- United States

- /

- Banks

- /

- NYSE:WBS

Webster Financial (WBS): Reassessing Valuation After Trade Tensions Rattle Regional Banks

Reviewed by Kshitija Bhandaru

Recent trade tensions between the US and China have caught the attention of investors, particularly following new tariff announcements and China's export controls on key minerals. Webster Financial (WBS) saw its stock move in line with broader declines in regional banks.

See our latest analysis for Webster Financial.

Webster Financial’s share price has been a bit volatile lately, reacting to shifting headlines on trade tensions and economic outlook, but the big-picture trend remains positive. With a 22.45% 1-year total shareholder return and a notable 139.5% gain over five years, long-term sentiment looks strong even as short-term momentum has cooled.

If the recent shakeup in banks has you thinking more broadly about opportunities, it could be the perfect moment to see what stands out among fast growing stocks with high insider ownership.

With shares trading well below analyst price targets and long-term outlooks improving, the central question emerges: is Webster Financial undervalued right now, or is the market already factoring in future growth?

Most Popular Narrative: 20.1% Undervalued

Compared to the last close price, the most popular narrative calculates a fair value of $71.59 for Webster Financial, placing it well above its recent close of $57.18. The narrative combines growth prospects and improved fundamentals to support this higher target, despite prevailing market uncertainty.

The expansion of HSA Bank's addressable market due to new healthcare legislation is expected to drive significant long-term deposit growth and fee income, with management projecting an incremental $1 to $2.5 billion in HSA deposits over the next five years. This will increase the company's low-cost, sticky funding base and recurring non-interest income, supporting net interest margin and earnings.

What’s powering that bold valuation estimate? This narrative builds its case on assumptions you might not expect, such as transformative profit margins and a pathway to higher future earnings. Find out which surprising underlying forecasts set up the stock for those ambitious price targets.

Result: Fair Value of $71.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant commercial real estate exposure and ongoing margin pressure could challenge Webster Financial’s growth outlook if market or regulatory conditions shift unexpectedly.

Find out about the key risks to this Webster Financial narrative.

Another View: What Do Earnings Multiples Suggest?

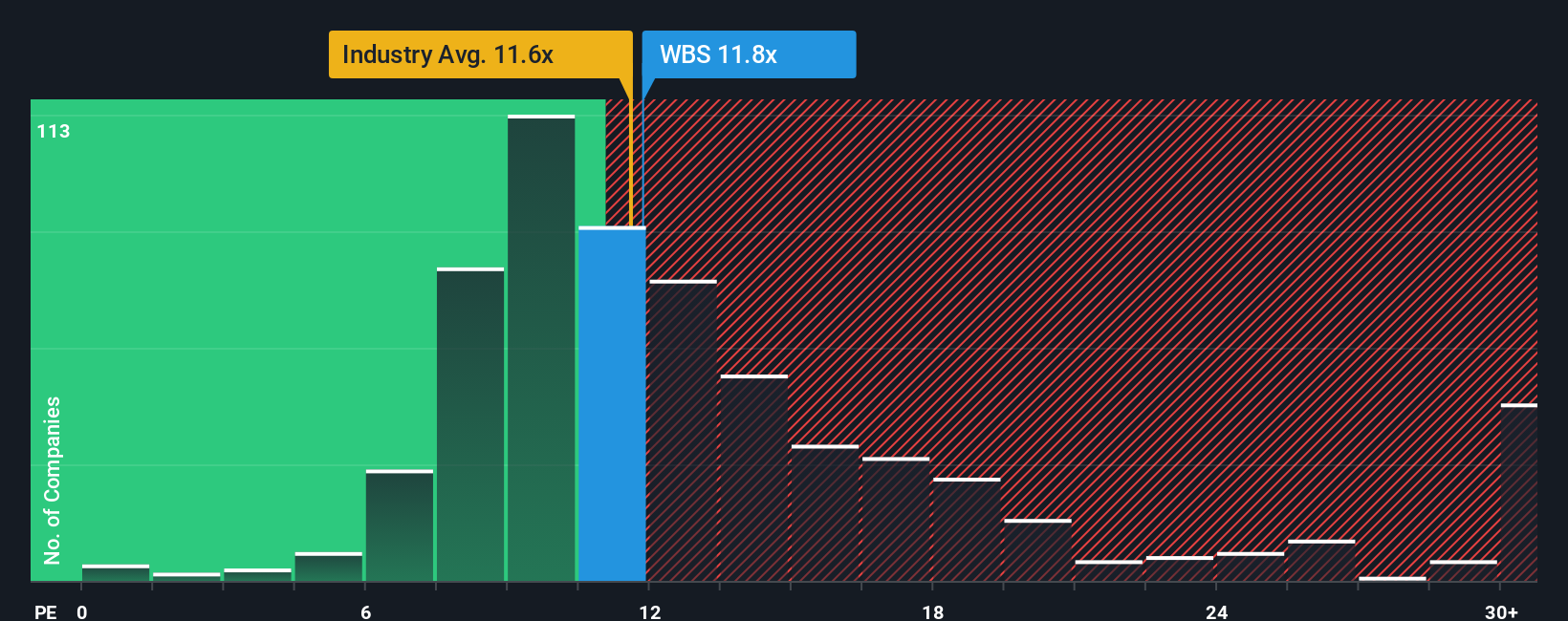

Taking a different approach, let's look at valuation through the company’s price-to-earnings ratio. Webster Financial trades at 11.4x earnings, nearly matching the broader US Banks industry average of 11.3x, but more attractively priced than its peer group, which averages 14.7x. Importantly, the fair ratio for the business could be as high as 14.1x. This means the stock has some room for multiple expansion in the future, or it could signal lingering concerns the market hasn’t yet priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Webster Financial Narrative

If you see things differently or want a hands-on look at the numbers, you can craft your own take on Webster Financial in just a few minutes, starting with Do it your way.

A great starting point for your Webster Financial research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay a step ahead by spotting trends early. Don’t get left behind. Expand your watchlist with these standout opportunities selected for real growth potential:

- Grow your income stream and target reliable yields by checking out these 18 dividend stocks with yields > 3% delivering consistent returns above 3%.

- Capitalize on booming tech innovation by investigating these 25 AI penny stocks driving transformation in artificial intelligence and reshaping entire industries.

- Position yourself for tomorrow’s breakthroughs with these 26 quantum computing stocks unlocking new value in quantum computing, cybersecurity, and data science applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Webster Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WBS

Webster Financial

Operates as the bank holding company for Webster Bank, National Association that provides various financial products and services to businesses, individuals, and families in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives