- United States

- /

- Banks

- /

- NYSEAM:TMP

Tompkins Financial (TMP): Assessing Valuation After Insider Buying and Dividend Increase

Reviewed by Simply Wall St

Tompkins Financial (TMP) recently caught investors' attention as a company director made a substantial share purchase. In addition, the board approved a 4.6% increase to its regular quarterly dividend. These moves could reflect growing management confidence.

See our latest analysis for Tompkins Financial.

Tompkins Financial’s 7-day share price return of nearly 7% stands out against otherwise more muted movements this year, suggesting some renewed momentum after recent insider buying and a dividend boost. Even so, the past 12 months have delivered a total shareholder return of -6%, while the five-year total return remains a solid 26% overall.

If you’re looking to discover more opportunities with strong management signals, this is a great time to broaden your perspective and explore fast growing stocks with high insider ownership

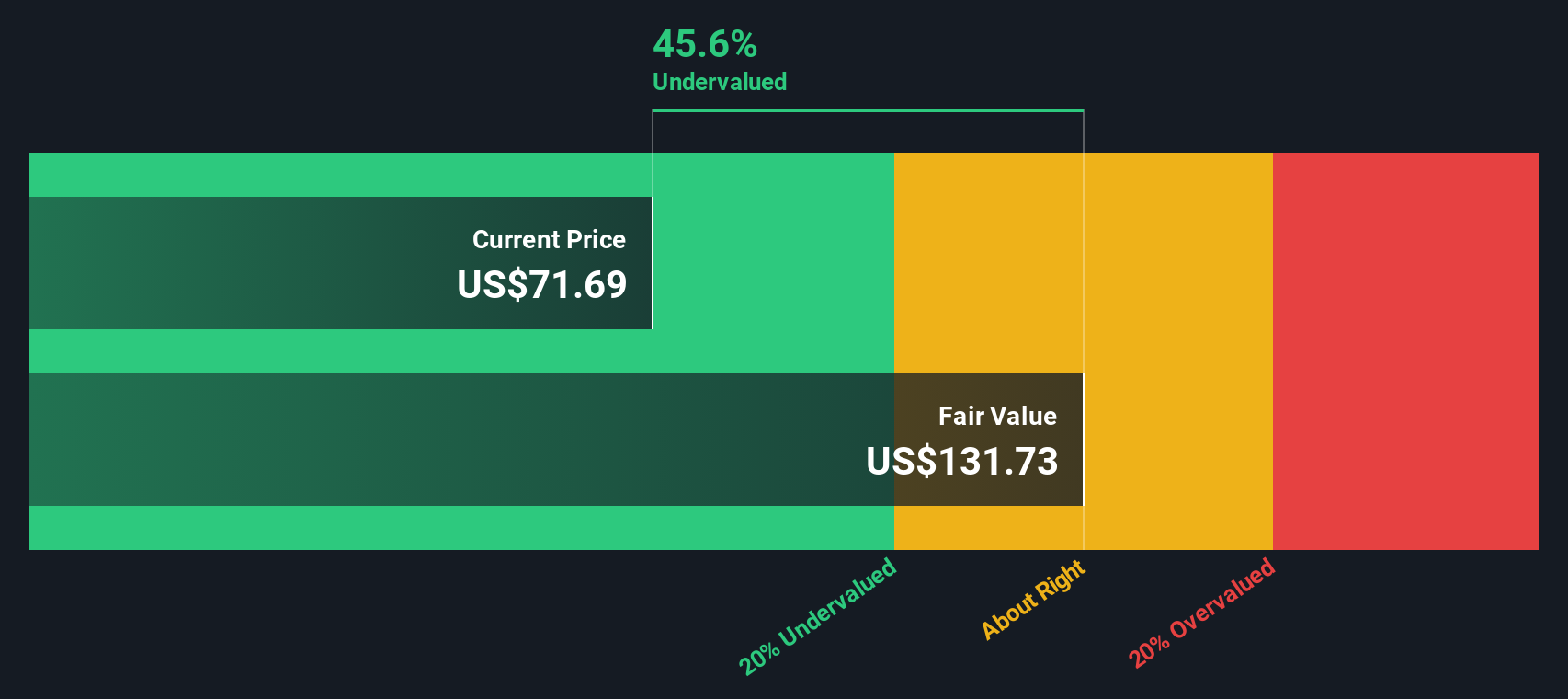

With shares still trading at a meaningful discount to analyst targets and recent insider buying activity, the question arises: could Tompkins Financial present a compelling value opportunity, or is the market already accounting for its future growth prospects?

Price-to-Earnings of 11.9x: Is it justified?

Tompkins Financial's current share price reflects a price-to-earnings (P/E) ratio of 11.9x, which positions the stock in a somewhat premium range compared to its industry peers.

The P/E ratio measures how much investors are willing to pay for each dollar of the company's earnings. It is especially relevant for banks, where steady profitability and established earnings streams make earnings multiples a key valuation metric.

Tompkins Financial trades at a lower P/E ratio than its direct peers, which indicates the market may be underestimating its earnings power. However, it is trading at a slightly higher multiple than the industry average and above what is considered a fair price-to-earnings ratio for the company. This mixed signal highlights ongoing debate over whether Tompkins’ current valuation fully reflects its financial prospects and recent momentum.

Explore the SWS fair ratio for Tompkins Financial

Result: Price-to-Earnings of 11.9x (ABOUT RIGHT)

However, slower net income growth and mixed multi-year returns could dampen optimism around Tompkins Financial’s recent valuation and insider activity.

Find out about the key risks to this Tompkins Financial narrative.

Another View: Discounted Cash Flow Perspective

In addition to considering earnings multiples, our DCF model values Tompkins Financial at $89.40 per share, which is about 22% above its current market price. This may indicate that the market is not fully recognizing the company’s long-term cash-generating ability, even though expectations for near-term profit growth remain modest. Is this a hidden opportunity or a reason to proceed with caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tompkins Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 932 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tompkins Financial Narrative

If you see the story differently, or want to dive into the numbers yourself, you can build your own narrative from the ground up in just a few minutes with Do it your way.

A great starting point for your Tompkins Financial research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the crowd and give your portfolio new opportunities by targeting handpicked stocks in dynamic market themes. These unique screens are built to spotlight real potential you might miss elsewhere.

- Catch high-yield opportunities in income-driven companies with these 15 dividend stocks with yields > 3% that offer attractive returns even when the market is uncertain.

- Ride the artificial intelligence wave by checking out these 25 AI penny stocks packed with innovators shaping tomorrow’s digital landscape.

- Find market bargains that could be overlooked by mainstream analysts using these 932 undervalued stocks based on cash flows. These gems might deliver tomorrow’s standout returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tompkins Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:TMP

Tompkins Financial

A financial holding company, provides commercial and consumer banking, leasing, trust and investment management, financial planning and wealth management, and insurance services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion