- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

Fluence Energy (FLNC): Examining Valuation After 83% Share Price Surge and Strong Revenue Growth

Reviewed by Kshitija Bhandaru

Fluence Energy (FLNC) has been catching a lot of eyes lately after its share price jumped 83% this past month. Such a surge, supported by meaningful revenue growth, has investors taking notice and asking what is behind the momentum.

See our latest analysis for Fluence Energy.

Momentum around Fluence Energy is hard to ignore after its 93.6% 1-month share price return, highlighted by executive changes and ongoing sector-wide uncertainty from the recent government shutdown. Still, the stock’s 1-year total shareholder return lags at -39.7%, showing long-term challenges have not disappeared even as excitement builds.

If the sharp swings in Fluence have you curious about what else the market is serving up, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With impressive growth numbers but a recent run-up in valuation, the big question remains: Is Fluence Energy still undervalued, or has the market already priced in the company's future potential for growth?

Most Popular Narrative: 65% Overvalued

The narrative’s fair value estimate places Fluence Energy’s shares far below the current market price, suggesting investors could be paying a premium. The narrative’s assumptions rest on strong sector tailwinds, yet not everyone is convinced the price is justified at this level.

Rapid global electrification and surging power demand, driven by data centers, transportation, and industrial sectors, are expected to sharply increase the need for grid resilience and flexibility. This is projected to lead to substantial growth for large-scale battery storage, driving material revenue growth for Fluence over the next several years.

What is driving the most widely followed narrative’s price? Analysts are betting big on accelerating growth, bullish margins, and a market-shifting profit trajectory. Want to uncover exactly which forecasts underpin this bold fair value? The secret ingredient might surprise you.

Result: Fair Value of $7.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff and trade policy uncertainty, along with supply chain dependencies, could quickly undermine the bullish outlook for Fluence Energy.

Find out about the key risks to this Fluence Energy narrative.

Another View: What Do Sales Ratios Say?

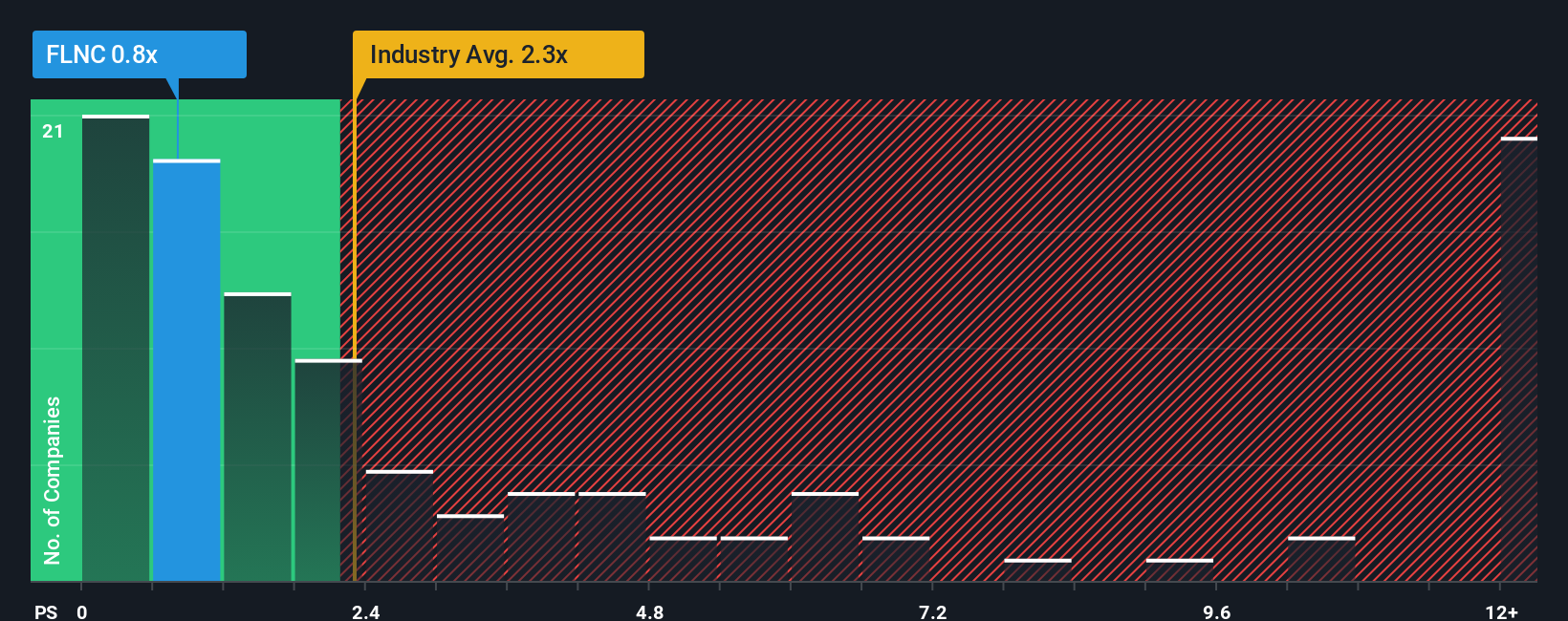

Looking at things through a different lens, Fluence appears attractively priced when stacking its price-to-sales ratio against both peers and industry averages. The company's ratio is just 0.7x, which is well below the industry average of 2.1x and the peer average of 5.7x. Even when compared to the fair ratio of 1.7x, the current valuation looks reasonable. This gap suggests the market may be overlooking a potential value opportunity, but why is it so discounted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fluence Energy Narrative

If these perspectives don't match your own analysis or you want to put the data to the test, crafting a personal narrative only takes a few minutes, so why not Do it your way?

A great starting point for your Fluence Energy research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Your next winning stock could be just a click away. Gain an edge by using these handpicked investment paths in the Simply Wall Street Screener and never miss another smart opportunity.

- Catch market momentum and target value by accessing these 898 undervalued stocks based on cash flows, which experts believe are trading below their true worth.

- Secure high-yielding income with these 19 dividend stocks with yields > 3%, designed to spotlight stocks offering dividends above 3%.

- Capitalize on the future of medicine when you check out these 33 healthcare AI stocks, transforming care through advanced artificial intelligence solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives