- United States

- /

- Banks

- /

- NYSE:TFC

Truist Financial (NYSE:TFC) Quarterly Earnings: Net Income Reaches US$1.26 Billion

Reviewed by Simply Wall St

Truist Financial (NYSE:TFC) recently reported its first-quarter earnings for 2025, highlighting growth in net interest income and net income, alongside improved earnings per share. Despite these positive results, the company's stock experienced a 5% decline last week. This move may reflect a range of broader market conditions, as the overall market dropped 3% amid economic concerns, including the impact of tech restrictions and a steep decline in UnitedHealth shares. Truist's decline aligns with these broader downward pressures, as strong earnings were insufficient to counter the effects of a complex economic landscape.

Over the longer-term, Truist Financial's total return, including share price and dividends, was 33.55% over the past five years. However, in comparison, the company underperformed the US Market, which had a 4.6% return over the past year, and the US Banks industry, which returned 13% over the same period. This suggests a more challenging short-term environment relative to its longer-term performance.

The recent earnings announcement highlighted improvements in net interest income and net income, yet the stock price declined 5% last week alongside broader market challenges. Despite growth in net interest income and solid earnings per share, these did not fully cushion the stock against external pressures. Such market conditions could impact future revenue and earnings forecasts, potentially affecting investor sentiment.

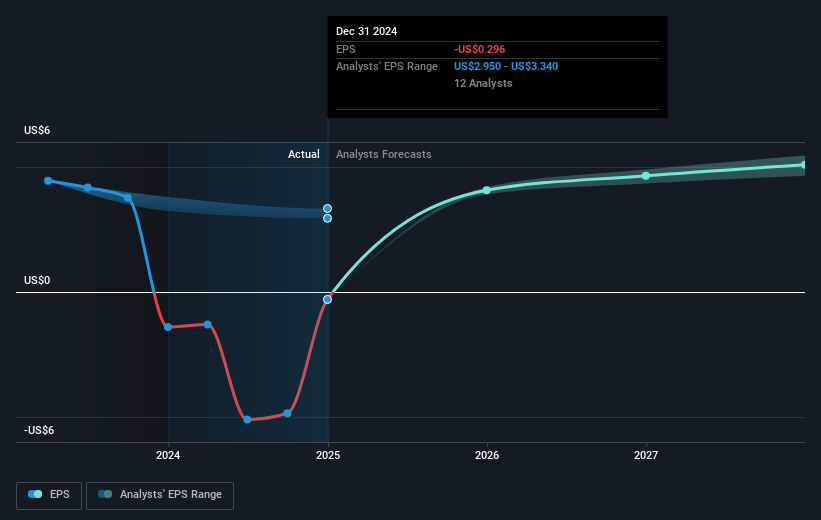

With the share price currently at US$36 and analysts' consensus price target significantly higher at US$47.73, the stock is seen trading at a discount. If forecasts of becoming profitable within three years hold true, there may be potential upside. However, the near-term may remain uncertain amid a complex macroeconomic landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truist Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TFC

Truist Financial

A financial services company, provides banking and trust services in the Southeastern and Mid-Atlantic United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives