- United States

- /

- Software

- /

- NYSE:SMWB

Insider Confidence In July 2025's Leading Growth Companies

Reviewed by Simply Wall St

As the U.S. stock market continues to reach new heights, with the S&P 500 and Nasdaq Composite setting record highs, investor sentiment is buoyed by strong corporate earnings and optimistic economic indicators. In such a robust market environment, companies with high insider ownership often signal confidence in their growth potential, making them an intriguing focus for investors seeking opportunities aligned with insider interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Zapp Electric Vehicles Group (ZAPP.F) | 16.1% | 170.8% |

| Wallbox (WBX) | 24.6% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| Niu Technologies (NIU) | 36% | 88.1% |

| FTC Solar (FTCI) | 24.9% | 62.5% |

| Credo Technology Group Holding (CRDO) | 11.7% | 36.9% |

| Chemung Financial (CHMG) | 19.6% | 78.3% |

| Atour Lifestyle Holdings (ATAT) | 22.2% | 23.6% |

| Astera Labs (ALAB) | 12.8% | 45.4% |

Let's review some notable picks from our screened stocks.

AerSale (ASLE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AerSale Corporation supplies aftermarket commercial aircraft, engines, and parts to a diverse range of clients globally, including airlines and defense contractors, with a market cap of approximately $291.48 million.

Operations: AerSale's revenue is primarily derived from its Tech Ops - MRO Services at $103.28 million, Tech Ops - Product Sales at $21.61 million, Asset Management Solutions - Engine at $162.66 million, and Asset Management Solutions - Aircraft at $32.76 million.

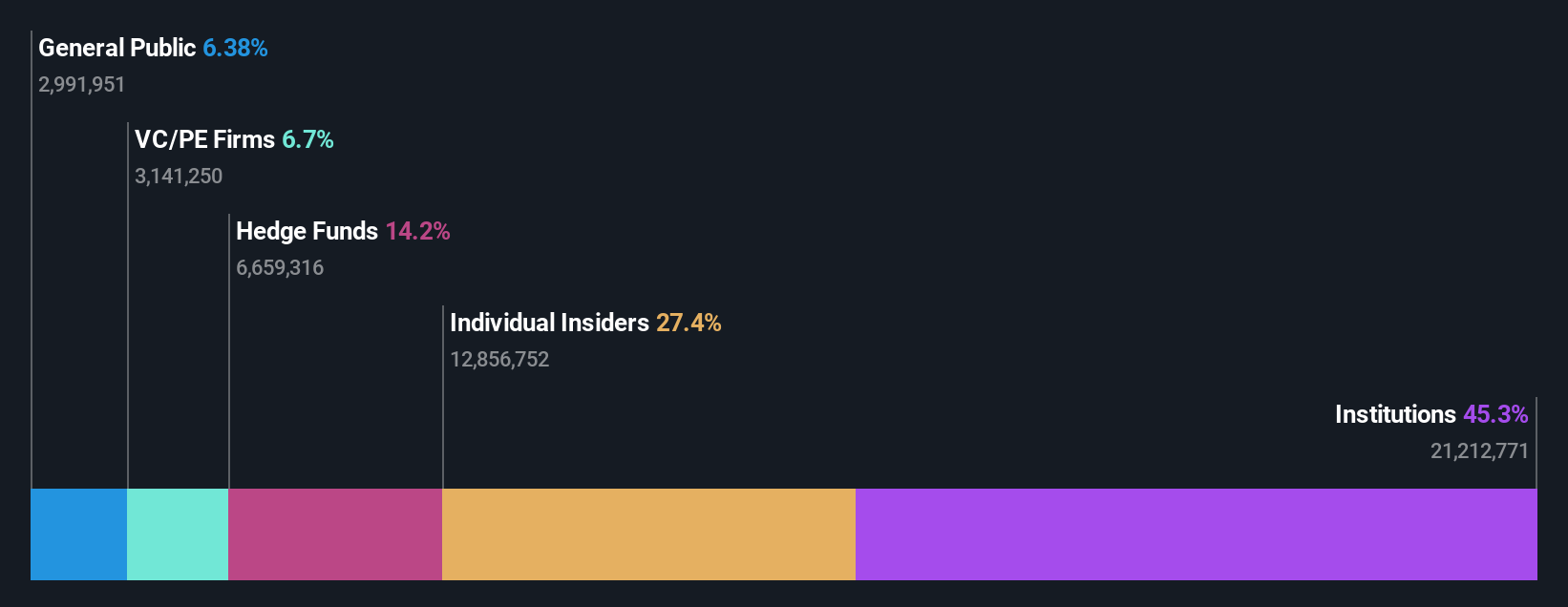

Insider Ownership: 27.5%

Return On Equity Forecast: N/A (2028 estimate)

AerSale, recently added to the Russell 2000 Value-Defensive Index, is expected to grow earnings by 170.74% annually and become profitable within three years. Despite a net loss of US$5.28 million in Q1 2025, insider ownership remains high with no substantial selling or buying over the past three months. The company trades at a significant discount to its estimated fair value and has completed a US$45 million share buyback, indicating potential confidence in future performance.

- Click to explore a detailed breakdown of our findings in AerSale's earnings growth report.

- Our expertly prepared valuation report AerSale implies its share price may be lower than expected.

Community West Bancshares (CWBC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Community West Bancshares is the bank holding company for Central Valley Community Bank, offering commercial banking services to small and middle-market businesses and individuals in California, with a market cap of $403.27 million.

Operations: The company's revenue is primarily generated from its banking operations, amounting to $132.83 million.

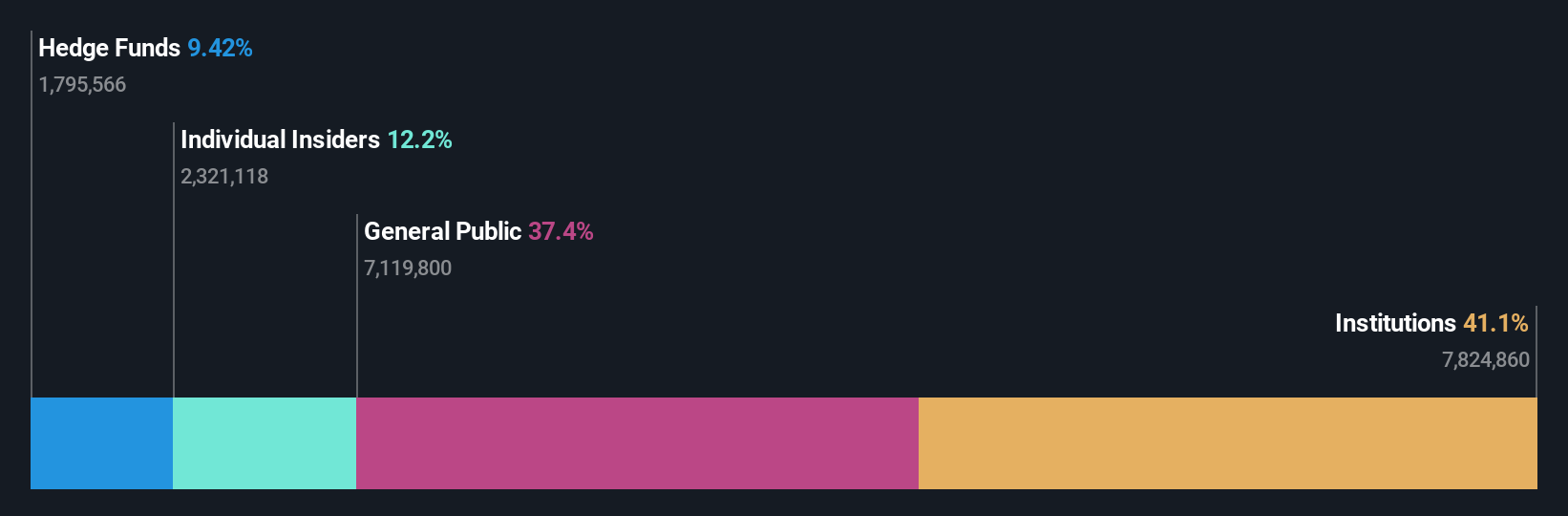

Insider Ownership: 12.2%

Return On Equity Forecast: N/A (2028 estimate)

Community West Bancshares, recently added to multiple Russell Growth indices, is experiencing strong earnings growth with a net income of US$16.13 million for the first half of 2025 compared to a loss last year. Insider ownership remains substantial with more shares bought than sold over the past three months. The company trades at 52.2% below its estimated fair value and has announced a share repurchase program, reflecting confidence in its growth trajectory despite an unstable dividend history.

- Take a closer look at Community West Bancshares' potential here in our earnings growth report.

- Our valuation report here indicates Community West Bancshares may be overvalued.

Similarweb (SMWB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. offers digital data and analytics services to support critical business decisions across various regions, including the United States, Europe, the Asia Pacific, the United Kingdom, and Israel, with a market cap of approximately $767.71 million.

Operations: The company generates revenue from its On Line Financial Information Providers segment, amounting to $258.02 million.

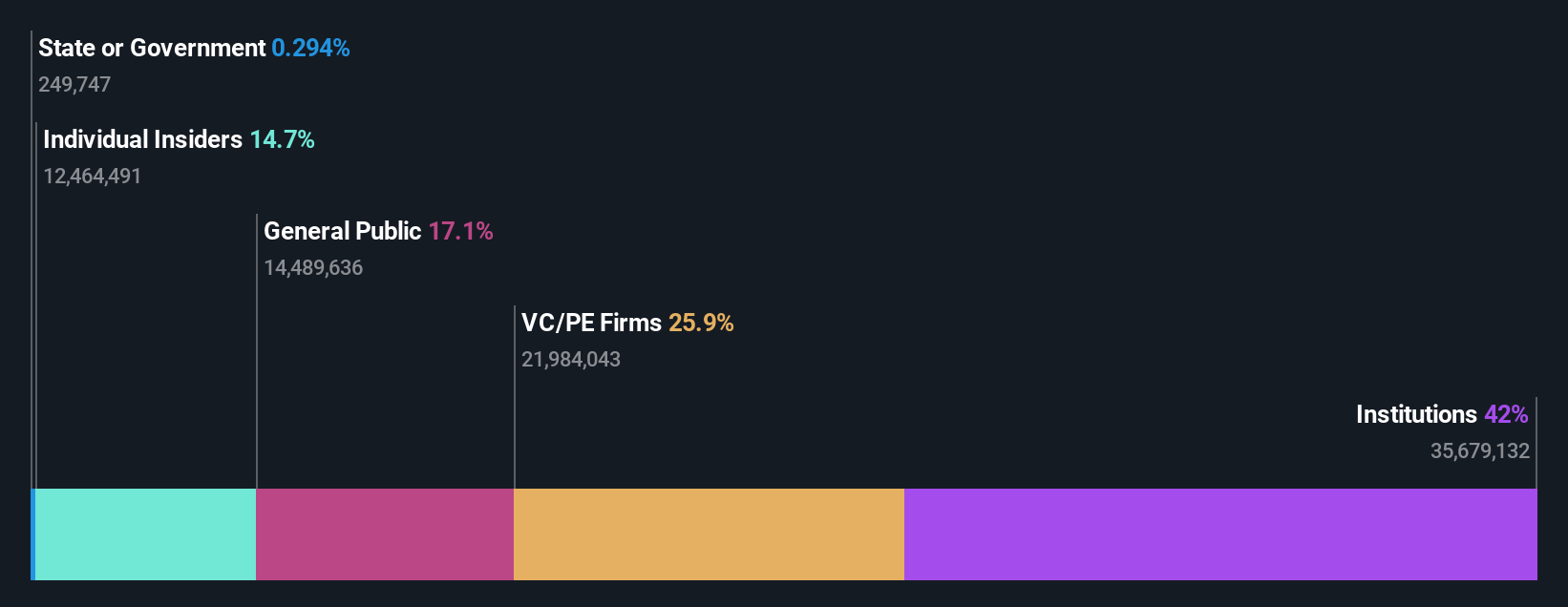

Insider Ownership: 14.9%

Return On Equity Forecast: 35% (2028 estimate)

Similarweb is trading at 44.7% below its estimated fair value, with revenue projected to grow faster than the US market at 14.2% annually. Despite a current net loss of US$9.26 million in Q1 2025, earnings are forecasted to grow significantly by 69.66% per year, becoming profitable within three years and achieving a high return on equity of 35.4%. Recent AI product launches aim to enhance digital strategy capabilities for businesses globally.

- Navigate through the intricacies of Similarweb with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Similarweb's share price might be on the cheaper side.

Seize The Opportunity

- Dive into all 190 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Curious About Other Options? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SMWB

Similarweb

Provides digital data and analytics for power critical business decisions in the United States, Europe, the Asia Pacific, the United Kingdom, Israel, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives