- United States

- /

- Banks

- /

- NYSE:UCB

United Community Banks (UCB) Earnings Growth Surges 43.6%, Challenging Cautious Market Narratives

Reviewed by Simply Wall St

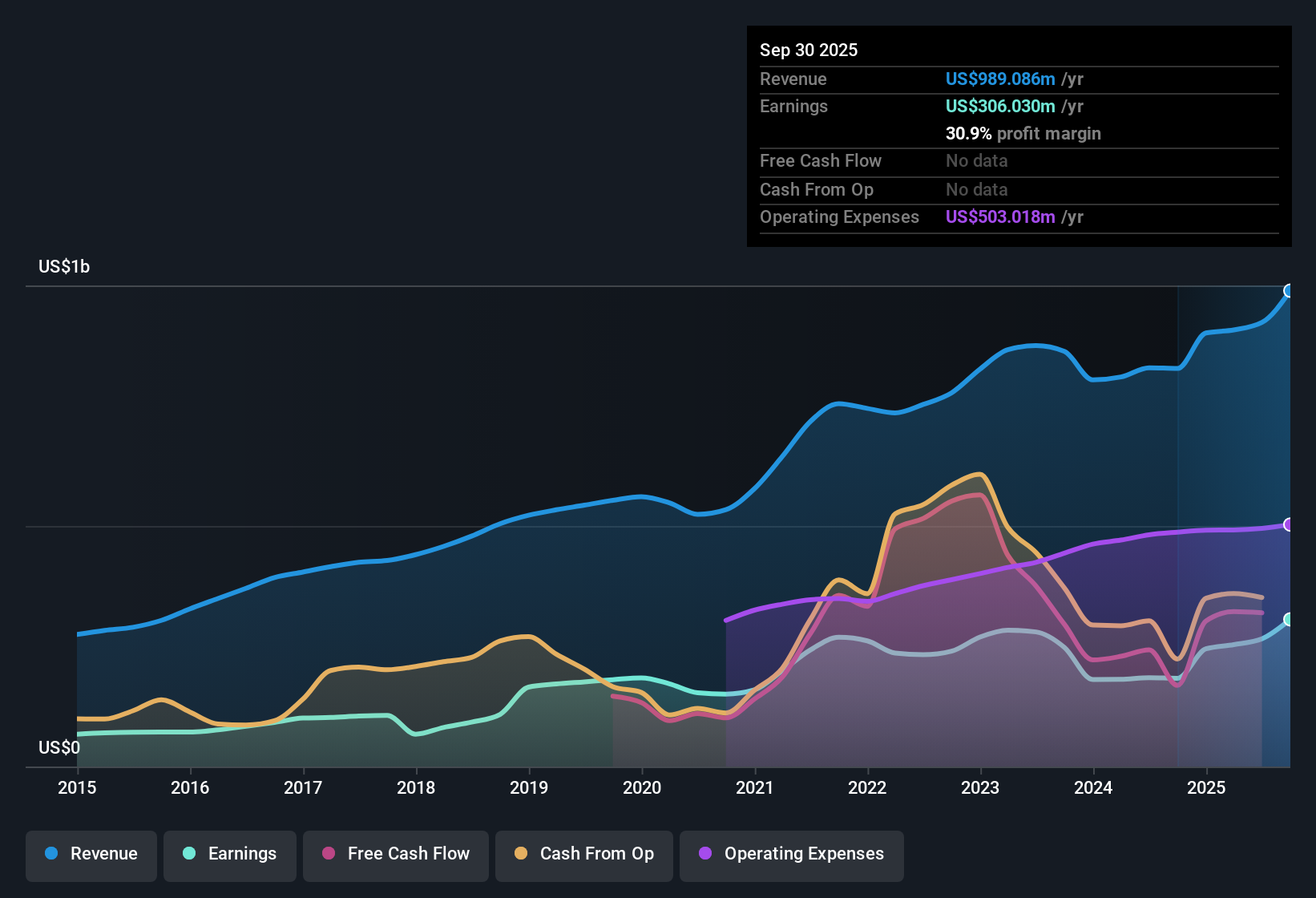

United Community Banks (UCB) reported standout earnings growth of 43.6% over the past year, a marked acceleration compared to its 5-year annual average of 2.5%. Net profit margins reached 28.8% this year, up from 22.3% a year ago, reflecting improved operational efficiency and profitability. With the current share price of $30.06 sitting below an estimated fair value of $39.80, alongside a favorable Price-To-Earnings ratio of 13.8x versus peers, investors are finding plenty to be optimistic about, even as future growth forecasts trail the broader market.

See our full analysis for United Community Banks.Now, let’s see how UCB’s latest results measure up to the most popular narratives among investors. This is where the story really gets interesting.

See what the community is saying about United Community Banks

Profit Margins Tighten Against Analysts’ Guidance

- Profit margins are projected to rise from 28.8% to 32.9% by 2028, a significant increase that underpins analyst optimism for UCB’s future operating efficiency.

- According to the analysts' consensus view, this margin expansion is expected to come from a combination of disciplined expense management and ongoing diversification of income streams.

- Expense control measures and integration benefits from acquisitions are intended to deliver cost savings, freeing up more revenue to flow through to profit.

- Consensus narrative notes that higher fee income from activities like wealth management and mortgage banking could help UCB rely less on traditional interest income. This change may make profits more resilient even as broader market growth slows.

Competitive Discount Narrows Versus Select Peers

- UCB trades at a Price-to-Earnings ratio of 13.8x, lower than the peer average of 22.9x but at a premium to the US banks industry at 11.2x. This frames the valuation context around market expectations for growth and risk.

- Consensus narrative highlights this multiple discrepancy as a reflection of strong recent profit growth and high perceived quality of earnings.

- While the 13.8x multiple is more attractive compared to select peers, it also reflects the company's trailing forecast growth rate of 7.36%, which is below the US market's 15.5%. This means investors are paying up for consistency and defensive attributes rather than breakout momentum.

- The stock’s current price of $30.06 sits below its DCF fair value of $39.80 and is a modest 14.5% below the analysts’ target of $35.17. This supports the view that UCB is not aggressively priced relative to its earnings quality.

Revenue Growth Lags, But Analysts See Upside

- UCB’s revenue is expected to grow at 5.1% per year, just half the broader US market’s 10.1% average, while analysts forecast earnings to rise to $442.5 million by 2028, up from $265.4 million today.

- Consensus narrative makes clear that this more measured growth outlook is offset by steady fee income and a focus on profitable expansion rather than risky market share grabs.

- The consensus view is that strategic expansion in Southeastern US markets and disciplined hiring of lending talent are key drivers behind the earnings trajectory, not just top-line growth for its own sake.

- Analysts’ agreement around earnings and margin expectations underscores a preference for predictable returns, even as UCB’s topline lags high-fliers in the sector.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for United Community Banks on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these figures from a new angle? It only takes a few moments to shape your own perspective. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding United Community Banks.

See What Else Is Out There

UCB’s revenue growth is expected to lag behind the broader US market, signaling a slower pace despite improvements in profit margins.

If you want to focus on companies that consistently deliver both steady revenue and earnings growth, target stable growth stocks screener (2094 results) for reliable opportunities designed to outperform uneven trends like these.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UCB

United Community Banks

Operates as the bank holding company for United Community Bank that provides financial products and services to commercial, retail, government, education, energy, health care, and real estate sectors in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives