 per share, while others see higher risks and put fair value closer to $20. Narratives empower you to compare these viewpoints and invest according to the story you believe in most.

Do you think there's more to the story for Firefly Aerospace? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FLY

Firefly Aerospace

Operates as a space and defense technology company and provides mission solutions for national security, government, and commercial customers.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives