- United States

- /

- Software

- /

- NasdaqGM:APPF

3 US Growth Stocks With Insider Ownership And 20% Revenue Growth

Reviewed by Simply Wall St

As the U.S. stock market experiences a rally, with major indices like the S&P 500 and Nasdaq climbing due to gains in large-cap technology stocks, investors are keenly observing economic indicators such as interest rate adjustments and oil price fluctuations. In this environment, growth companies with substantial insider ownership and robust revenue expansion can present intriguing opportunities for those looking to navigate the complexities of today's market landscape.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.2% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 41.3% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

Underneath we present a selection of stocks filtered out by our screen.

Corcept Therapeutics (NasdaqCM:CORT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Corcept Therapeutics Incorporated focuses on discovering and developing drugs for severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States, with a market cap of approximately $4.75 billion.

Operations: The company's revenue is primarily derived from the discovery, development, and commercialization of pharmaceutical products, amounting to $569.61 million.

Insider Ownership: 11.6%

Revenue Growth Forecast: 20.4% p.a.

Corcept Therapeutics is experiencing significant growth, with earnings forecasted to increase by 38.1% annually over the next three years, outpacing the US market. Despite limited insider buying recently, insiders have bought more shares than sold in the past three months. The company raised its 2024 revenue guidance to between US$640 million and US$670 million following strong Q2 results, reporting net income of US$35.49 million compared to last year's US$27.53 million for the same period.

- Take a closer look at Corcept Therapeutics' potential here in our earnings growth report.

- Our expertly prepared valuation report Corcept Therapeutics implies its share price may be lower than expected.

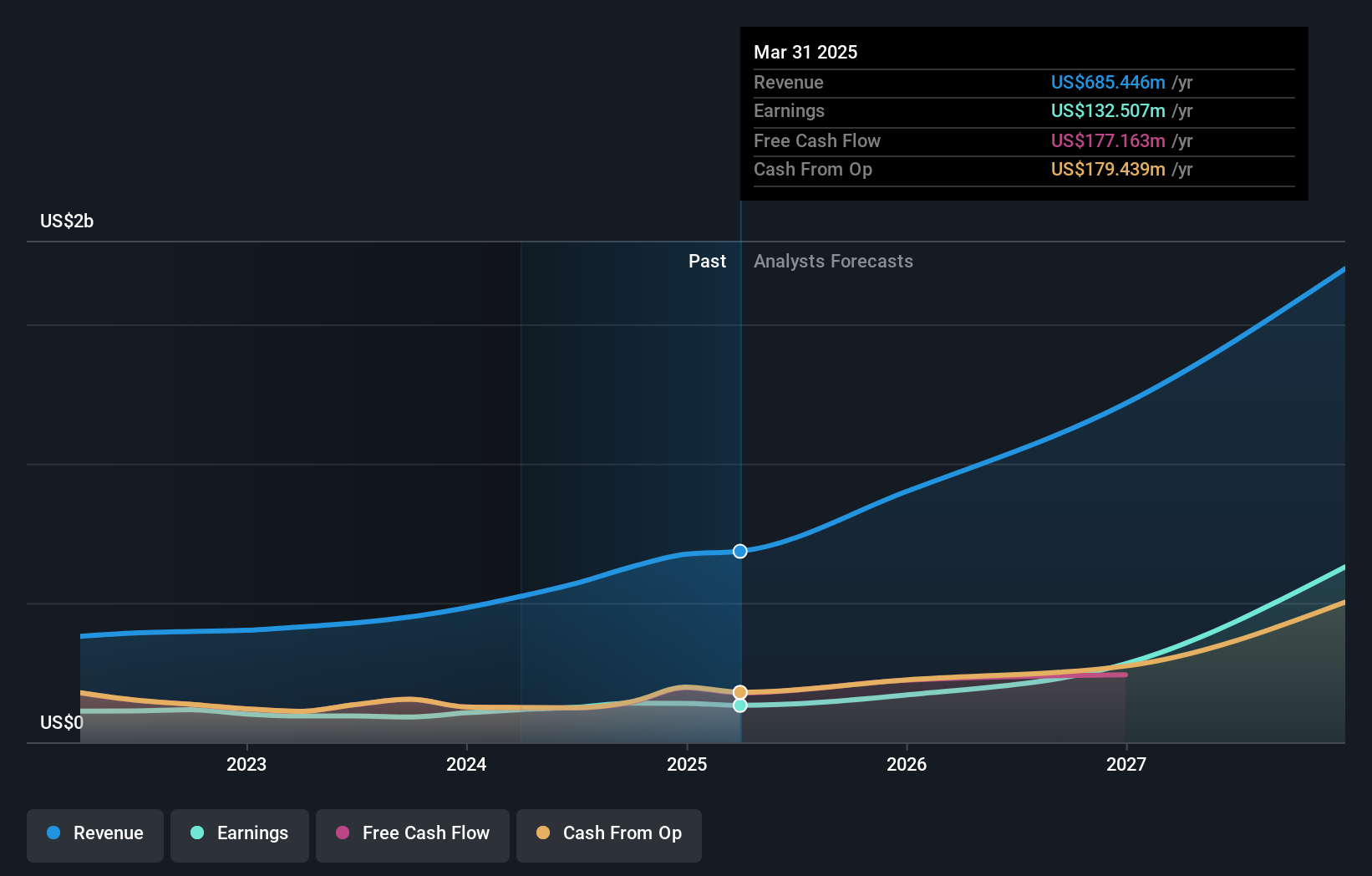

AppFolio (NasdaqGM:APPF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppFolio, Inc. offers cloud-based business management solutions for the real estate industry in the United States and has a market cap of approximately $8.24 billion.

Operations: The company's revenue is primarily derived from its cloud-based business management software and Value+ platforms, totaling $722.08 million.

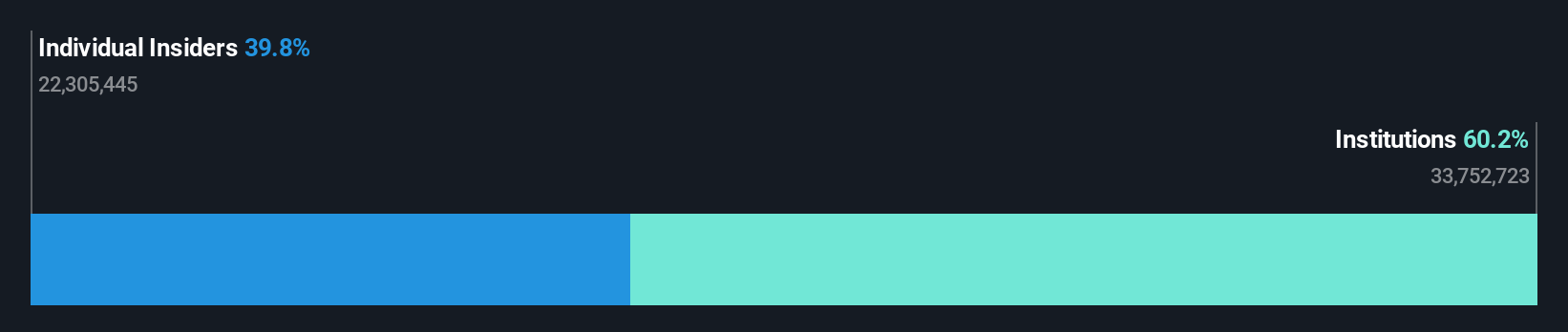

Insider Ownership: 30.9%

Revenue Growth Forecast: 16.9% p.a.

AppFolio's growth trajectory is promising, with earnings expected to rise by 20.5% annually, surpassing the US market average. Recent results show a turnaround from loss to a net income of US$29.67 million in Q2 2024, driven by increased sales of US$197.38 million. Despite no substantial insider buying recently and some significant selling, the company remains focused on expanding revenue streams and enhancing customer engagement under new leadership with Marcy Campbell as Chief Revenue Officer.

- Navigate through the intricacies of AppFolio with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report AppFolio implies its share price may be too high.

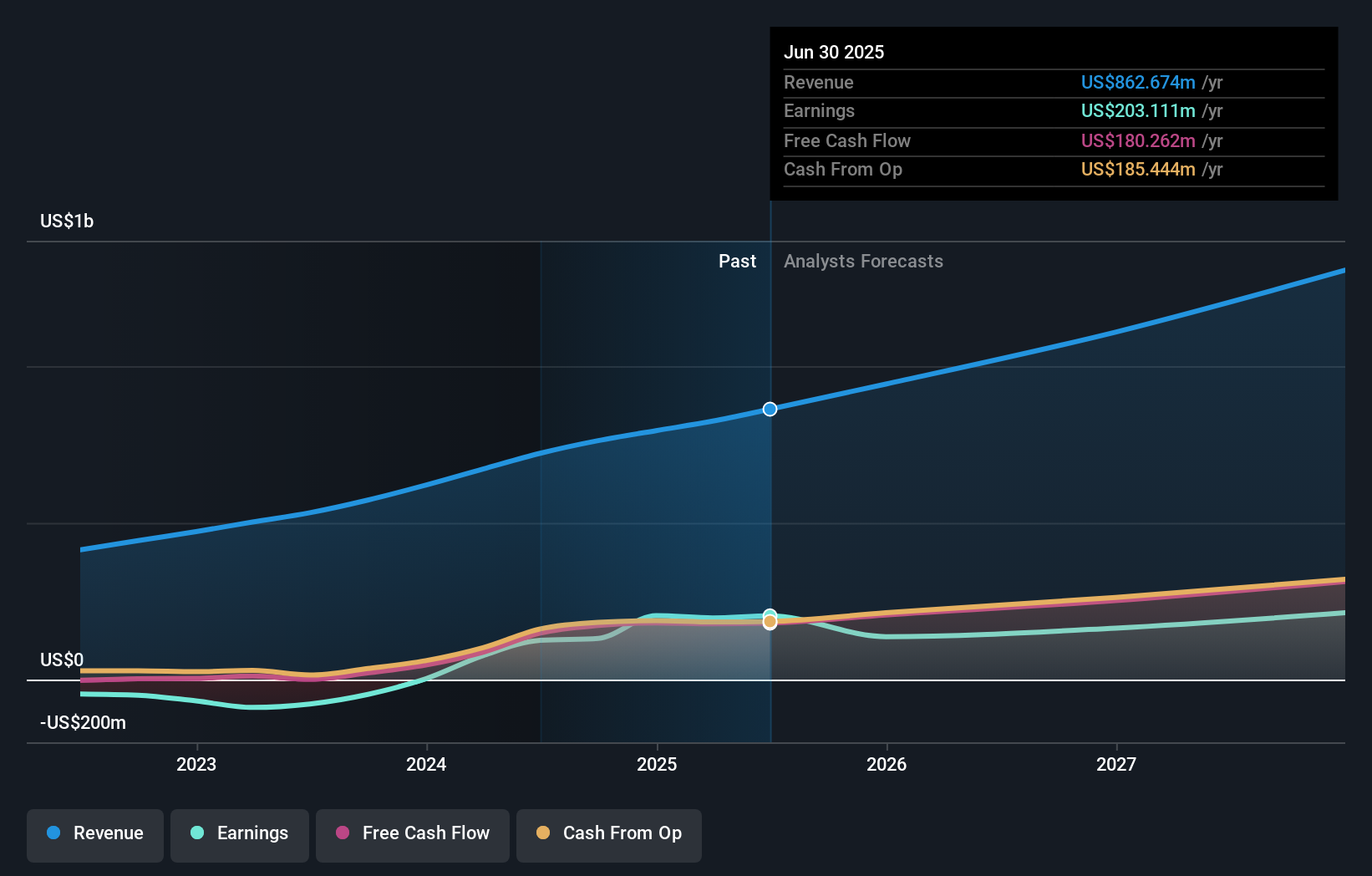

Ameresco (NYSE:AMRC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ameresco, Inc. is a clean technology integrator offering energy efficiency and renewable energy solutions across the United States, Canada, Europe, and internationally with a market cap of approximately $1.82 billion.

Operations: The company's revenue segments include $207.40 million from Europe, $410.94 million from U.S. Federal, and $137.13 million from Alternative Fuels.

Insider Ownership: 37.2%

Revenue Growth Forecast: 10.7% p.a.

Ameresco's growth is supported by its focus on renewable energy projects, such as the recent Keller Canyon landfill gas plant and Utah’s first floating solar array. Earnings are forecast to grow significantly at 28.1% annually, outpacing the US market. However, high non-cash earnings and interest coverage issues could be concerns. Despite no recent insider trading activity, Ameresco's strategic expansions in sustainable energy solutions highlight its commitment to innovation and environmental impact reduction.

- Dive into the specifics of Ameresco here with our thorough growth forecast report.

- The analysis detailed in our Ameresco valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Access the full spectrum of 182 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:APPF

AppFolio

Provides cloud business management solutions for the real estate industry in the United States.

Flawless balance sheet with reasonable growth potential.