- United States

- /

- Banks

- /

- NYSE:USB

What U.S. Bancorp (USB)'s New Digital Assets Push Means for Shareholders

Reviewed by Sasha Jovanovic

- U.S. Bank recently announced the creation of a new Digital Assets and Money Movement organization, expanding its reach into stablecoin issuance, cryptocurrency custody, asset tokenization, and digital money movement, with payments industry veteran Jamie Walker at the helm.

- This move demonstrates the bank's commitment to innovating in digital financial services, reflecting heightened industry competition and evolving client demand for emerging crypto and payment technologies.

- We'll explore how this advance into digital assets may reshape U.S. Bancorp's long-term growth narrative and efficiency outlook.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

U.S. Bancorp Investment Narrative Recap

U.S. Bancorp’s investment appeal is rooted in its established position in digital payments and fee-based services, supported by measured expansion into digital assets and technology-driven platforms. The recent launch of its Digital Assets and Money Movement organization signals meaningful progress in digital finance, but does not materially alter the near-term focus, where quarterly earnings and credit quality trends remain the most important driver and risk for the stock.

Of the recent announcements, the partnership with Mastercard to enable digital subscription management for cardholders stands out for its close connection to U.S. Bancorp’s digital growth strategy. This initiative directly addresses consumer demand for integrated digital banking solutions, potentially strengthening the bank’s fee income and reinforcing the case for ongoing digital transformation as a key business catalyst.

However, despite this digital progress, it’s worth noting that intensifying competition from fintechs in core payments could start to affect...

Read the full narrative on U.S. Bancorp (it's free!)

U.S. Bancorp's outlook anticipates $32.6 billion in revenue and $7.4 billion in earnings by 2028. This is based on 8.5% annual revenue growth and a $0.9 billion earnings increase from current earnings of $6.5 billion.

Uncover how U.S. Bancorp's forecasts yield a $54.95 fair value, a 18% upside to its current price.

Exploring Other Perspectives

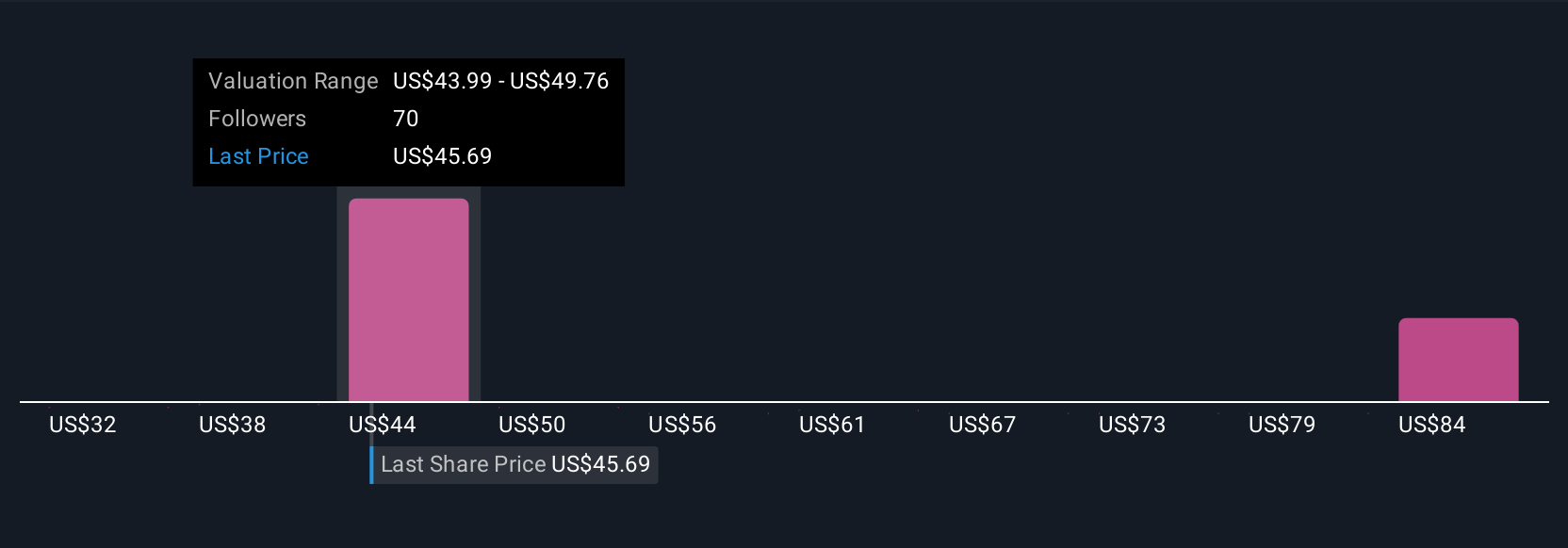

Simply Wall St Community members have published 10 fair value estimates for U.S. Bancorp ranging from US$32.45 to US$79.38 per share. While these opinions span wide extremes, many are watching how digital investments and non-bank competitors might shape the company’s future performance, compare the different forecasts for fresh insights.

Explore 10 other fair value estimates on U.S. Bancorp - why the stock might be worth as much as 71% more than the current price!

Build Your Own U.S. Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your U.S. Bancorp research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free U.S. Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate U.S. Bancorp's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 39 companies in the world exploring or producing it. Find the list for free.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USB

U.S. Bancorp

A financial services holding company, provides various financial services to individuals, businesses, institutional organizations, governmental entities, and other financial institutions in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives