- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

Fluence Energy (NasdaqGS:FLNC) Faces 14% Drop Over Week Amid Class Action Lawsuit Concerns

Reviewed by Simply Wall St

Fluence Energy (NasdaqGS:FLNC) experienced a 14% decline in its share price over the past week. This movement occurs amid significant developments, including the appointment of Peter Williams to an expanded role as Senior Vice President and Chief Product and Supply Chain Officer, aiming to enhance operational efficiency. However, the company's market performance might also be affected by the broader market downturn, where indices like the Nasdaq have descended into bear market territory following global trade tensions and the imposition of tariffs, contributing to sell-offs in tech and energy stocks. The class action lawsuit alleging misleading business practices further adds uncertainty to Fluence's outlook.

Buy, Hold or Sell Fluence Energy? View our complete analysis and fair value estimate and you decide.

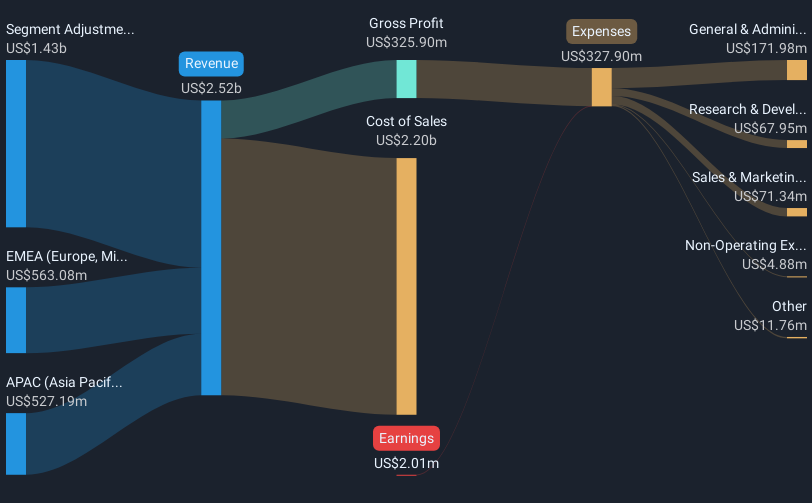

Over the three-year period leading up to April 2025, Fluence Energy's total shareholder return deteriorated by 64.44%. This significant decline reflects challenges that go beyond recent management changes and share price fluctuations. Throughout this period, the company faced notable issues, such as a class-action lawsuit filed in March 2025, alleging that Fluence Energy engaged in false and misleading business practices, potentially impacting investor trust. Furthermore, the reported Q1 2025 earnings showed a sales drop to US$186.79 million, further underscoring the firm's financial struggles, with a net loss reported as US$41.47 million, compared to the same period last year.

Fluence Energy also had to adjust its revenue guidance for FY 2025 due to contract timing delays in Australia, leading to reduced expectations from an original range of US$3.6 billion to US$4.4 billion, now set at US$3.1 billion to US$3.7 billion. Competitive pressures, especially from Chinese providers, have further strained margins, although the company has begun implementing a U.S. domestic content strategy to counter these challenges. Despite product innovations like the Smartstack™ platform, these efforts are unfolding in a complex landscape where the company has underperformed relative to both the US market and the electrical industry over the past year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives