- United States

- /

- Electrical

- /

- NasdaqCM:EOSE

Insider Buyers At Eos Energy Enterprises Recover Some Losses, But Still Down US$105k

Insiders who bought US$169.2k worth of Eos Energy Enterprises, Inc. (NASDAQ:EOSE) stock in the last year recovered part of their losses as the stock rose by 13% last week. However, the purchase is proving to be a costly gamble, since losses made by insiders have totalled US$105k since the time of purchase.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

View our latest analysis for Eos Energy Enterprises

Eos Energy Enterprises Insider Transactions Over The Last Year

In the last twelve months, the biggest single purchase by an insider was when CEO & Director Joseph Mastrangelo bought US$75k worth of shares at a price of US$2.05 per share. That means that an insider was happy to buy shares at above the current price of US$0.79. Their view may have changed since then, but at least it shows they felt optimistic at the time. To us, it's very important to consider the price insiders pay for shares. As a general rule, we feel more positive about a stock if insiders have bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price.

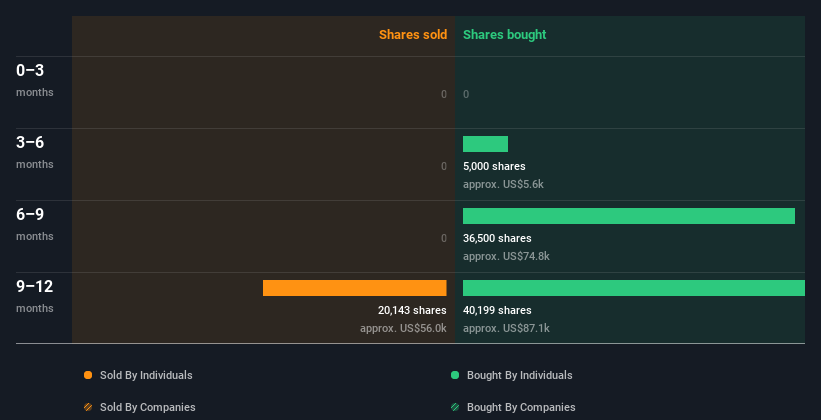

Happily, we note that in the last year insiders paid US$169k for 81.70k shares. But insiders sold 20.14k shares worth US$56k. In total, Eos Energy Enterprises insiders bought more than they sold over the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

There are always plenty of stocks that insiders are buying. If investing in lesser known companies is your style, you could take a look at this free list of companies. (Hint: insiders have been buying them).

Does Eos Energy Enterprises Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. I reckon it's a good sign if insiders own a significant number of shares in the company. Based on our data, Eos Energy Enterprises insiders have about 1.7% of the stock, worth approximately US$2.9m. I generally like to see higher levels of ownership.

So What Do The Eos Energy Enterprises Insider Transactions Indicate?

There haven't been any insider transactions in the last three months -- that doesn't mean much. On a brighter note, the transactions over the last year are encouraging. We'd like to see bigger individual holdings. However, we don't see anything to make us think Eos Energy Enterprises insiders are doubting the company. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Case in point: We've spotted 5 warning signs for Eos Energy Enterprises you should be aware of, and 3 of them are concerning.

But note: Eos Energy Enterprises may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

If you're looking to trade Eos Energy Enterprises, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eos Energy Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EOSE

Eos Energy Enterprises

Designs, manufactures, and markets zinc-based energy storage solutions for utility-scale, microgrid, and commercial and industrial (C&I) applications in the United States.

High growth potential low.

Similar Companies

Market Insights

Community Narratives