- United States

- /

- Banks

- /

- NYSE:SNV

How Synovus Financial's Rising Earnings Could Shape Investor Sentiment Toward SNV

Reviewed by Sasha Jovanovic

- Synovus Financial Corp. recently reported its third-quarter and nine-month 2025 earnings, showing net interest income of US$474.7 million and net income of US$196.99 million for the quarter, both up from the previous year.

- This sustained improvement in core banking metrics, including an increase in earnings per share, reflects continued momentum in operational and financial results compared to 2024.

- Given this strong quarterly growth in net interest income, we'll explore what it could mean for Synovus Financial's investment narrative going forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Synovus Financial Investment Narrative Recap

To be a shareholder in Synovus Financial, you need to believe that the company can continue capturing growth from Southeast market trends, manage competitive pressure, and deliver consistent earnings progress, even as risks tied to regional economies and commercial real estate remain front of mind. The recent earnings beat confirms short-term operational strength but doesn't dramatically shift the most important catalyst: how well Synovus can sustain margin improvement amid ongoing industry competition. Meanwhile, the risk posed by commercial real estate exposure is still relevant and remains a key factor for investors to watch, as there are no material new developments from this result to alter that assessment.

Among recent company actions, the Pinnacle Financial Partners merger announcement stands out. This acquisition, slated for completion in Q1 2026, could be a significant catalyst, providing Synovus with greater scale and resources if the deal goes ahead as planned. For current and prospective investors, it adds another layer to consider in light of Synovus's ongoing profit growth and changing competitive dynamics.

However, given the sustained pressure on credit quality linked to commercial real estate, what investors should also watch out for is possible shifts in asset quality that...

Read the full narrative on Synovus Financial (it's free!)

Synovus Financial's outlook anticipates $2.7 billion in revenue and $825.1 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 6.8% and an earnings increase of $86.6 million from current earnings of $738.5 million.

Uncover how Synovus Financial's forecasts yield a $57.79 fair value, a 23% upside to its current price.

Exploring Other Perspectives

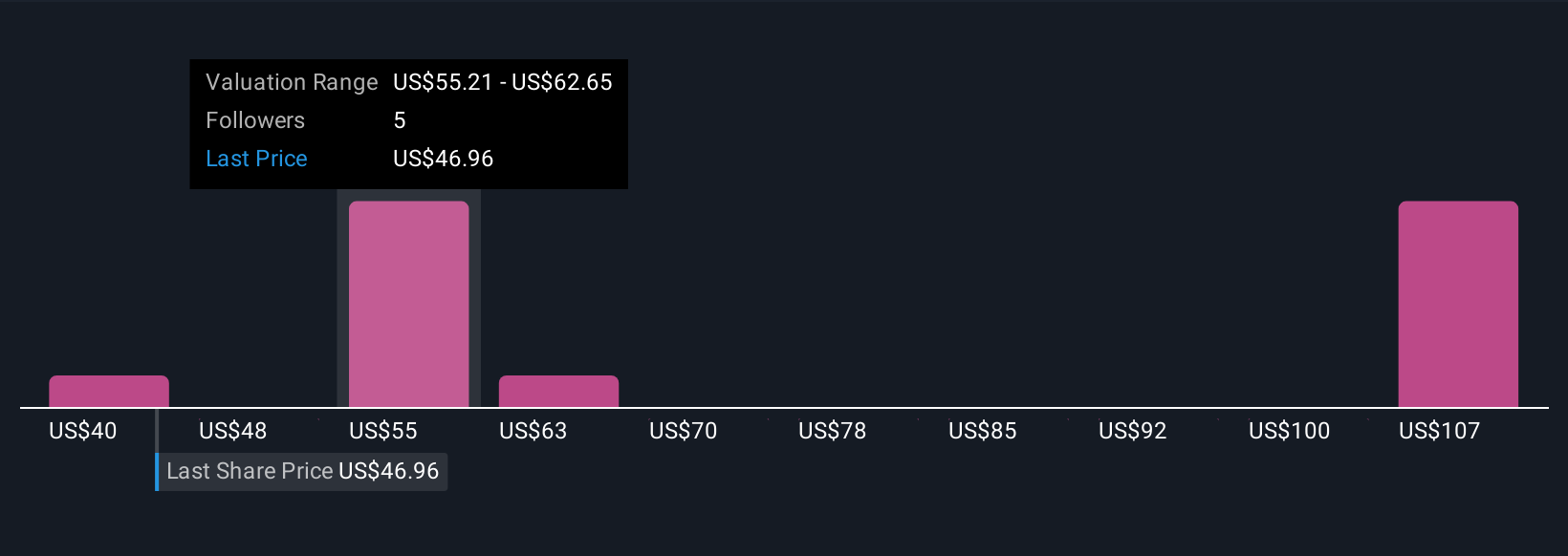

Four members of the Simply Wall St Community valued Synovus Financial between US$40.34 and US$114.71 per share. With commercial real estate exposure still a focus after the strong quarter, you can see just how much investor perspectives can differ, consider exploring several viewpoints yourself.

Explore 4 other fair value estimates on Synovus Financial - why the stock might be worth 14% less than the current price!

Build Your Own Synovus Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Synovus Financial research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Synovus Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Synovus Financial's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNV

Synovus Financial

Operates as the bank holding company for Synovus Bank that provides commercial and consumer banking products and services in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives