- United States

- /

- Machinery

- /

- NasdaqGM:BLBD

Why Blue Bird (BLBD) Is Up 8.2% After Opening Its $38M Plattsburgh Facility and Raising Guidance

Reviewed by Simply Wall St

- Earlier this month, Micro Bird USA LLC, a joint venture between Blue Bird and Girardin Minibus, celebrated the grand opening of its US$38 million manufacturing facility in Plattsburgh, New York, marking a significant expansion of its production capacity and presence in North America.

- This development reinforces Blue Bird’s commitment to both Buy America Act compliance and scaling electric and alternative-fuel bus offerings for U.S. customers, further strengthening its long-term growth strategy.

- We’ll now explore how Blue Bird’s record electric bus deliveries and raised EBITDA guidance may impact its investment outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Blue Bird Investment Narrative Recap

Blue Bird’s investment story centers on the belief that U.S. school bus electrification will accelerate, fueled by government programs and customer demand for clean, Buy America Act-compliant vehicles. The new Plattsburgh facility adds meaningful production capacity and delivers on compliance requirements, but the factory opening itself does not materially change the near-term catalyst, ongoing federal EV incentives, nor does it lessen the current risk: that cuts or delays in these programs could curb demand for electric buses and impact revenue momentum.

The most relevant recent update is Blue Bird's raised full-year adjusted EBITDA guidance, a move supported by record electric bus deliveries and a still-large backlog of orders. This announcement links directly to the Plattsburgh expansion, as increased manufacturing capability and stronger U.S. presence may help convert backlogged sales faster if incentives remain in place and supply chain stability persists. In contrast, investors should be aware of the risk that proposed funding changes to government EV incentives could suddenly reduce...

Read the full narrative on Blue Bird (it's free!)

Blue Bird's outlook anticipates $1.6 billion in revenue and $152.3 million in earnings by 2028. This scenario requires 4.0% annual revenue growth and a $36.4 million increase in earnings from $115.9 million today.

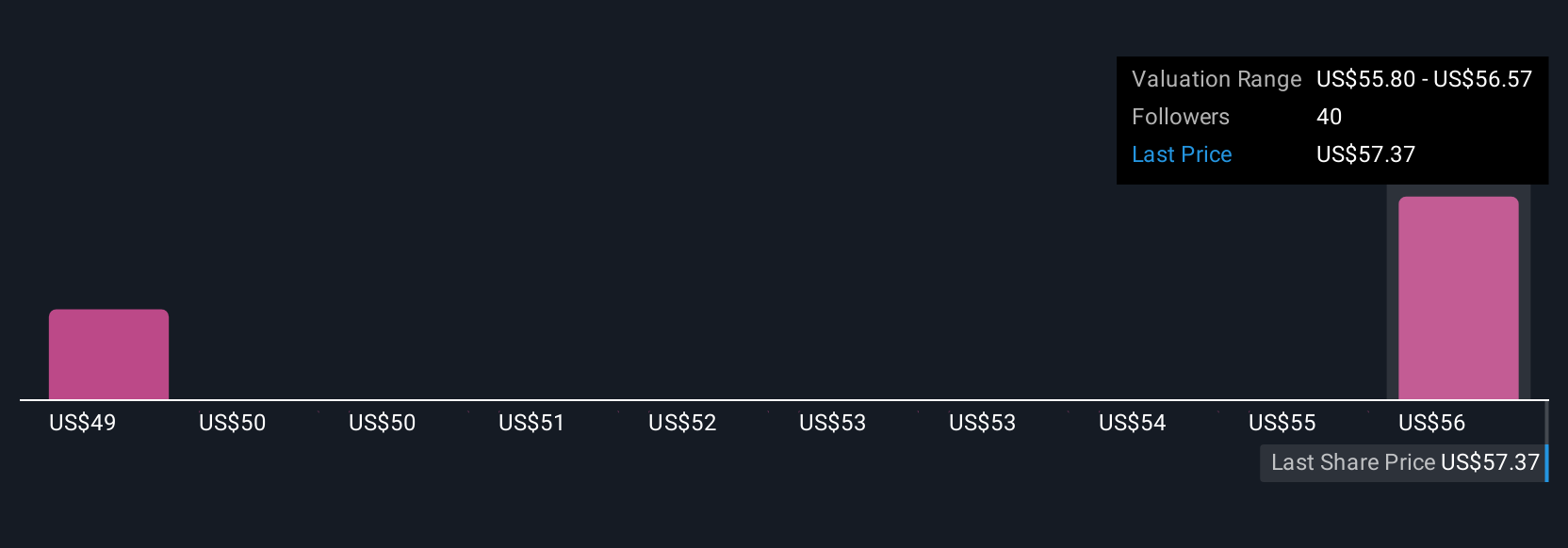

Uncover how Blue Bird's forecasts yield a $59.12 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Fair value estimates from 3 Simply Wall St Community members range widely between US$59.13 and US$138.92 per share. While opinions vary, future margin gains could depend on continued government EV funding support, which remains a critical factor to watch.

Explore 3 other fair value estimates on Blue Bird - why the stock might be worth over 2x more than the current price!

Build Your Own Blue Bird Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Bird research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Blue Bird research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blue Bird's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blue Bird might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BLBD

Blue Bird

Designs, engineers, manufactures, and sells school buses in the United States, Canada, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives