- United States

- /

- Software

- /

- NasdaqGS:NTNX

3 US Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As U.S. markets rise, with the Nasdaq leading gains as investors look past tariff threats, there is a renewed interest in identifying stocks that may be trading below their estimated value. In this environment, a good stock often exhibits strong fundamentals and resilience to external pressures, making it potentially undervalued despite broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CareTrust REIT (NYSE:CTRE) | $26.11 | $50.40 | 48.2% |

| German American Bancorp (NasdaqGS:GABC) | $39.94 | $77.95 | 48.8% |

| Brookline Bancorp (NasdaqGS:BRKL) | $12.37 | $24.11 | 48.7% |

| First National (NasdaqCM:FXNC) | $26.33 | $50.60 | 48% |

| AGNC Investment (NasdaqGS:AGNC) | $10.14 | $19.39 | 47.7% |

| Midland States Bancorp (NasdaqGS:MSBI) | $19.60 | $37.82 | 48.2% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $112.83 | $217.38 | 48.1% |

| Coastal Financial (NasdaqGS:CCB) | $86.45 | $172.68 | 49.9% |

| Sociedad Química y Minera de Chile (NYSE:SQM) | $38.37 | $73.27 | 47.6% |

| Nutanix (NasdaqGS:NTNX) | $71.75 | $141.36 | 49.2% |

We're going to check out a few of the best picks from our screener tool.

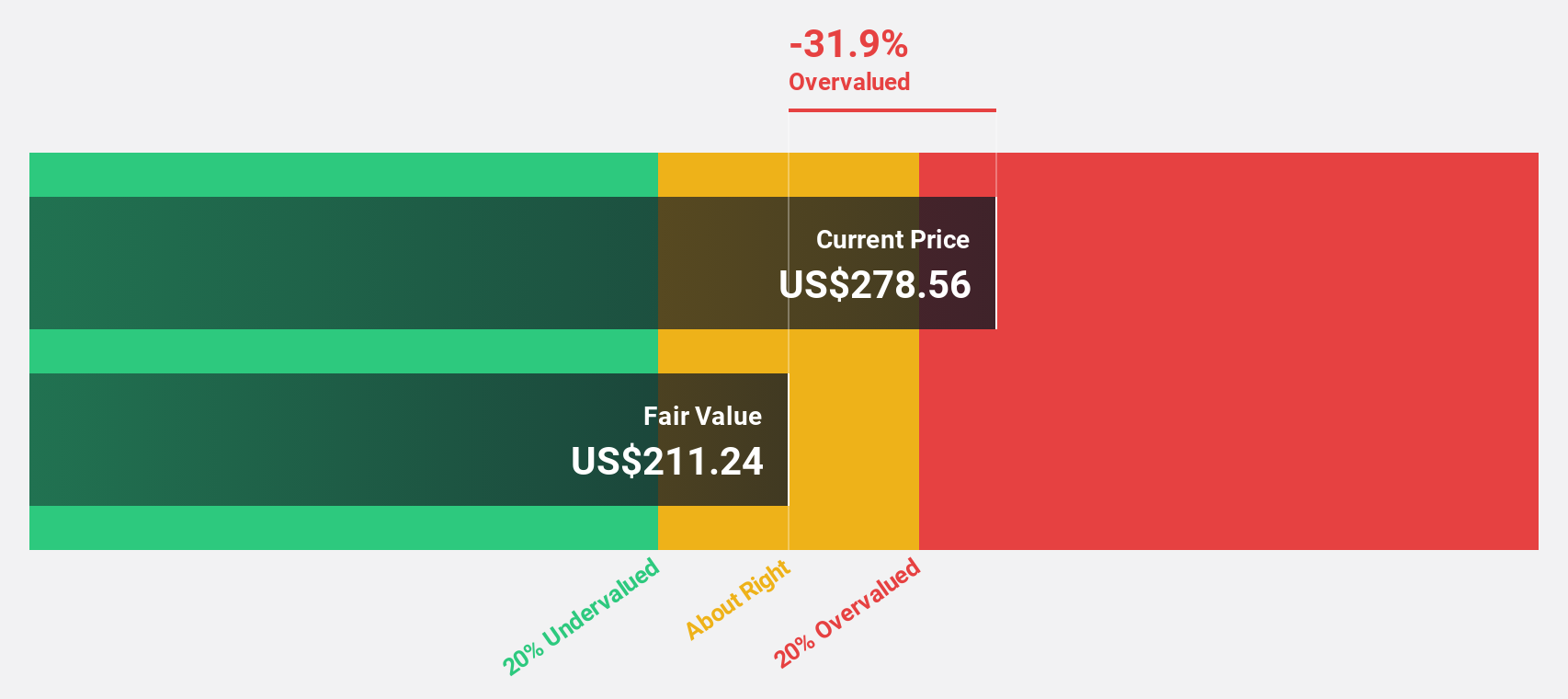

AeroVironment (NasdaqGS:AVAV)

Overview: AeroVironment, Inc. specializes in designing, developing, producing, delivering, and supporting robotic systems and related services for government agencies and businesses globally, with a market cap of approximately $4.95 billion.

Operations: The company's revenue segments include Maccready Works at $77.97 million, UnCrewed Systems at $422.42 million, and Loitering Munitions Systems at $261.11 million.

Estimated Discount To Fair Value: 18.7%

AeroVironment appears undervalued based on cash flows, trading at US$182.15, below its estimated fair value of US$223.96. Recent contracts with the U.S. Army, including a $288 million order for Switchblade systems, bolster future cash flow prospects amidst expected earnings growth of 39.3% annually over the next three years—outpacing the broader market's 14.5%. Despite reduced net income recently, revenue forecasts remain strong at 12.7% annual growth.

- Our growth report here indicates AeroVironment may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of AeroVironment.

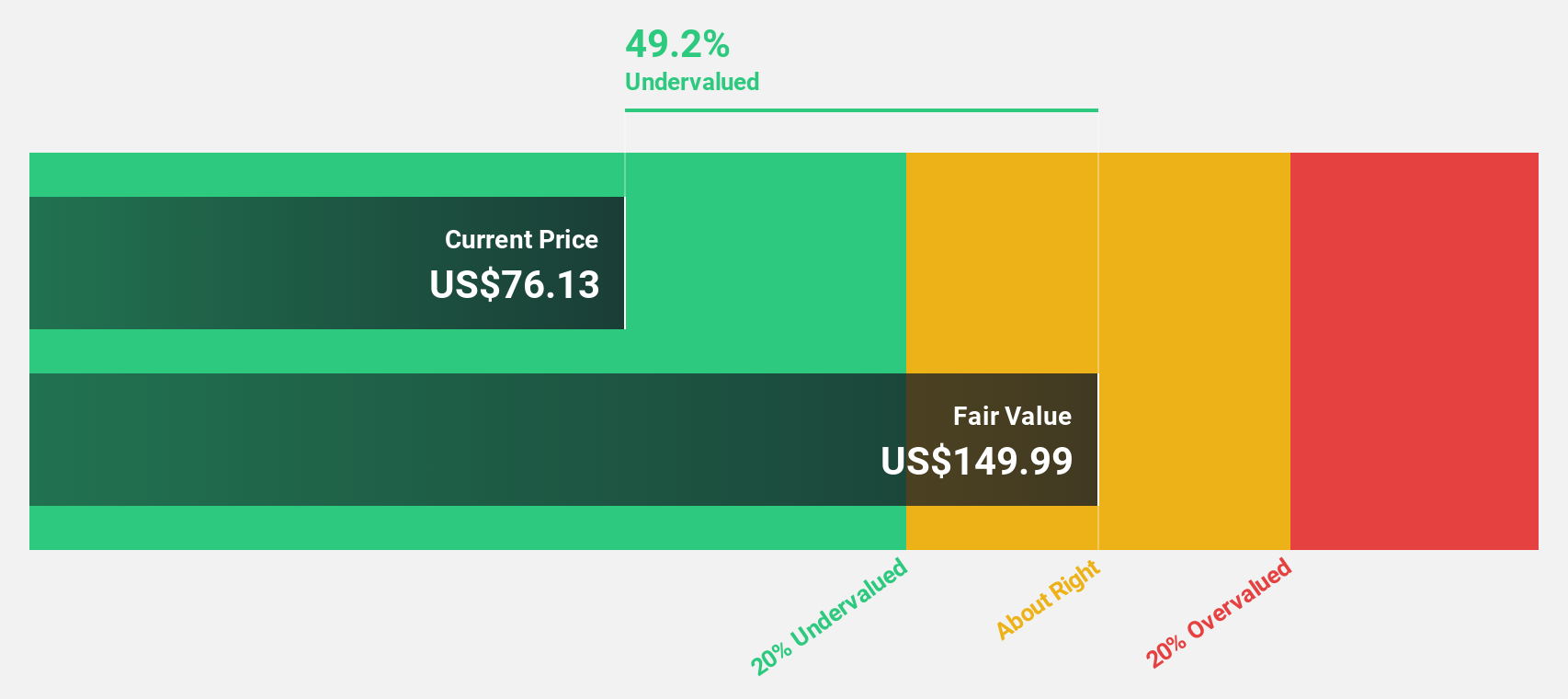

Nutanix (NasdaqGS:NTNX)

Overview: Nutanix, Inc. offers an enterprise cloud platform across various regions including North America, Europe, and the Asia Pacific, with a market cap of approximately $18.90 billion.

Operations: The company's revenue segment is primarily derived from Internet Software & Services, generating approximately $2.23 billion.

Estimated Discount To Fair Value: 49.2%

Nutanix is trading at US$71.75, significantly below its estimated fair value of US$141.36, suggesting it may be undervalued based on cash flows. The recent integration with Traefik Labs enhances Nutanix's Kubernetes capabilities, potentially driving operational efficiencies and security improvements for hybrid multicloud environments. Despite slower revenue growth forecasts of 13% annually, earnings are projected to grow substantially by 92% per year, indicating robust profitability prospects over the next three years.

- The analysis detailed in our Nutanix growth report hints at robust future financial performance.

- Get an in-depth perspective on Nutanix's balance sheet by reading our health report here.

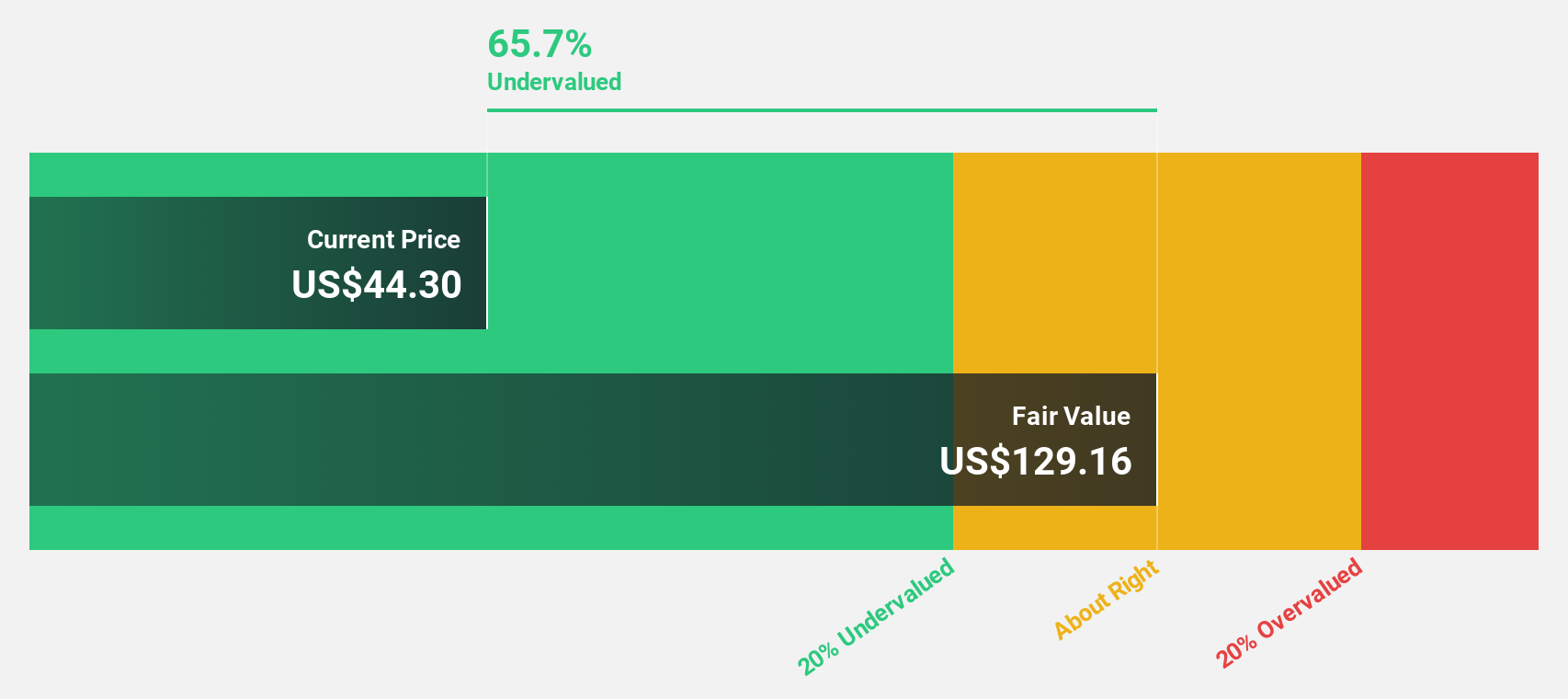

KBR (NYSE:KBR)

Overview: KBR, Inc. offers scientific, technology, and engineering solutions to governments and commercial clients globally, with a market cap of approximately $7.27 billion.

Operations: The company's revenue is derived from two main segments: Government Solutions, contributing $5.60 billion, and Sustainable Technology Solutions, accounting for $1.75 billion.

Estimated Discount To Fair Value: 46.2%

KBR is trading at US$55.37, significantly below its estimated fair value of US$102.88, indicating it may be undervalued based on cash flows. Recent contracts with Weardale Lithium and the U.S. Department of State enhance its revenue streams and technological footprint. While revenue growth is forecasted at 12.7% annually, slower than 20%, earnings are expected to grow significantly by over 20% per year, highlighting strong profitability potential amidst a robust contract pipeline.

- In light of our recent growth report, it seems possible that KBR's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of KBR.

Seize The Opportunity

- Reveal the 167 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives