- United States

- /

- Banks

- /

- NYSE:WBS

Webster Financial (NYSE:WBS) Eyes Growth in Health Savings Accounts Amid CRE Challenges and Shareholder Returns

Reviewed by Simply Wall St

Webster Financial (NYSE:WBS) is currently navigating a dynamic financial environment, marked by a 3.6% growth in deposits and strategic initiatives to optimize their balance sheet for enhanced interest income. Despite these positive developments, the company faces challenges within its commercial real estate portfolio, particularly in traditional office spaces, which have seen an increase in nonaccrual loans. The following report examines key areas such as deposit growth strategies, challenges in commercial real estate, and emerging opportunities in Health Savings Accounts.

Click here and access our complete analysis report to understand the dynamics of Webster Financial.

Key Assets Propelling Webster Financial Forward

Webster Financial has demonstrated growth in deposits, achieving a 3.6% increase, including notable expansions in demand deposit accounts (DDA), overall commercial deposits, and Health Savings Accounts (HSA). This growth aligns with their full-year expectations, as highlighted by CEO John Ciulla. Additionally, the company has maintained strong capital levels, with a CET1 ratio exceeding 11% and an industry-leading efficiency ratio of 45%. These metrics underscore Webster's ability to enhance earnings and maintain capital flexibility. The strategic execution of a $400 million deposit opportunity for HSA Bank further emphasizes their capability to boost deposit growth, showcasing their commitment to strengthening their financial position.

Internal Limitations Hindering Webster Financial's Growth

The commercial real estate (CRE) portfolio presents ongoing challenges, particularly within traditional office spaces, where nonaccrual loans have increased to 14% from 9% in the previous quarter. This issue is compounded by negative risk rating migration, primarily driven by the office portfolio, as explained by CEO Ciulla. Furthermore, the company faces pressure on core fee growth, despite a slight increase in noninterest income. CFO William Holland noted that year-over-year fees are up by $3 million, though this is offset by changes in credit valuation adjustments. These factors indicate areas where Webster Financial must focus on improving operational efficiencies and addressing market challenges.

Emerging Markets Or Trends for Webster Financial

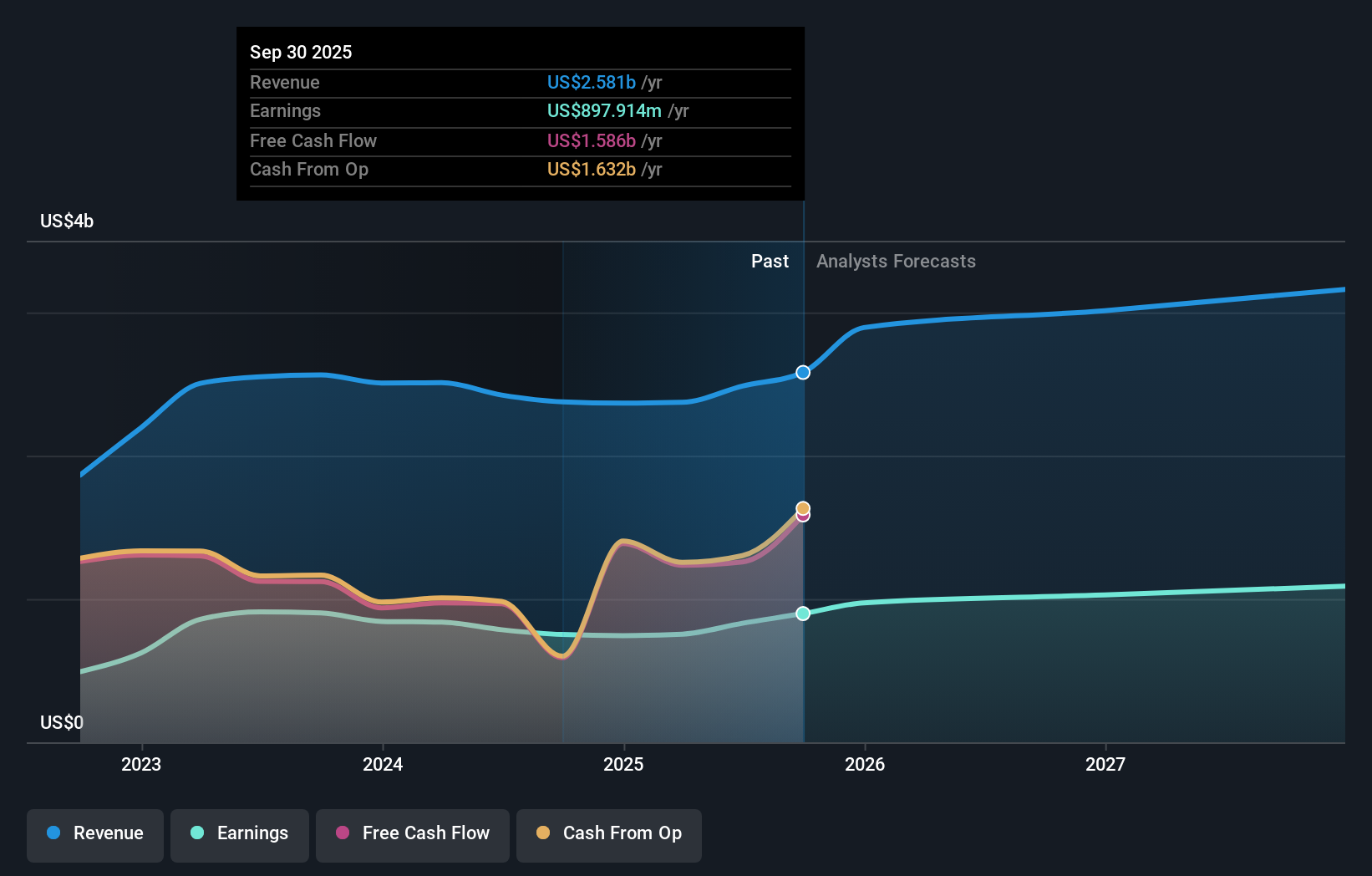

Webster Financial is actively optimizing its balance sheet to enhance interest income, a move that CEO Ciulla has highlighted as already showing positive impacts. The potential for faster deposit growth in HSA Bank by 2025, supported by investments in client-facing technology, represents a significant opportunity for the company. COO Luis Massiani anticipates this growth trajectory to slightly exceed current levels, further strengthening their market position. Additionally, the increased capacity to return capital to shareholders, possibly through share repurchases, reflects a proactive approach to capital management, which could enhance shareholder value.

Key Risks and Challenges That Could Impact Webster Financial's Success

Challenges with office loans in default pose a significant risk to Webster Financial's financial performance. CEO Ciulla acknowledged the impact of two office loans on the increase in nonperforming assets. Economic headwinds and potential interest rate changes also threaten the company's credit quality and overall financial health. As Webster prepares for Category 4 regulations, the anticipated increase in expenses and competitive pressures could further strain resources. The company's current trading position, with a Price-To-Earnings Ratio of 13.7x, is higher than the industry average of 13.1x, suggesting potential concerns that may affect investor sentiment.

Conclusion

Webster Financial's strategic focus on deposit growth, particularly through Health Savings Accounts, and its strong capital position, with a CET1 ratio above 11%, positions the company well for continued earnings optimization and capital flexibility. However, challenges in the commercial real estate sector, especially with office loans, and pressures on core fee growth highlight areas requiring operational improvements. The company's proactive balance sheet management and potential for increased shareholder returns, coupled with its current trading price below the estimated fair value of $133.69, suggest a favorable outlook for investors despite its higher-than-industry-average Price-To-Earnings Ratio of 13.7x. This indicates that while there are risks, the strategic initiatives in place could enhance Webster Financial's market position and shareholder value over time.

Summing It All Up

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

```Valuation is complex, but we're here to simplify it.

Discover if Webster Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WBS

Webster Financial

Operates as the bank holding company for Webster Bank, National Association that provides various financial products and services to businesses, individuals, and families in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives