- United States

- /

- Commercial Services

- /

- NYSE:HNI

3 Reliable Dividend Stocks Offering Up To 4% Yield

Reviewed by Simply Wall St

In the midst of a volatile U.S. market, where major indices like the Dow Jones, S&P 500, and Nasdaq have recently faced declines due to economic uncertainties and policy concerns, investors are increasingly turning their attention to dividend stocks as a source of steady income. In such an environment, reliable dividend stocks offering yields up to 4% can provide a measure of stability and potential income for those looking to navigate these turbulent times.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Douglas Dynamics (NYSE:PLOW) | 4.85% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.99% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 5.01% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 7.15% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 6.77% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.45% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.98% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 6.65% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.57% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.83% | ★★★★★★ |

Click here to see the full list of 160 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

FS Bancorp (NasdaqCM:FSBW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FS Bancorp, Inc., with a market cap of $277.51 million, operates as a bank holding company for 1st Security Bank of Washington, offering banking and financial services to local families, businesses, and industry niches.

Operations: FS Bancorp, Inc. generates revenue through its Home Lending segment, which contributes $22.01 million, and its Commercial and Consumer Banking segment, which brings in $117.14 million.

Dividend Yield: 3.1%

FS Bancorp is trading at 64.4% below its estimated fair value and offers a reliable dividend yield of 3.07%, though lower than the top 25% of US dividend payers at 4.74%. Its dividends have been stable and growing over the past decade, with a low payout ratio ensuring coverage by earnings both currently (23.7%) and in three years (24.8%). Recently, FS Bancorp increased its quarterly dividend to $0.28 per share, marking its forty-eighth consecutive increase.

- Click here to discover the nuances of FS Bancorp with our detailed analytical dividend report.

- Our valuation report unveils the possibility FS Bancorp's shares may be trading at a discount.

Bar Harbor Bankshares (NYSEAM:BHB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bar Harbor Bankshares, with a market cap of $448.95 million, operates as the holding company for Bar Harbor Bank & Trust, offering banking and nonbanking products and services mainly to consumers and businesses.

Operations: Bar Harbor Bankshares generates its revenue primarily from the community banking industry, amounting to $148.79 million.

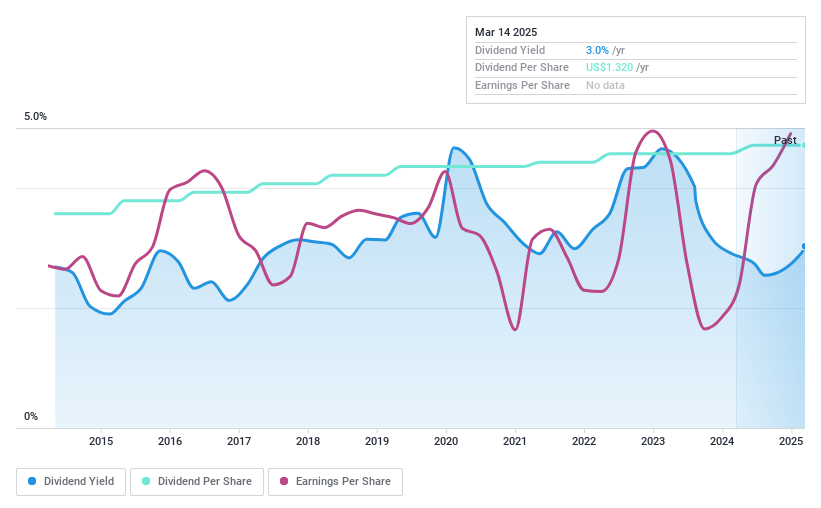

Dividend Yield: 4%

Bar Harbor Bankshares offers a stable and growing dividend, currently yielding 4%, though below the top US payers. Its dividends have been reliably covered by earnings with a payout ratio of 41.3%, expected to remain sustainable at 43.1% in three years. The stock trades at a significant discount to its estimated fair value. Recent developments include a merger agreement with Guaranty Bancorp, potentially impacting future operations and dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Bar Harbor Bankshares.

- The analysis detailed in our Bar Harbor Bankshares valuation report hints at an deflated share price compared to its estimated value.

HNI (NYSE:HNI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HNI Corporation, with a market cap of $2.08 billion, operates in the manufacture, sale, and marketing of workplace furnishings and residential building products primarily in the United States and Canada.

Operations: HNI Corporation generates its revenue from two main segments: Workplace Furnishings, which accounts for $1.89 billion, and Residential Building Products, contributing $638.40 million.

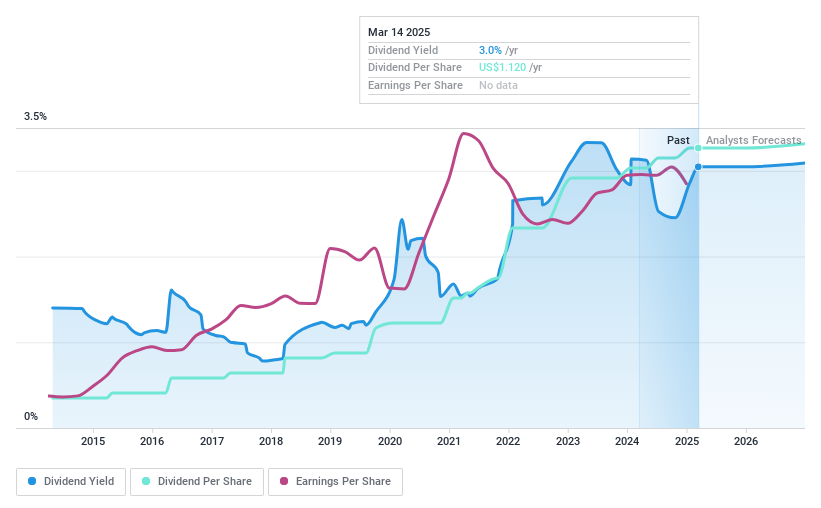

Dividend Yield: 3%

HNI Corporation's dividend, yielding 3%, is reliable and has grown steadily over the past decade. The company's dividends are well covered by both earnings and cash flows, with payout ratios of 44.5% and 35.7% respectively. Despite a lower yield compared to top-tier US dividend payers, HNI trades at a significant discount to its estimated fair value. Recent earnings reports show strong profit growth, enhancing the sustainability of its dividend strategy amidst anticipated sales fluctuations in 2025.

- Click to explore a detailed breakdown of our findings in HNI's dividend report.

- According our valuation report, there's an indication that HNI's share price might be on the cheaper side.

Turning Ideas Into Actions

- Navigate through the entire inventory of 160 Top US Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade HNI, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HNI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HNI

HNI

Engages in the manufacture, sale, and marketing of workplace furnishings and residential building products primarily in the United States and Canada.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives