- United States

- /

- Construction

- /

- NasdaqGS:MYRG

Undervalued Small Caps In United States With Insider Buying For September 2024

Reviewed by Simply Wall St

Over the last 7 days, the market has risen 1.2%. In the last year, the market has climbed 30%, with earnings forecast to grow by 15% annually. Identifying stocks that are undervalued and have insider buying can offer potential opportunities in such a dynamic environment.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 20.3x | 0.9x | 44.20% | ★★★★★★ |

| Hanover Bancorp | 9.5x | 2.2x | 48.27% | ★★★★★☆ |

| Thryv Holdings | NA | 0.8x | 22.66% | ★★★★★☆ |

| Citizens & Northern | 13.0x | 2.9x | 43.10% | ★★★★☆☆ |

| MYR Group | 34.1x | 0.5x | 42.55% | ★★★★☆☆ |

| German American Bancorp | 14.3x | 4.8x | 45.11% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.4x | -128.97% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -51.03% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -255.54% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

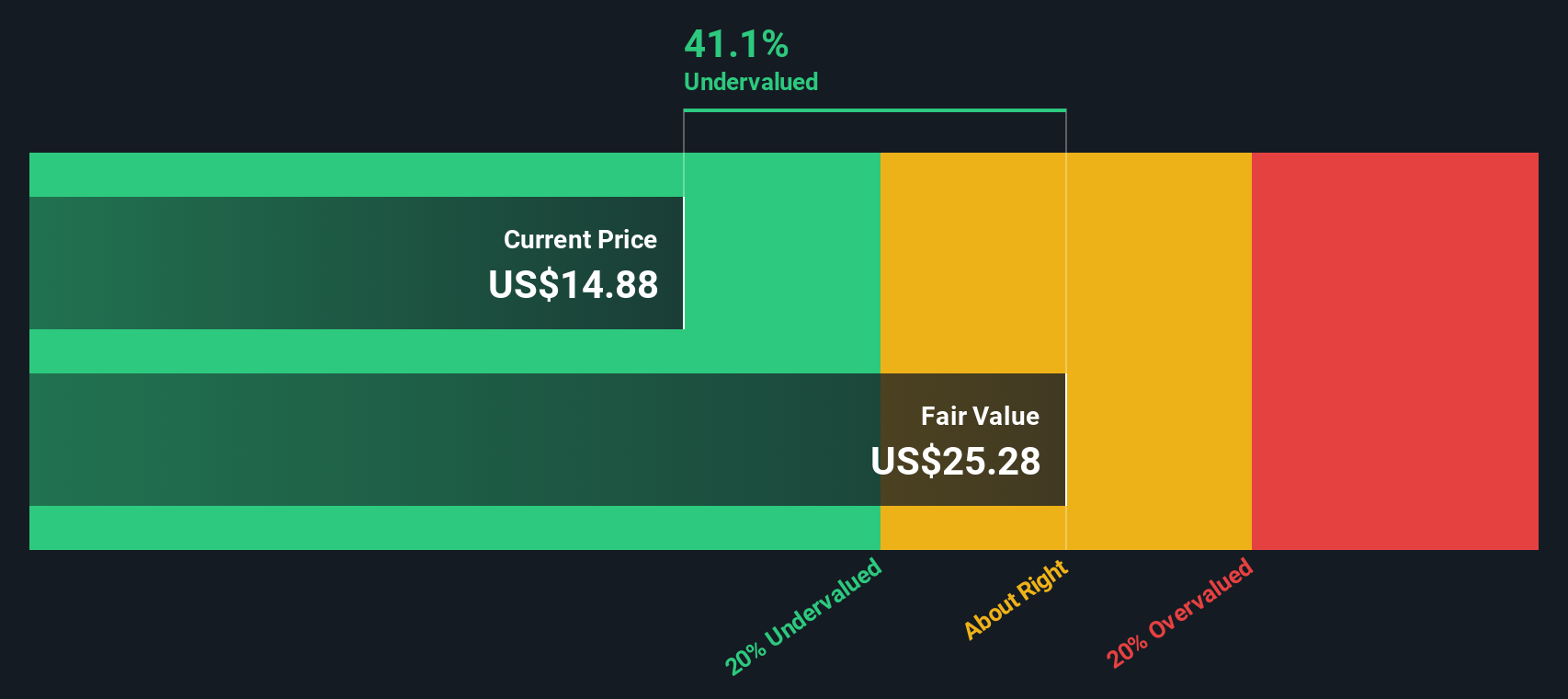

Columbus McKinnon (NasdaqGS:CMCO)

Simply Wall St Value Rating: ★★★★★★

Overview: Columbus McKinnon is a company specializing in machinery and industrial equipment, with a market cap of approximately $1.25 billion.

Operations: Revenue primarily comes from the Machinery & Industrial Equipment segment, totaling $1.02 billion. The company's gross profit margin has shown an upward trend, reaching 37.08% as of September 22, 2024. Operating expenses include significant allocations for sales and marketing ($108.13 million) and general & administrative expenses ($105.42 million).

PE: 20.3x

Columbus McKinnon, a small-cap industrial company, recently reported Q1 2025 sales of US$239.73 million, slightly up from US$235.49 million a year ago. Net income dipped to US$8.63 million from US$9.28 million over the same period. Despite these mixed results, insider confidence is evident with recent share purchases by executives in July 2024. The company forecasts modest annual sales growth and maintains regular dividends at $0.07 per share amidst leadership changes and strategic adjustments for future stability and growth.

- Take a closer look at Columbus McKinnon's potential here in our valuation report.

Understand Columbus McKinnon's track record by examining our Past report.

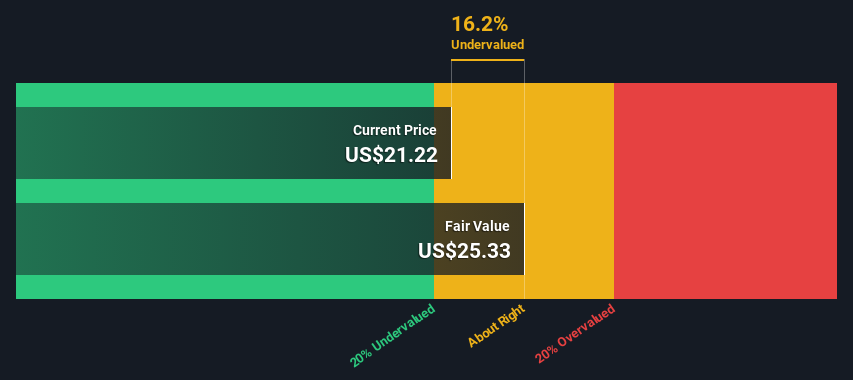

MYR Group (NasdaqGS:MYRG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MYR Group is a company specializing in electrical construction services, focusing on commercial and industrial projects as well as transmission and distribution, with a market cap of $1.86 billion.

Operations: MYR Group's revenue streams are primarily derived from its Commercial & Industrial (C&I) and Transmission & Distribution (T&D) segments, generating $1.50 billion and $2.09 billion respectively. The company's gross profit margin has seen fluctuations, reaching a peak of 14.03% in Q4 2014 and declining to 8.83% by Q2 2024. Operating expenses have consistently risen over the periods, impacting overall profitability, with general and administrative expenses being a significant component of the cost structure.

PE: 34.1x

MYR Group, a small-cap player in the construction services sector, has recently shown insider confidence with significant share purchases. From May 6 to June 30, 2024, the company repurchased 117,422 shares for US$16.26 million. Despite reporting a net loss of US$15.28 million for Q2 2024 and seeing sales dip to US$828.89 million from US$888.62 million year-over-year, MYR Group is actively seeking acquisitions and investments to bolster growth using its strong balance sheet and credit facility.

- Click here and access our complete valuation analysis report to understand the dynamics of MYR Group.

Gain insights into MYR Group's historical performance by reviewing our past performance report.

PRA Group (NasdaqGS:PRAA)

Simply Wall St Value Rating: ★★★★★☆

Overview: PRA Group specializes in purchasing and collecting nonperforming loans, with a market cap of approximately $1.23 billion.

Operations: The company generates revenue primarily from accounts receivable management, with operating expenses and non-operating expenses being significant cost components. Gross profit margins have consistently been at 100%, while net income margins have fluctuated, reaching as high as 23.85% and dropping to -10.40%.

PE: 220.7x

PRA Group has shown significant financial improvement, reporting a net income of US$21.52 million for Q2 2024, compared to a net loss of US$3.8 million the previous year. Revenue also increased to US$284.23 million from US$209.24 million in the same period last year. Notably, insider confidence is evident with Independent Director Geir Olsen purchasing 11,750 shares valued at approximately US$251,333 between July and August 2024. The company was added to the Russell 2000 Dynamic Index but dropped from several defensive indices on July 1, 2024.

- Dive into the specifics of PRA Group here with our thorough valuation report.

Gain insights into PRA Group's past trends and performance with our Past report.

Key Takeaways

- Embark on your investment journey to our 50 Undervalued US Small Caps With Insider Buying selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MYRG

MYR Group

Through its subsidiaries, provides electrical construction services in the United States and Canada.

Flawless balance sheet with moderate growth potential.