- United States

- /

- Electrical

- /

- NasdaqCM:FLUX

Is FLUX’s Shelf Registration a Hint at New Growth Strategies or Simply Prudent Funding Flexibility?

Reviewed by Sasha Jovanovic

- In recent days, Flux Power Holdings, Inc. filed a shelf registration statement to potentially offer up to US$19.57 million in common stock, comprising 3,644,289 shares.

- This move gives the company financial flexibility, potentially signaling preparations for future capital needs, business development plans, or expansion opportunities.

- We'll examine how the shelf registration could affect Flux Power Holdings' narrative, especially its impact on future funding and growth plans.

Find companies with promising cash flow potential yet trading below their fair value.

Flux Power Holdings Investment Narrative Recap

To be optimistic about Flux Power Holdings, an investor needs faith in the company’s ability to convert rising sales and operational efficiencies into a path toward profitability, especially within a market focused on electrification. The shelf registration to offer up to US$19.57 million in common stock enhances financial flexibility, but does not substantially change the immediate focus for many investors: securing ongoing funding to address liquidity risks while supporting expansion and reducing dependence on costly short-term capital.

Earlier this month, Flux Power reported a follow-on equity offering of US$12 million in common stock and pre-funded warrants, following multiple other fundraising efforts throughout the year. These moves align directly with the company’s efforts to bolster its cash reserves and address concerns raised by its auditor about the ability to continue as a going concern, a central issue that investors watching catalysts for sustained growth will have front of mind.

By contrast, one immediate risk for investors to keep in mind is that after several rounds of capital raising, the effect of dilution and persistent questions about financial stability remain unresolved...

Read the full narrative on Flux Power Holdings (it's free!)

Flux Power Holdings' outlook anticipates $110.7 million in revenue and $8.6 million in earnings by 2028. This scenario relies on annual revenue growth of 20.6% and an earnings improvement of $16.3 million from current earnings of -$7.7 million.

Uncover how Flux Power Holdings' forecasts yield a $5.75 fair value, a 13% downside to its current price.

Exploring Other Perspectives

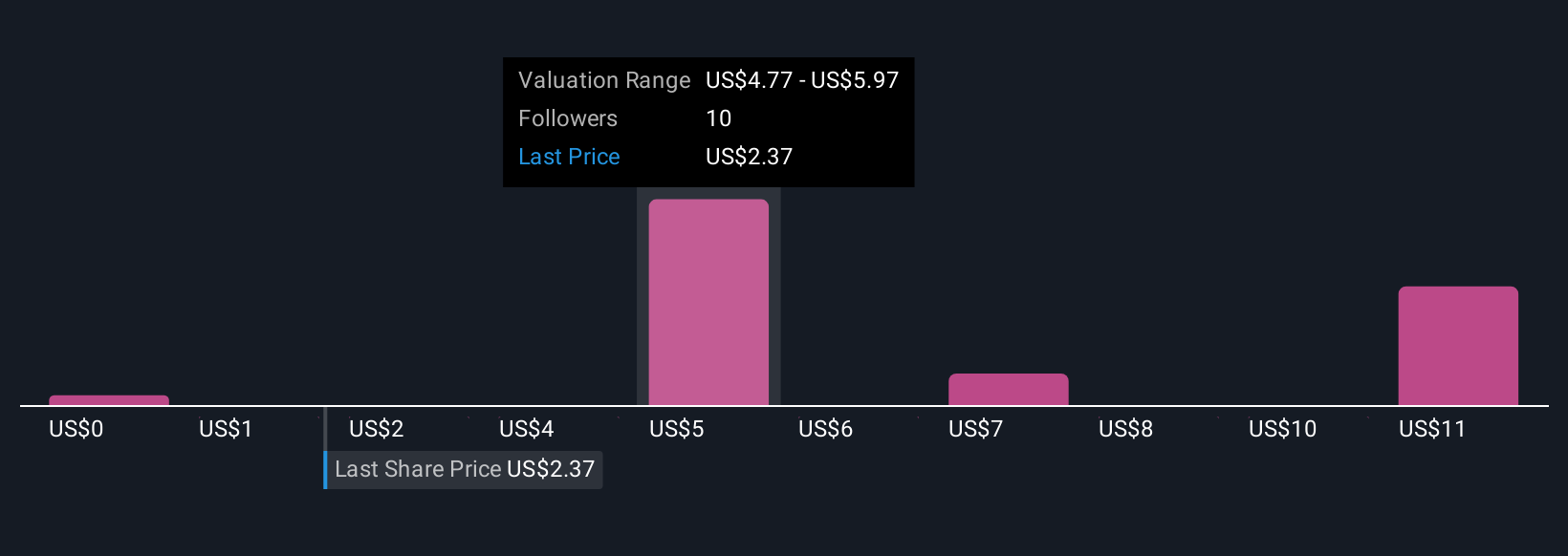

The Simply Wall St Community’s four fair value estimates for Flux Power range from US$1.32 to US$13.19, highlighting widely differing views on upside and downside. These valuations sit alongside ongoing questions about the company’s liquidity and funding needs, underscoring the importance of considering multiple viewpoints on future performance.

Explore 4 other fair value estimates on Flux Power Holdings - why the stock might be worth less than half the current price!

Build Your Own Flux Power Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Flux Power Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Flux Power Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Flux Power Holdings' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FLUX

Flux Power Holdings

Through its subsidiary, designs, develops, manufactures, and sells lithium-ion energy storage solutions in North America.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)