- United States

- /

- Banks

- /

- NYSE:WAL

Does Western Alliance Bancorporation (NYSE:WAL) Deserve A Spot On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Western Alliance Bancorporation (NYSE:WAL), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Western Alliance Bancorporation

Western Alliance Bancorporation's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. As a tree reaches steadily for the sky, Western Alliance Bancorporation's EPS has grown 26% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

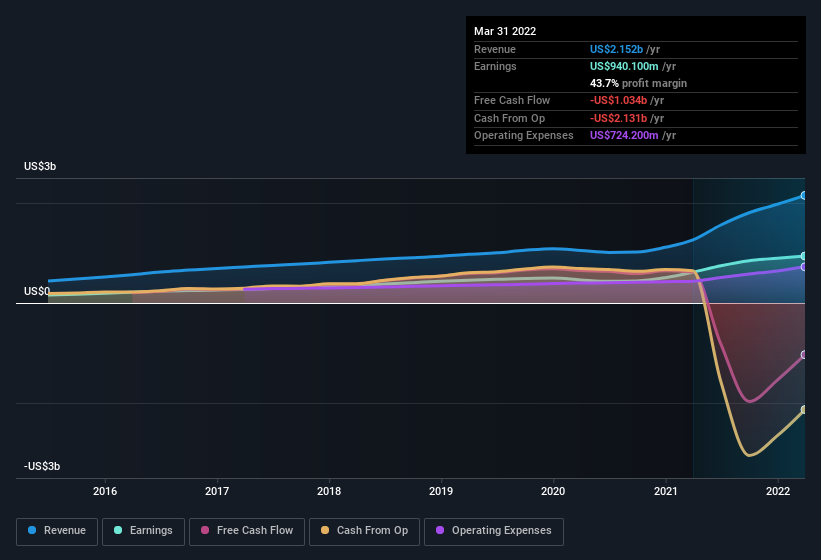

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Western Alliance Bancorporation's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Western Alliance Bancorporation maintained stable EBIT margins over the last year, all while growing revenue 71% to US$2.2b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Western Alliance Bancorporation's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Western Alliance Bancorporation Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We do note that, in the last year, insiders sold -US$2.0m worth of shares. But that's far less than the US$3.7m insiders spend purchasing stock. This makes me even more interested in Western Alliance Bancorporation because it suggests that those who understand the company best, are optimistic. We also note that it was the Executive Chairman of the Board, Robert Sarver, who made the biggest single acquisition, paying US$1.9m for shares at about US$77.24 each.

Along with the insider buying, another encouraging sign for Western Alliance Bancorporation is that insiders, as a group, have a considerable shareholding. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$225m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Ken Vecchione, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Western Alliance Bancorporation with market caps between US$4.0b and US$12b is about US$8.3m.

The Western Alliance Bancorporation CEO received US$7.3m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Western Alliance Bancorporation To Your Watchlist?

For growth investors like me, Western Alliance Bancorporation's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 2 warning signs for Western Alliance Bancorporation you should be aware of.

As a growth investor I do like to see insider buying. But Western Alliance Bancorporation isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Western Alliance Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WAL

Western Alliance Bancorporation

Operates as the bank holding company for Western Alliance Bank that provides various banking products and related services primarily in Arizona, California, and Nevada.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives