- United States

- /

- Banks

- /

- NYSE:TFC

Will Q2 Results and Buyback Progress Change Truist Financial's (TFC) Narrative?

Reviewed by Simply Wall St

- Truist Financial Corporation recently reported its second quarter 2025 results, posting higher net income of US$1.24 billion and earnings per share increases versus the same period last year, alongside reduced net charge-offs and the completion of a US$750 million share buyback tranche.

- The introduction of Truist Merchant Engage, an integrated merchant services platform tailored for small and medium-sized businesses, underscores the company’s commitment to expanding its digital offerings and capturing additional fee-based growth opportunities.

- We’ll examine how Truist’s improved profitability and significant buyback progress could shift its investment narrative moving forward.

Truist Financial Investment Narrative Recap

To be a Truist shareholder, you'd need to believe in the company's ability to deliver profitable growth through both digital innovation and disciplined capital management, while managing credit risk from its still-heavy commercial real estate lending. The recent second quarter results highlight improvements in net income, supported by lower net charge-offs and active share repurchases, but do not materially alter the key short-term catalyst, digital and fee-income expansion, or the main risk, which remains commercial real estate exposure.

Of the latest announcements, the US$750 million share buyback completion stands out. This move supported positive earnings per share trends and suggests continued focus on shareholder returns, yet the impact on long-term valuation will depend on Truist's success in offsetting pressures from its commercial real estate portfolio and driving sustainable non-interest income growth.

In contrast, investors should be aware that Truist’s risk from commercial real estate exposure continues to linger and that ...

Read the full narrative on Truist Financial (it's free!)

Truist Financial's outlook anticipates $22.5 billion in revenue and $6.3 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 7.4% and a $1.4 billion increase in earnings from the current $4.9 billion.

Exploring Other Perspectives

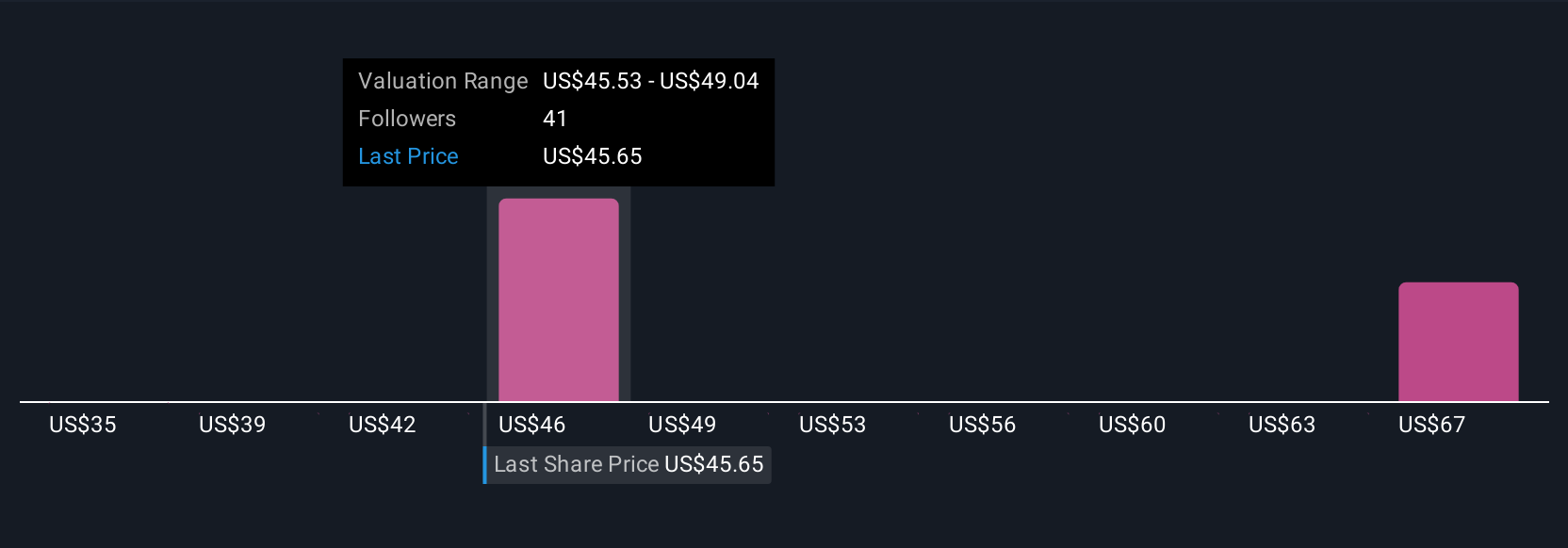

Fair value estimates from four members of the Simply Wall St Community range from US$35.00 up to US$71.18 per share. While some anticipate digital banking as a long-term growth driver, others point to ongoing risks tied to commercial real estate, highlighting the importance of comparing multiple viewpoints before making any decision.

Build Your Own Truist Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Truist Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Truist Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Truist Financial's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truist Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFC

Truist Financial

A financial services company, provides banking and trust services in the Southeastern and Mid-Atlantic United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives