- United States

- /

- Machinery

- /

- NasdaqGS:CMCO

Exploring Columbus McKinnon And 2 Other Undervalued Small Caps With Insider Activity

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.6%, and over the past 12 months, it has seen a growth of 12%, with earnings forecasted to grow by 14% annually. In this thriving environment, identifying stocks that are potentially undervalued and have notable insider activity can be key to uncovering promising investment opportunities.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 0.9x | 34.47% | ★★★★★★ |

| Columbus McKinnon | NA | 0.5x | 39.46% | ★★★★★☆ |

| Citizens & Northern | 10.8x | 2.7x | 48.89% | ★★★★☆☆ |

| Five Star Bancorp | 12.3x | 4.8x | 46.24% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 25.36% | ★★★★☆☆ |

| Titan Machinery | NA | 0.2x | -342.41% | ★★★★☆☆ |

| MVB Financial | 13.4x | 1.8x | 37.44% | ★★★☆☆☆ |

| Cracker Barrel Old Country Store | 21.3x | 0.4x | -647.97% | ★★★☆☆☆ |

| Farmland Partners | 9.2x | 9.3x | -19.21% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -55.18% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

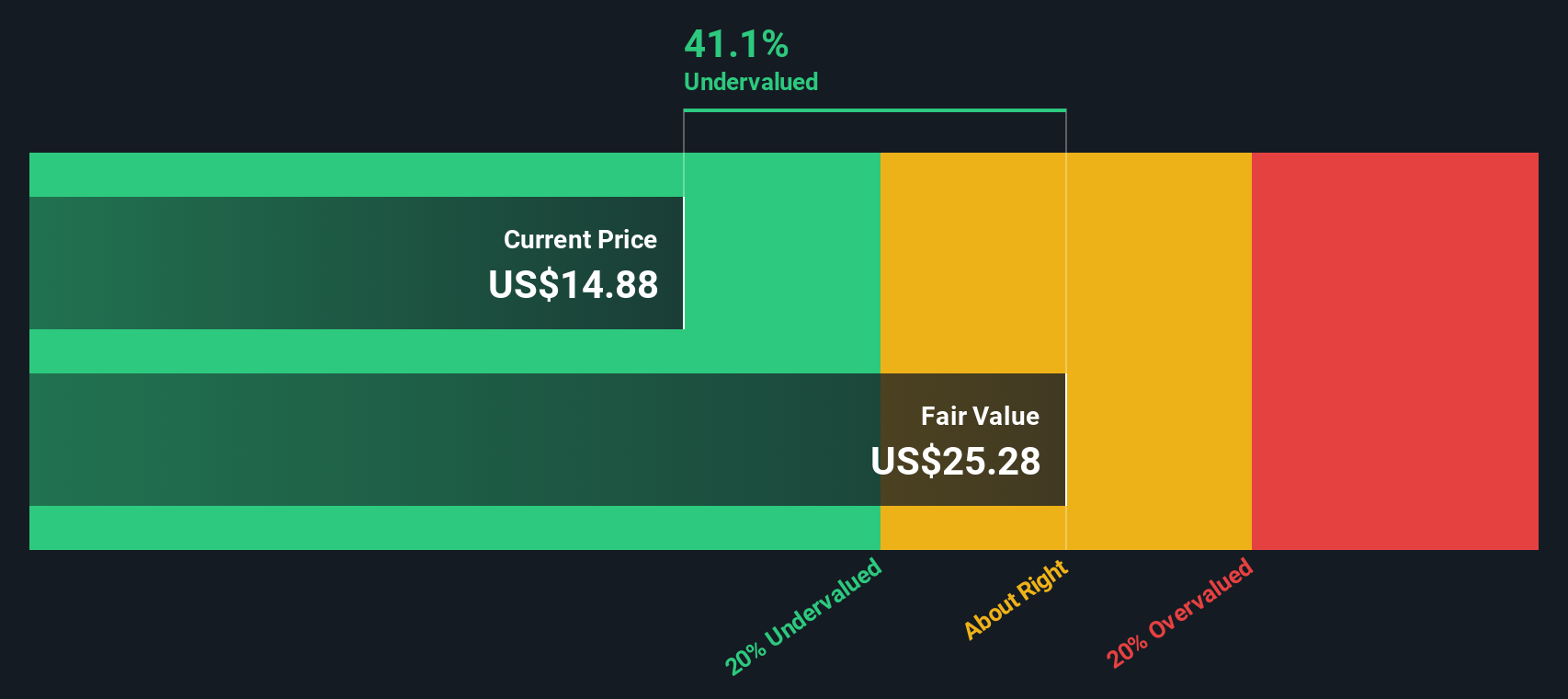

Columbus McKinnon (CMCO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Columbus McKinnon is a company that specializes in the design, manufacturing, and marketing of machinery and industrial equipment with operations generating $963.03 million in revenue, and it has a market capitalization of approximately $1.5 billion.

Operations: The company generates revenue primarily from the Machinery & Industrial Equipment segment, with recent figures showing $963.03 million in revenue. The gross profit margin has shown variability, reaching 37.10% in late 2024 before dropping to 35.48% by early 2025, highlighting fluctuations in cost management and pricing strategies over time. Operating expenses have been significant, contributing to shifts in net income margins which reached negative territory at -0.53% by March 2025 due to increased non-operating expenses and operating costs relative to revenue growth.

PE: -84.6x

Columbus McKinnon, a smaller company in the U.S. market, is navigating financial challenges with a recent net loss of US$5.14 million for the year ending March 2025, compared to a profit of US$46.63 million previously. Despite flat sales projections for fiscal 2026, insider confidence is evident as David Wilson purchased 31,300 shares valued at over US$1 million between January and March 2025. The company's strategic focus includes maintaining dividends despite earnings pressure and leveraging external borrowing for funding needs.

- Click here and access our complete valuation analysis report to understand the dynamics of Columbus McKinnon.

Examine Columbus McKinnon's past performance report to understand how it has performed in the past.

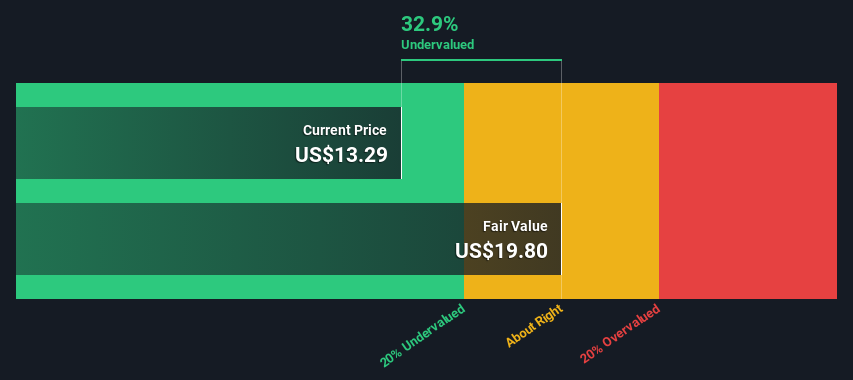

LendingClub (LC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: LendingClub operates as a financial services company specializing in personal loans and banking, with a market capitalization of approximately $1.22 billion.

Operations: LendingClub generates revenue primarily through its Lending Club Bank and the parent company, with recent figures showing a gross profit margin of 23.68%. The company's cost structure includes significant operating expenses such as sales and marketing, general and administrative costs, and non-operating expenses.

PE: 23.9x

LendingClub, a smaller company in the financial sector, is drawing attention for its potential value. Despite reporting net income of US$11.67 million for Q1 2025, slightly down from US$12.25 million a year ago, insider confidence is evident with Michael Zeisser purchasing 20,000 shares recently valued at US$257,600. The company anticipates earnings growth of over 46% annually and has invested in a new headquarters property in San Francisco for US$74.5 million.

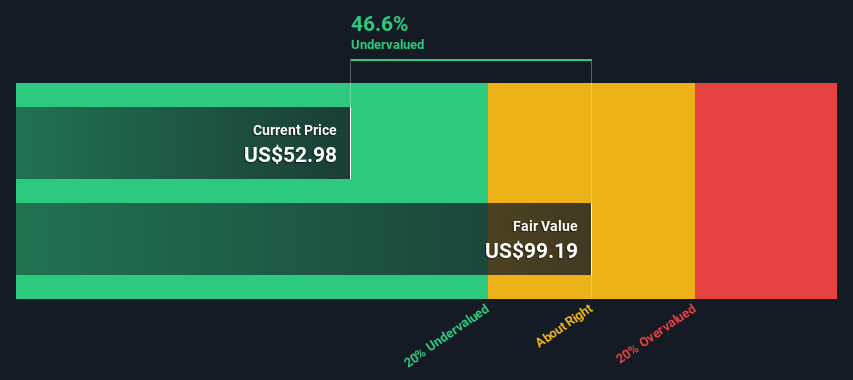

Minerals Technologies (MTX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Minerals Technologies operates in the Engineered Solutions and Consumer & Specialties segments, with a market capitalization of approximately $2.23 billion.

Operations: Minerals Technologies generates revenue primarily from its Engineered Solutions and Consumer & Specialties segments, with the latter contributing $1.11 billion. The company's gross profit margin has shown fluctuations, reaching 25.85% in late 2024 before declining to 25.60% by early 2025. Operating expenses and non-operating expenses have a notable impact on net income, which experienced negative figures in early 2025 due to increased costs, including a significant rise in non-operating expenses to $295 million.

PE: -77.7x

Minerals Technologies, a smaller player in its sector, recently reported a challenging first quarter with sales of US$491.8 million and a net loss of US$144 million. Despite this, insider confidence is evident as they continue to purchase shares. The company's earnings are projected to grow significantly at 172% annually. Although debt is covered by operating cash flow, reliance on external borrowing presents risks. A regular quarterly dividend of $0.11 per share underscores their commitment to shareholders amidst these challenges.

Make It Happen

- Click here to access our complete index of 94 Undervalued US Small Caps With Insider Buying.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CMCO

Columbus McKinnon

Designs, manufactures, and markets motion solutions for moving, lifting, positioning, and securing materials worldwide.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives