- United States

- /

- Banks

- /

- NYSE:TFIN

Triumph Financial (TFIN): Evaluating Valuation Following Recent Share Price Decline

Reviewed by Kshitija Bhandaru

See our latest analysis for Triumph Financial.

The sharp 21% slide in Triumph Financial's share price over the last month comes after a year already marked by fading investor confidence and mounting concerns about growth and risk. With a 47.1% share price drop year-to-date and a 40.6% total shareholder return loss over 12 months, momentum has clearly shifted. This makes the stock's long-term performance look uncertain compared to peers.

If shifting sentiment in the financial sector has you looking for next opportunities, broaden your search and discover fast growing stocks with high insider ownership.

With shares down sharply and trading nearly 24% below analyst targets, the real question now is whether Triumph Financial is deeply undervalued or if the market is already pricing in weaker prospects ahead.

Most Popular Narrative: 22% Undervalued

With Triumph Financial’s fair value set at $60.50 in the most popular narrative, the current share price of $46.95 stands considerably lower. This creates high expectations for a potential rebound driven by future growth catalysts and digital transformation.

Integration of Greenscreens into Triumph's platform, with its $40B in proprietary audit and payment data, is significantly improving product accuracy and penetration within the top freight brokers. This is accelerating adoption, elevating average contract value, and positioning the intelligence business as Triumph's fastest-growing segment. The result supports higher fee-based revenue and improved earnings growth.

Want to see what factors drive this sky-high valuation? The playbook behind the optimistic fair value hinges on game-changing innovations and bolder earnings projections than you might expect. Wondering how aggressive margin targets and future profitability assumptions could rewrite Triumph’s story? Uncover the surprising details that are moving the price target needle.

Result: Fair Value of $60.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Triumph Financial’s heavy reliance on freight markets and increased technology investment could expose it to revenue volatility if headwinds in the sector continue.

Find out about the key risks to this Triumph Financial narrative.

Another View: Earnings Ratio Sends a Caution Signal

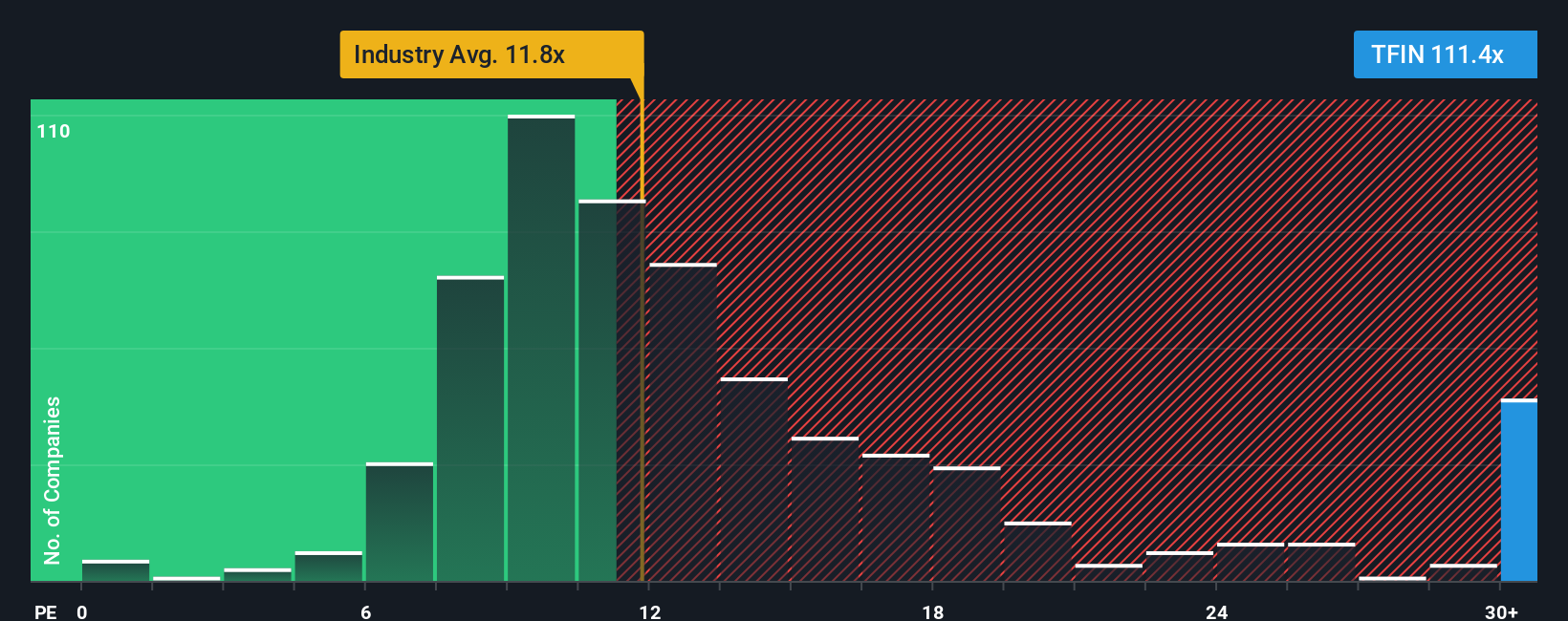

Looking at Triumph Financial’s valuation through its price-to-earnings ratio reveals a far less optimistic story. The stock trades at 107 times earnings, which is strikingly high compared to both the US Banks industry average of 11.3 and peers at 24.3. Even our fair ratio estimate is just 53.1. Such a big gap suggests the market is pricing in tremendous future growth. Is that justified, or does it raise the risks for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Triumph Financial Narrative

If you want to take a different angle or trust your own analysis, you can dig into the data and build a custom narrative in just minutes. Do it your way.

A great starting point for your Triumph Financial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep options open. Take your research a step further and seize unique opportunities outside the mainstream by browsing these curated stock picks:

- Capitalize on breakthrough tech with access to these 24 AI penny stocks, which are shaping tomorrow’s digital landscape and redefining industries.

- Secure steady income by checking out these 19 dividend stocks with yields > 3%, featuring consistent yields and robust payout histories.

- Uncover high-upside gems by reviewing these 892 undervalued stocks based on cash flows, where strong fundamentals meet attractive entry prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Triumph Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFIN

Triumph Financial

A financial holding company, provides banking, factoring, payments, and intelligence services in the United States.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives