- United States

- /

- Banks

- /

- NYSE:WBS

Is Webster Financial's (WBS) Share Buyback a Sign of Strengthening Fundamentals or Cautious Optimism?

Reviewed by Sasha Jovanovic

- Webster Financial recently saw its fair value estimate increase after analysts pointed to stronger fundamentals, improved asset quality, broad-based loan growth, and continued expansion in lending operations.

- The company also completed a significant share repurchase program, which reflects a deliberate focus on capital return and active credit quality management as contributing factors to its improved outlook.

- We'll look at how Webster Financial's capital management and improving fundamentals may reshape its long-term investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Webster Financial Investment Narrative Recap

To be a shareholder in Webster Financial, you need to believe in the company's ability to sustain improved fundamentals, like stronger asset quality and broad-based loan growth, while navigating headwinds such as ongoing margin compression or potential credit losses in commercial real estate. The recent fair value estimate increase and analyst optimism highlight asset quality improvements and growth, but external risks like trade tensions may weigh on short-term sentiment, with the biggest risk remaining Webster’s exposure to CRE if the market worsens; the impact from the latest trade disruptions appears immaterial for now.

The company's completion of a substantial share repurchase program stands out, directly reinforcing its capital management discipline and focus on returns to shareholders. This is especially relevant as Webster's approach to capital allocation and active risk oversight has become a central part of its investment thesis, tying back to the short-term catalysts of improved book quality and earnings potential amid sector volatility.

Yet, in contrast to these operational strengths, investors should also pay close attention to...

Read the full narrative on Webster Financial (it's free!)

Webster Financial's narrative projects $3.4 billion revenue and $1.2 billion earnings by 2028. This requires 10.8% yearly revenue growth and a $369.4 million earnings increase from $830.6 million today.

Uncover how Webster Financial's forecasts yield a $71.59 fair value, a 28% upside to its current price.

Exploring Other Perspectives

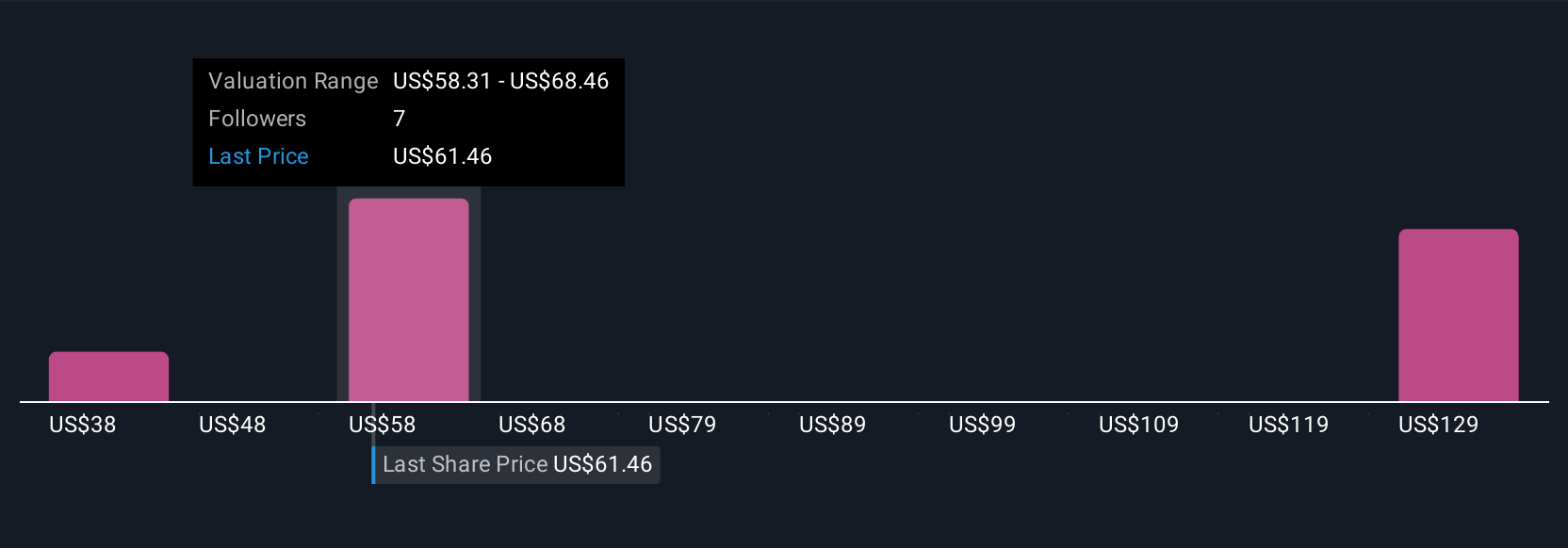

Four individual fair value estimates from the Simply Wall St Community span a wide US$38 to US$125.64, underscoring differences in investor outlooks and conviction. Consider this range as you weigh Webster’s robust recent asset quality against lingering sector risks like commercial real estate exposure.

Explore 4 other fair value estimates on Webster Financial - why the stock might be worth over 2x more than the current price!

Build Your Own Webster Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Webster Financial research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Webster Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Webster Financial's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Webster Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WBS

Webster Financial

Operates as the bank holding company for Webster Bank, National Association that provides various financial products and services to businesses, individuals, and families in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives