- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

Fluence Energy (NasdaqGS:FLNC) Reports Disappointing Q2 Performance With US$31 Million Net Loss

Reviewed by Simply Wall St

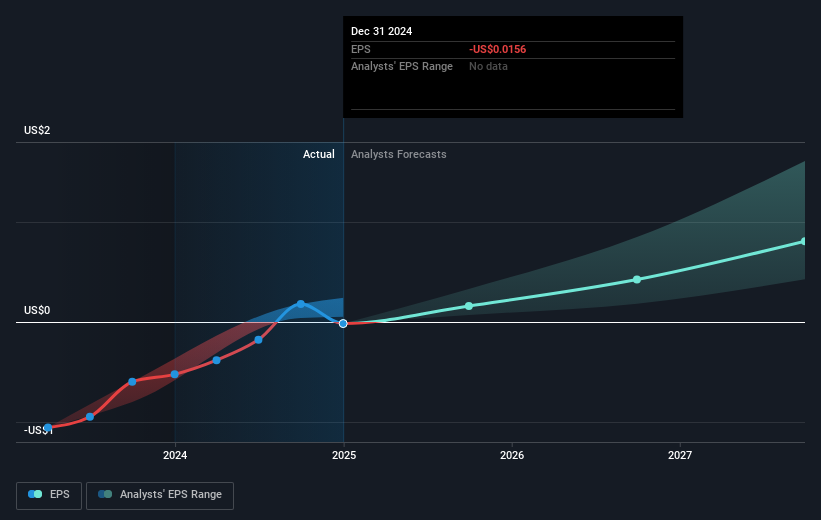

Fluence Energy (NasdaqGS:FLNC) recently lowered its fiscal year 2025 revenue guidance, citing economic uncertainties and tariff issues, and reported a disappointing Q2 performance with a net loss of $31 million. Despite these challenges, the company's stock price rose by 39% over the past month. This price movement seems at odds with the downward trend in its financial projections, potentially indicating a broader market influence. The overall market's positive momentum, with a 3.9% increase in the last week, may have contributed to Fluence Energy's unusual share price performance, although its fundamentals suggest a different narrative.

We've discovered 1 risk for Fluence Energy that you should be aware of before investing here.

The recent events at Fluence Energy, specifically the downward revision of its fiscal year 2025 revenue guidance and a net loss of US$31 million for Q2, highlight significant challenges the company faces. Despite these hurdles, the stock's 39% climb over the past month suggests a disconnect between market sentiment and the company's financial outlook. Over the past three years, Fluence Energy's total return, including dividends, recorded a 32.95% decline, indicating a tougher longer-term landscape. In contrast, it has underperformed both the US market and the Electrical industry over the past year, which saw returns of 11.6% and 14.3% respectively.

Moving forward, the news of reduced revenue guidance could dampen analysts' forecasts for Fluence Energy's future revenue and earnings growth. This, coupled with tariff and geopolitical pressures, might trigger further revisions in expectations. Analysts have a price target of US$7.70, suggesting potential upside from the current share price of US$4.12, yet the target is contingent on achieving substantial future growth and improved margins. The discrepancy between the current stock performance and the price target implies that investor optimism may be premised on expected long-term strategic shifts, like the domestic content strategy and new product platforms, potentially impacting projected revenue and earnings positively if realized by 2026.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Fluence Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives