- United States

- /

- Banks

- /

- NYSE:WBS

Webster Financial (WBS): Assessing Valuation After Analyst Upgrades and Strong Q2 Performance

Reviewed by Kshitija Bhandaru

Webster Financial (WBS) is attracting attention after a wave of positive analyst actions, including a new 'Buy' rating. This follows strong second quarter results and an expanded share buyback program.

See our latest analysis for Webster Financial.

Momentum appears to be building for Webster Financial, which has outpaced many peers thanks to a mix of upbeat analyst sentiment and visible progress in its operations. The bank’s total shareholder return over the past year stands at an impressive 39.9%. The stock price recently closed at $61.45, a sign that investors are becoming more optimistic about its growth and capital management moves.

If this kind of renewed optimism in financials has you thinking bigger, now is a perfect moment to discover fast growing stocks with high insider ownership.

With the stock currently trading below average analyst price targets and strong financial results drawing new attention, the question remains: is Webster Financial undervalued, or is the market already pricing in its future growth?

Most Popular Narrative: 13% Undervalued

Webster Financial's most widely followed narrative pegs fair value at $70.82, around 13% above the last close at $61.45. This signals a potentially attractive entry point if the narrative’s projection for higher earnings holds true.

The asset management joint venture with Marathon Asset Management will enable Webster to participate in larger private credit deals, expand commercial lending opportunities, and create new fee income streams. This may set up meaningful non-interest income growth beginning in 2026 and support top-line revenue expansion.

Curious what projections fuel such an optimistic outlook? One key assumption is an earnings growth engine that could reset expectations for this entire sector. The real story behind this valuation may surprise even seasoned market-watchers.

Result: Fair Value of $70.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including heavy commercial real estate exposure and ongoing margin compression. Either of these factors could dampen the current growth outlook.

Find out about the key risks to this Webster Financial narrative.

Another View: Based on Earnings Ratios

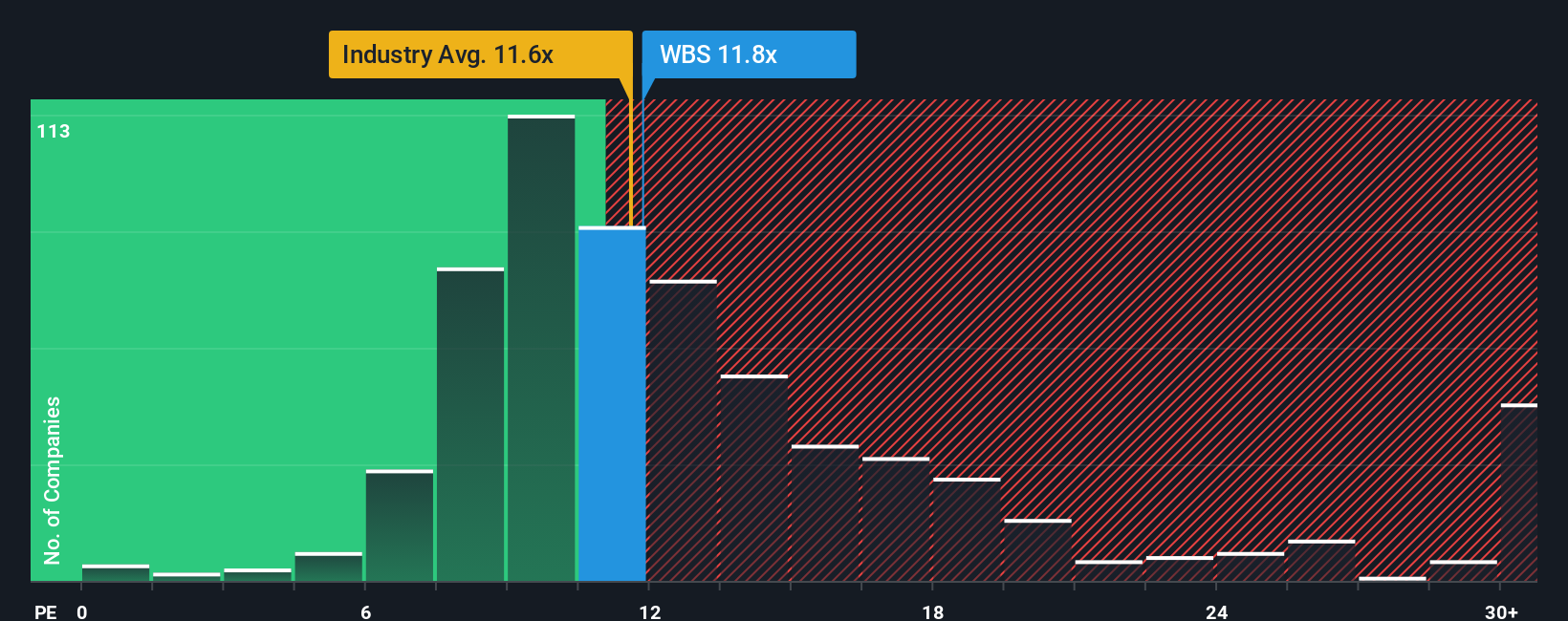

Looking at how Webster Financial is valued by its earnings, the company's current price-to-earnings ratio (12.3x) is slightly above the US Banks industry average (11.8x). However, it trades well below the peer average (14.6x) and even further below its own fair ratio (14.3x). This suggests the market could be underestimating its potential, but it also signals that sentiment is not universally bullish. Will investors start to close this gap, or is there good reason for caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Webster Financial Narrative

If you see things differently or want to put your own spin on the numbers, you can quickly craft a custom narrative using our tools in just a few minutes, so why not Do it your way.

A great starting point for your Webster Financial research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not let unique opportunities pass them by. Make your next move by checking out these standout strategies to uncover potential winners in today’s market:

- Uncover exceptional income opportunities by reviewing these 19 dividend stocks with yields > 3% for companies rewarding their shareholders with reliable, above-average yields.

- Kickstart your search for the next tech breakout with these 25 AI penny stocks, which spotlights trailblazers driving artificial intelligence innovation.

- Zero in on the market’s hidden gems with these 894 undervalued stocks based on cash flows, where stocks with real upside based on their cash flows await your attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Webster Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WBS

Webster Financial

Operates as the bank holding company for Webster Bank, National Association that provides various financial products and services to businesses, individuals, and families in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives