- United States

- /

- Banks

- /

- NYSE:USB

Is U.S. Bancorp Attractive After Lowering Its Prime Lending Rate Amid Recent Stock Dip?

Reviewed by Bailey Pemberton

If you’re eyeing U.S. Bancorp stock and wondering whether now is the time to buy, hold, or run for the exits, you’re not alone. This is one of those moments when the numbers tell a nuanced story, and the recent headlines only add more color to the picture. U.S. Bancorp’s shares recently closed at $46.16. Over the past seven days, the stock dipped 3.3%, and it is down 6.0% over the past month. Year-to-date, it is still down 3.6%. Looking further back provides a different perspective, with a rise of 2.4% in the past year, 25.1% over the last three years, and 46.7% over five years.

These numbers reflect more than just the bank’s balance sheet. Just last month, U.S. Bancorp announced a cut to its prime lending rate, nudging it from 7.5% down to 7.25%. Headlines about upcoming blockbuster IPOs and regulatory debates around banking and crypto have also kept the sector and investor emotions on alert. Markets can be sensitive to these shifts, and price swings often mirror wider debates about risk, opportunity, and the potential for future growth.

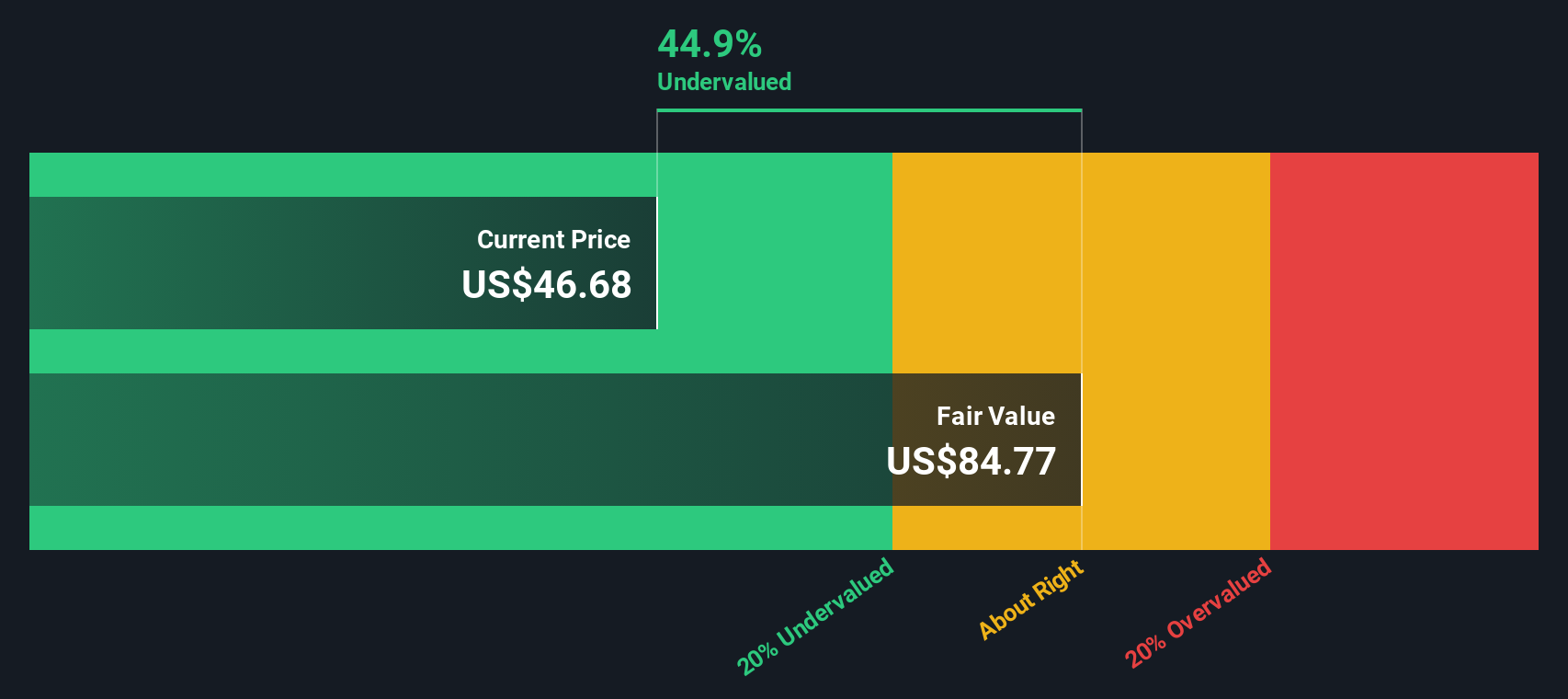

Is the stock trading for less than it is worth? U.S. Bancorp has a current value score of 5 out of 6, indicating it is undervalued in five of the six key checks analysts typically look for. In this article, I will walk you through what goes into those checks and what they mean for your portfolio, before introducing a more holistic way to think about bank stock valuation at the end.

Why U.S. Bancorp is lagging behind its peers

Approach 1: U.S. Bancorp Excess Returns Analysis

The Excess Returns valuation model focuses on the earnings generated above the cost of equity. This approach emphasizes whether U.S. Bancorp is using shareholders’ capital efficiently. By considering how much more the company earns over its required return, it helps gauge long-term value creation rather than short-term fluctuations.

For U.S. Bancorp, the numbers reveal strong fundamentals. The Book Value stands at $35.06 per share, while the anticipated Stable Earnings Per Share (EPS) are $4.94. These figures are based on weighted future Return on Equity estimates from 13 analysts, suggesting careful consensus about the company’s outlook. The Cost of Equity is $3.04 per share, leaving an Excess Return of $1.89 per share. The average Return on Equity is a healthy 12.62%, supporting prospects for ongoing profitability. Meanwhile, the Stable Book Value estimate is $39.11 per share, backed by forecasts from 12 analysts.

All this adds up to an estimated intrinsic value of $79.31 per share using the Excess Returns methodology. With the stock currently trading at $46.16, this model indicates the stock is trading at a 41.8% discount to its intrinsic value. This suggests the stock appears significantly undervalued by this approach.

Result: UNDERVALUED

Our Excess Returns analysis suggests U.S. Bancorp is undervalued by 41.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

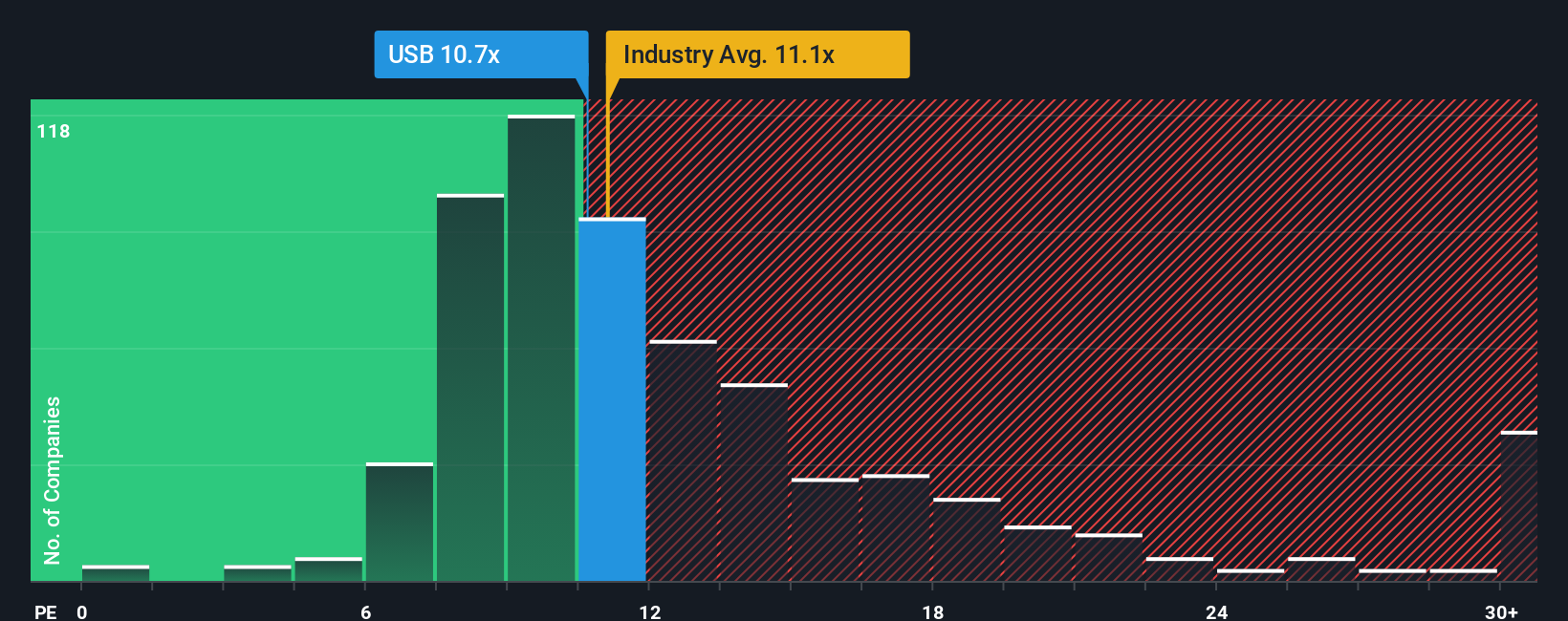

Approach 2: U.S. Bancorp Price vs Earnings

For profitable companies like U.S. Bancorp, the Price-to-Earnings (PE) ratio is often the go-to tool for quick comparison. This metric tells investors how much they are paying for each dollar of the company’s earnings, making it a direct way to gauge value for established businesses with steady profits.

The “right” PE ratio is not one-size-fits-all. It is influenced by expectations for future growth and the risks the business faces. Higher growth prospects or lower risk merit higher PE ratios, while companies with slow growth or higher uncertainty tend to command lower ones.

U.S. Bancorp is currently trading at a PE ratio of 11.0x. This puts it just below the banking industry average of 11.3x and well below the average of its peer group at 17.7x. To provide a more tailored benchmark, Simply Wall St’s proprietary “Fair Ratio” model estimates that U.S. Bancorp should trade at a PE of 14.4x. This Fair Ratio incorporates not just sector and peer group data, but also considers the company’s own profit margins, risk profile, growth outlook, and even its market capitalization.

Comparing against the Fair Ratio gives a more nuanced view than industry averages or peer comparisons alone. This is because the Fair Ratio accounts for U.S. Bancorp’s unique characteristics, including how its earnings are expected to grow and what risks it faces, rather than relying solely on broad-brush numbers.

With its actual PE ratio at 11.0x and a Fair Ratio at 14.4x, U.S. Bancorp appears undervalued by this measure. The market is pricing it below what would be expected given its growth and risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your U.S. Bancorp Narrative

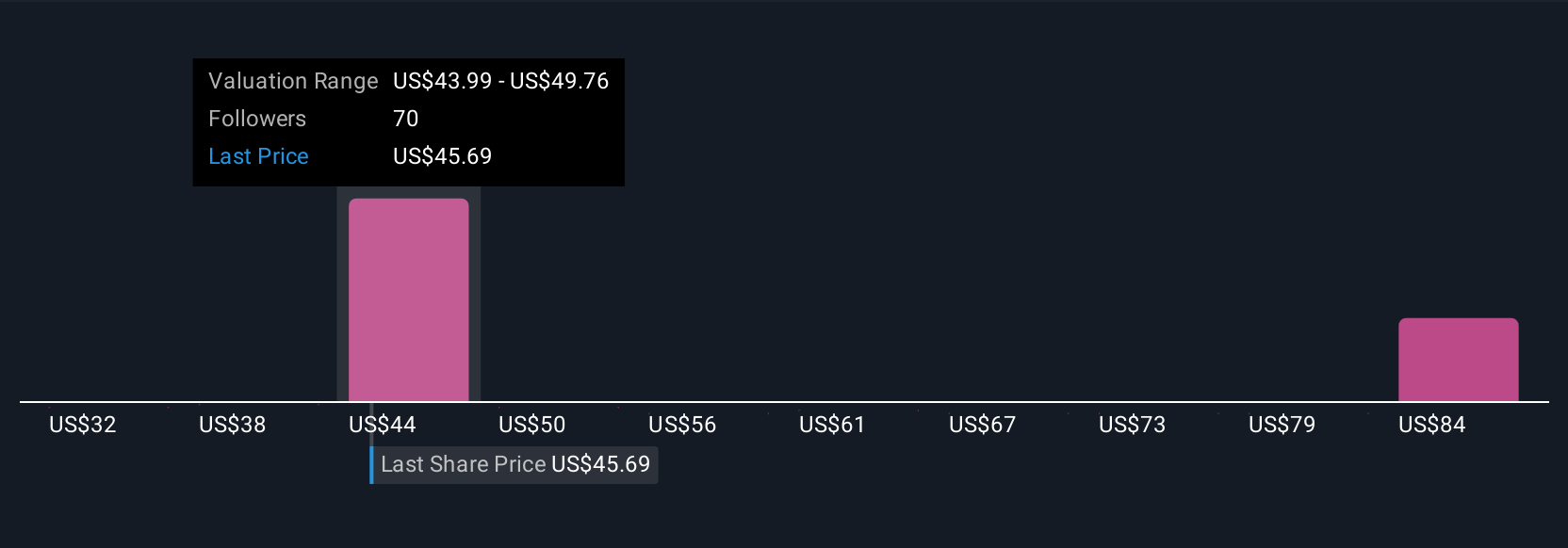

As promised, there is a smarter way to invest than relying on ratios alone, and it centers on Narratives. Put simply, a Narrative is the story and expectations you have for a company, with your own forecast for its future revenue, earnings, and profit margins, which you then link directly to your view of fair value. Narratives let you connect the company’s business reality to numbers, so your investment case is more than just a snapshot of past performance.

Narratives are quick and easy to use, found right within the Simply Wall St Community page. This is a hub millions of investors rely on. When you build a Narrative, you are tying together what you believe about U.S. Bancorp's future and checking if your fair value lines up with the current share price. Narratives are not static either. They update automatically as fresh news, analyst forecasts, or earnings reports come in, making sure your story stays relevant.

For example, investors who see digital payments and demographic trends as growth drivers for U.S. Bancorp may assign a fair value as high as $67 per share, while those more concerned about regional risks or credit quality may have a fair value closer to $47. Different assumptions, different stories. That is the power of Narratives.

Do you think there's more to the story for U.S. Bancorp? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USB

U.S. Bancorp

A financial services holding company, provides various financial services to individuals, businesses, institutional organizations, governmental entities, and other financial institutions in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives