- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

Fluence Energy (NasdaqGS:FLNC) Shares Dip 13% As FY 2025 Revenue Guidance Revised

Reviewed by Simply Wall St

Fluence Energy (NasdaqGS:FLNC) experienced a 13% decline over the past week, amidst several significant developments. The recent announcement of a collaboration with Cordelio Power to supply 1 GWh of battery storage systems highlighted Fluence's focus on U.S. manufacturing and grid stability, yet did not prevent the share price fall. Also, the introduction of the Smartstack™ platform underscored innovation within the company, although it did not mitigate market reactions. Notably, the revision of revenue guidance for FY 2025 due to contract delays in Australia could have adversely influenced investor sentiment. This week's declines align with a broader 1% decrease in major stock indexes, as economic concerns persisted, and weak manufacturing data may have further soured market perception. Fluence's challenges, in conjunction with a cautious market atmosphere, likely contributed to the observed price movement. Nonetheless, the company's efforts in expanding its energy storage footprint remain pivotal to its long-term narrative.

Unlock comprehensive insights into our analysis of Fluence Energy stock here.

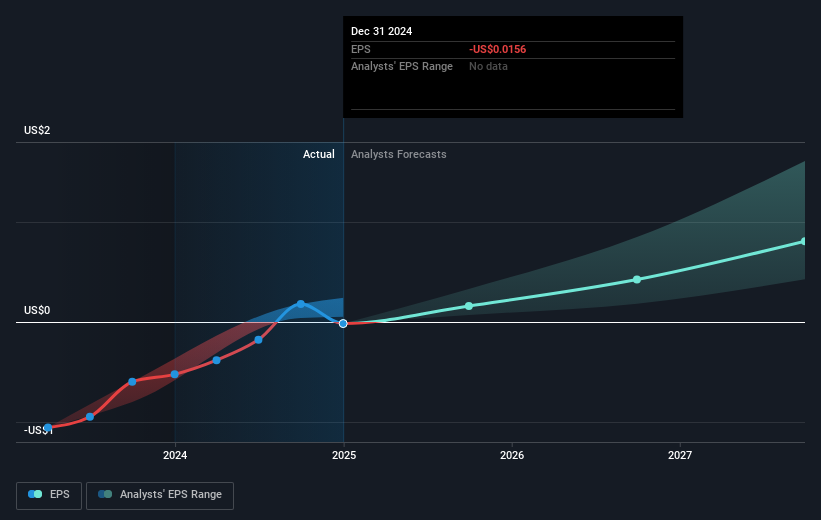

Over the past three years, Fluence Energy's total shareholder return was 41.93% down. This substantial decline is against the backdrop of significant operational and strategic developments. Despite Fluence's efforts in expanding their footprint, collaboration agreements like the one with Cordelio Power announced in February 2025 did not suffice to counterbalance broader challenges. The company's February 2025 earnings report revealed a net loss of US$41.47 million, while year-over-year sales dipped considerably from US$363.96 million to US$186.79 million, highlighting ongoing financial pressures.

Fluence's struggles were further compounded by lowered FY 2025 revenue guidance due to contract delays in Australia. The introduction of new energy storage solutions such as Smartstack™ in February 2025 showed their commitment to innovation; however, challenges in financial stability were intimated by high share price volatility in the preceding months. Amid executive shifts, with the January 2025 resignation of SVP and Chief Product Officer Rebecca Boll, the company underperformed against both the US market and the US Electrical industry over the past year.

- Unlock the insights behind Fluence Energy's valuation and discover its true investment potential

- Uncover the uncertainties that could impact Fluence Energy's future growth—read our risk evaluation here.

- Already own Fluence Energy? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives