- United States

- /

- Banks

- /

- NasdaqGS:HBT

Undiscovered Gems in United States Stocks To Explore January 2025

Reviewed by Simply Wall St

The United States market has shown robust performance recently, rising 3.2% in the last week and 24% over the past year, with all sectors experiencing gains and earnings projected to grow by 15% annually. In such a dynamic environment, identifying stocks that combine strong fundamentals with growth potential can uncover promising opportunities for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Energy Recovery (NasdaqGS:ERII)

Simply Wall St Value Rating: ★★★★★★

Overview: Energy Recovery, Inc. designs, manufactures, and sells energy efficiency technology solutions across various regions including the Americas, the Middle East, Africa, Asia, and Europe with a market cap of $855.09 million.

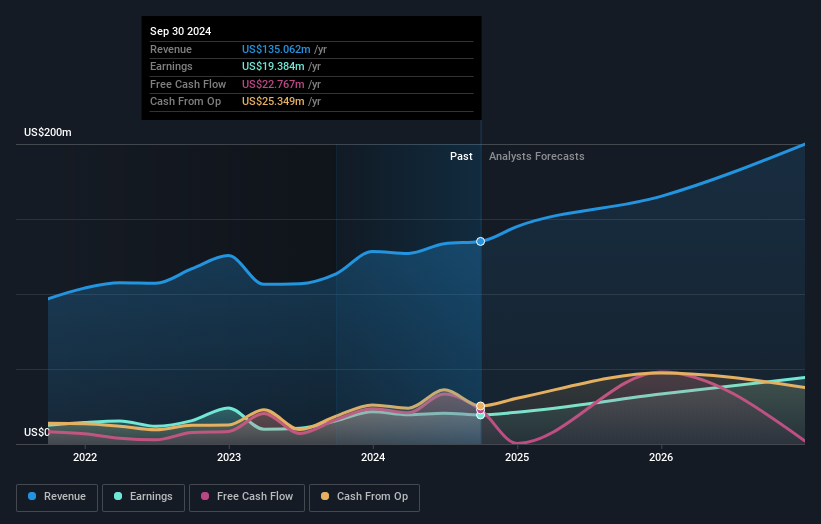

Operations: The company generates revenue primarily from its Water segment, contributing $134.45 million, while Emerging Technologies adds $0.61 million.

Energy Recovery is carving a niche in the energy-efficient technology space, with no debt and high-quality earnings. The company reported US$38.58 million in sales for Q3 2024, slightly up from US$37.04 million the previous year, but net income dipped to US$8.48 million from US$9.66 million in the same period last year. Its strategic expansion into wastewater and CO2 markets signals a promising diversification of revenue streams, despite potential risks due to regional reliance where over 70% of revenue is generated. With a share repurchase program worth up to US$50 million announced recently, Energy Recovery seems poised for growth amidst evolving market dynamics.

HBT Financial (NasdaqGS:HBT)

Simply Wall St Value Rating: ★★★★★★

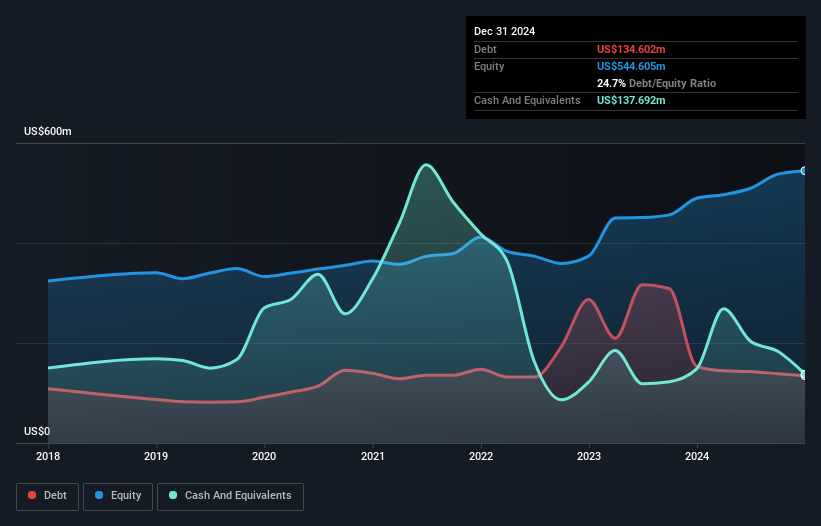

Overview: HBT Financial, Inc. is the bank holding company for Heartland Bank and Trust Company, offering business, commercial, and retail banking products and services in Central and Northeastern Illinois, as well as Eastern Iowa, with a market cap of approximately $702.20 million.

Operations: HBT Financial generates revenue primarily from its community banking segment, which contributed $212.34 million. The company's financial performance can be assessed through its net profit margin, which is a key indicator of profitability.

HBT Financial, with assets of US$5 billion and equity of US$537.7 million, presents a compelling case for consideration. Total deposits stand at US$4.3 billion while loans amount to US$3.3 billion, supported by a net interest margin of 4.2%. The bank's earnings grew by 15.6% over the past year, outpacing the broader industry decline of -10.5%. It maintains an appropriate level of bad loans at 0.2%, showcasing its risk management prowess with primarily low-risk funding sources making up 96% of liabilities. Recently, HBT announced a share repurchase program worth up to US$15 million until January 2026 and continues to explore acquisition opportunities for growth potential.

- Get an in-depth perspective on HBT Financial's performance by reading our health report here.

Understand HBT Financial's track record by examining our Past report.

Exodus Movement (NYSEAM:EXOD)

Simply Wall St Value Rating: ★★★★★★

Overview: Exodus Movement, Inc. is a financial technology company focused on the blockchain and digital asset industry in the United States, with a market cap of approximately $1.09 billion.

Operations: Exodus generates revenue primarily from its data processing segment, which amounts to $89.94 million. The company's financial performance includes a notable net profit margin trend that may be of interest to investors.

Exodus Movement, a nimble player in the software industry, recently turned profitable, marking a significant milestone with its earnings growth surpassing the industry average of 30.2%. The company's price-to-earnings ratio stands attractively at 19.2x compared to the sector's 40.8x. Despite its high level of non-cash earnings and zero debt status over five years, free cash flow remains negative with recent figures showing -US$9.45 million as of January 2025. Recent innovations include a revamped swap experience within their wallet app, enhancing transaction speed and flexibility while reducing costs starting at just 0.5%, positioning Exodus as an innovator in crypto usability.

Next Steps

- Investigate our full lineup of 253 US Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade HBT Financial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HBT Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HBT

HBT Financial

Operates as the bank holding company for Heartland Bank and Trust Company that provides financial products and services to consumers, businesses, and municipal entities in Illinois and Eastern Iowa.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives