As of September 2025, the U.S. stock market is experiencing a mixed performance with the Nasdaq Composite reaching new record highs, driven by strong gains in tech stocks like Tesla and Microsoft. Amid this backdrop, investors are keenly watching for potential Federal Reserve interest rate cuts that could further influence market dynamics. In such an environment, growth companies with high insider ownership can offer unique insights into confidence levels within their leadership teams and may present interesting opportunities for those looking to navigate current economic conditions effectively.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 93.2% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 69% |

| Hippo Holdings (HIPO) | 14.1% | 41.2% |

| Hesai Group (HSAI) | 12.5% | 41.5% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.4% | 32.9% |

| Cloudflare (NET) | 10.5% | 46.1% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.5% |

| Astera Labs (ALAB) | 12.1% | 36.8% |

Let's dive into some prime choices out of the screener.

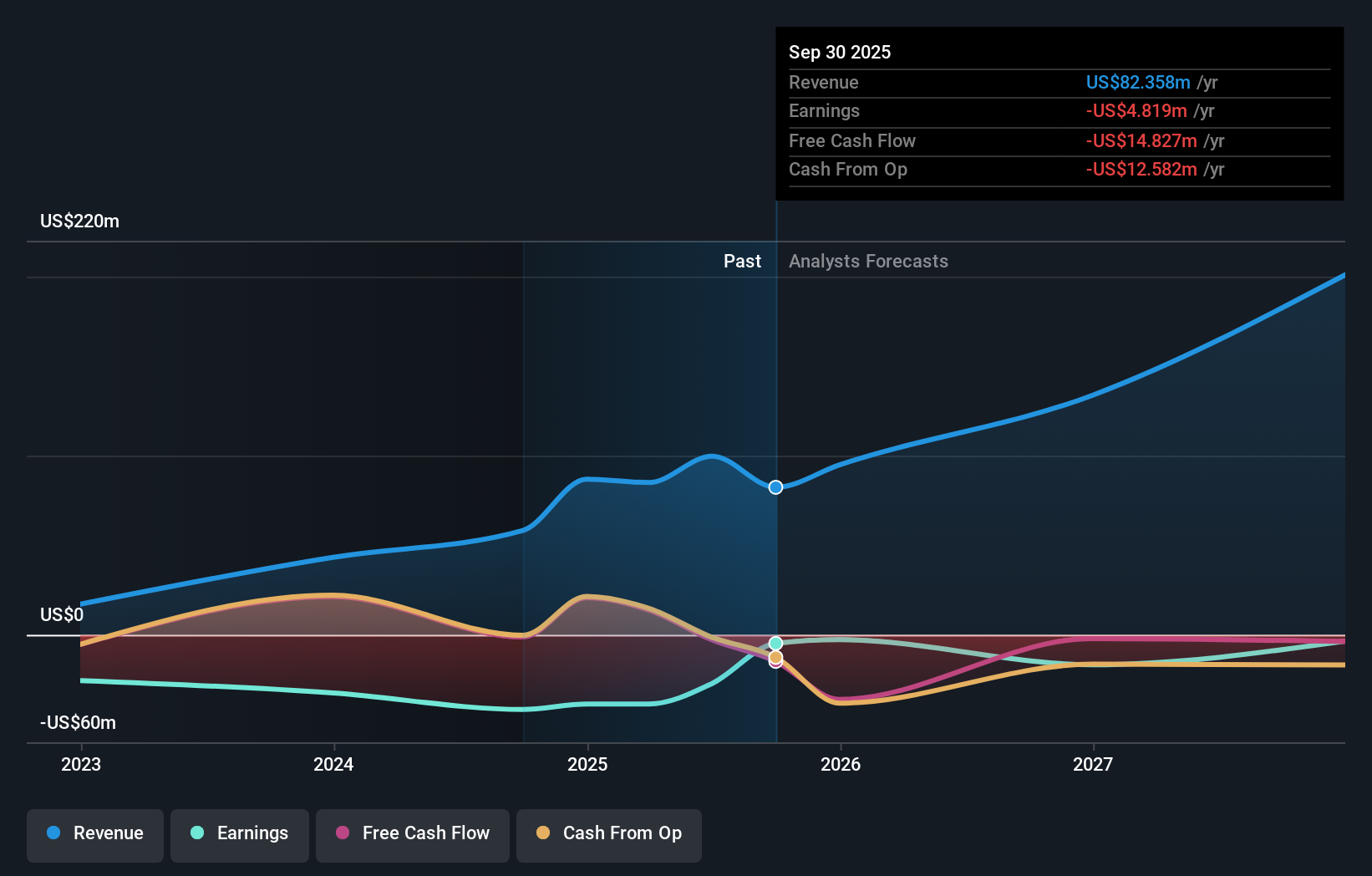

AIRO Group Holdings (AIRO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AIRO Group Holdings, Inc. is a multi-faceted advanced Aerospace and Defense company with a market cap of $636.85 million.

Operations: The company's revenue segments include Drones generating $88.75 million, Avionics contributing $7.16 million, and Training bringing in $3.85 million.

Insider Ownership: 15.3%

Revenue Growth Forecast: 31.2% p.a.

AIRO Group Holdings, a growth company with substantial insider ownership, is set to outpace the market with a forecasted 31.2% annual revenue growth and expected profitability within three years. Recent strategic moves include a $77.7 million equity offering and a joint venture with Nord Drone LLC to enhance its defense portfolio. Despite high share price volatility, AIRO trades significantly below estimated fair value, while analysts predict a 52.3% stock price increase amidst expanding operations in aerospace and defense sectors.

- Navigate through the intricacies of AIRO Group Holdings with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility AIRO Group Holdings' shares may be trading at a discount.

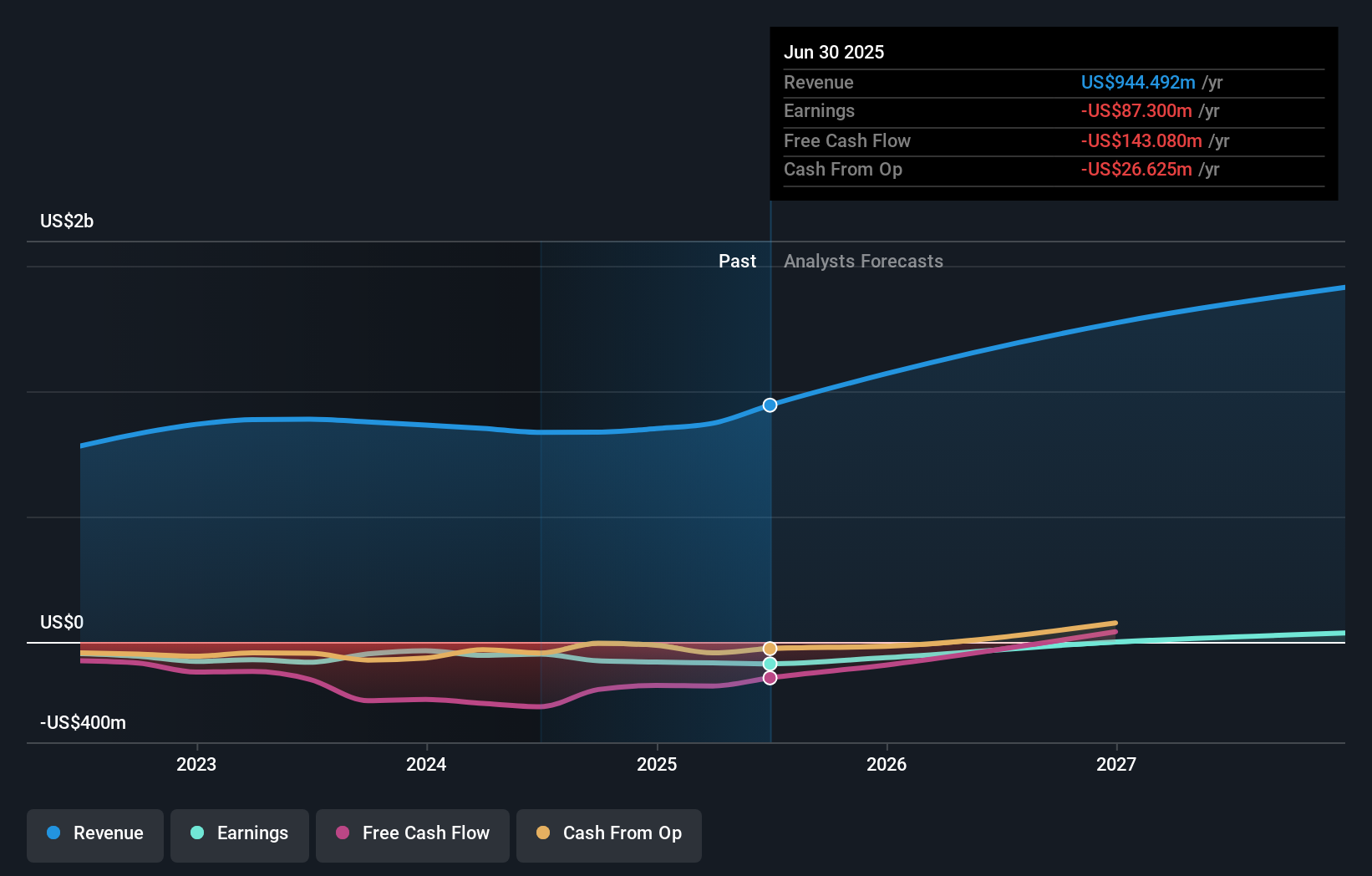

Westrock Coffee (WEST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Westrock Coffee Company, LLC is an integrated provider of coffee, tea, flavors, extracts, and ingredient solutions operating both in the United States and internationally with a market cap of $507.64 million.

Operations: The company's revenue is primarily derived from its Beverage Solutions segment, which accounts for $710.96 million, and its Sustainable Sourcing & Traceability segment, contributing $247.63 million.

Insider Ownership: 14.4%

Revenue Growth Forecast: 17.1% p.a.

Westrock Coffee demonstrates strong growth potential with revenue forecasted to grow 17.1% annually, surpassing the US market average. Despite recent net losses, insider buying suggests confidence in future profitability within three years. The company is expanding its operations with a new facility in Arkansas to meet increasing demand for single-serve coffee products, positioning itself advantageously as the market grows. Currently trading below fair value estimates, analysts expect significant stock price appreciation.

- Unlock comprehensive insights into our analysis of Westrock Coffee stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Westrock Coffee shares in the market.

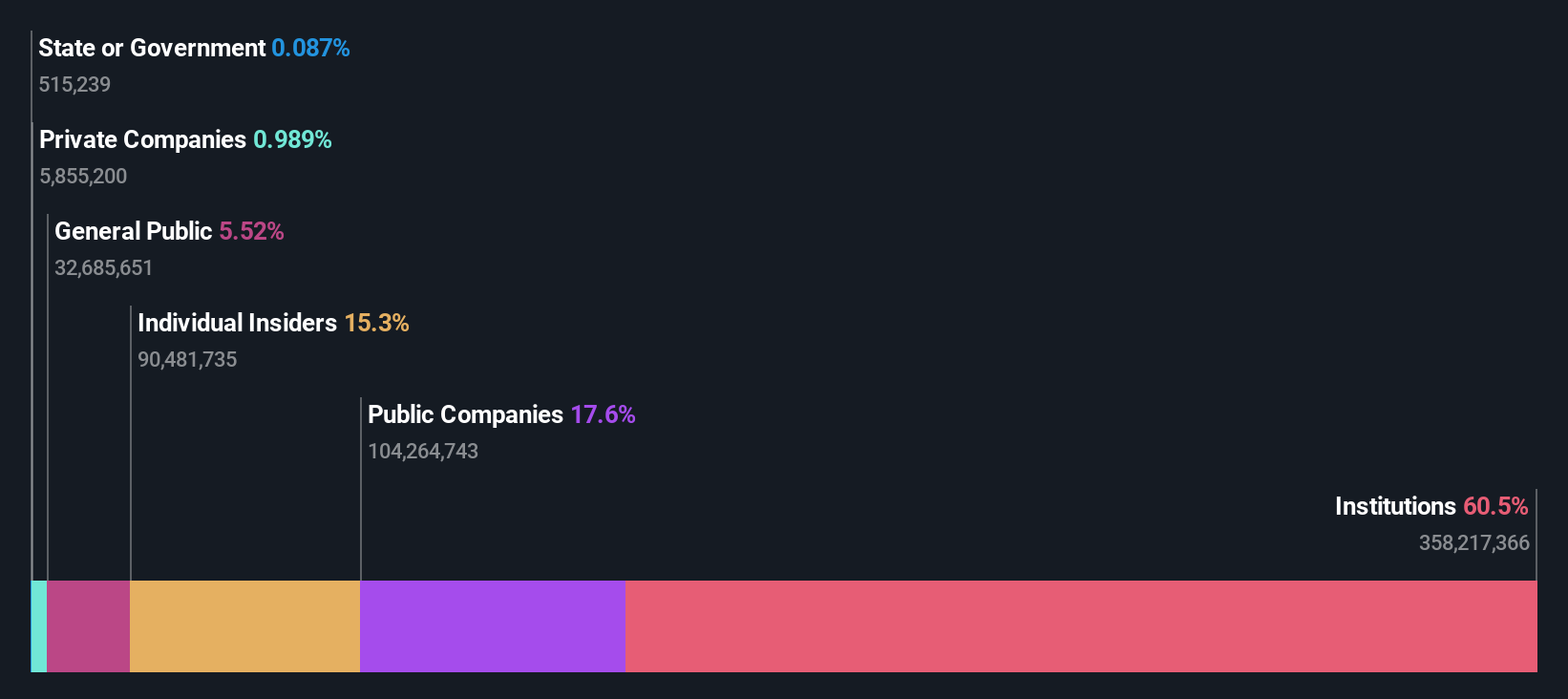

Sea (SE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sea Limited operates as a consumer internet company through its subsidiaries in Southeast Asia, Latin America, the rest of Asia, and internationally, with a market cap of approximately $116.07 billion.

Operations: Sea Limited generates revenue through its digital entertainment, e-commerce, and digital financial services segments across Southeast Asia, Latin America, and beyond.

Insider Ownership: 15.3%

Revenue Growth Forecast: 15.9% p.a.

Sea Limited's recent earnings report shows robust growth, with revenue reaching US$10.1 billion and net income at US$809.02 million for the first half of 2025. Insider ownership remains strong, aligning with a forecasted annual earnings growth of 30.3%, outpacing the US market average. The company's stock trades below fair value estimates, indicating potential upside as it continues to expand its market presence and profitability in the coming years.

- Dive into the specifics of Sea here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Sea is trading beyond its estimated value.

Where To Now?

- Investigate our full lineup of 194 Fast Growing US Companies With High Insider Ownership right here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Through its subsidiaries, operates as a consumer internet company in Southeast Asia, Latin America, the rest of Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026