- United States

- /

- Banks

- /

- NYSE:SNV

Does the Recent Synovus Stock Slide Present a Compelling Opportunity in 2025?

Reviewed by Bailey Pemberton

Thinking of what to do with Synovus Financial right now? You’re not alone. Whether you already hold the stock, are eyeing a new position, or just enjoy weighing options, Synovus demands attention. The last few weeks have been a roller coaster, with shares down 4.7% over the past week and off 10.7% in the last month. That kind of slide can look daunting in the moment, but let’s not overlook the bigger picture. Synovus is still up a strong 25% over three years, and if you zoom out to five years, it has climbed an impressive 132.1%. That seesaw pattern points toward shifting expectations in the market, possibly signaling that investors are still sorting out the balance between potential growth and perceived risks.

What really stands out, though, is how undervalued Synovus is right now based on traditional yardsticks. Out of six key valuation checks, the company scores a perfect 6, meaning it looks undervalued across the board. That is not something we see every day, and it is exactly the kind of green flag value-oriented investors hunt for. In the next section, we will break down each valuation approach and what it reveals about Synovus’s current stock price. Stick around, because after that, we will look at a smarter, more holistic way to judge value in a shifting financial landscape.

Why Synovus Financial is lagging behind its peers

Approach 1: Synovus Financial Excess Returns Analysis

The Excess Returns model evaluates a company’s ability to generate returns above its cost of equity, focusing on how much value it consistently creates for shareholders over time. It goes beyond basic earnings, looking at how effectively Synovus reinvests the money entrusted to it by shareholders and whether those investments deliver returns greater than shareholders require in compensation for risk.

For Synovus Financial, the numbers are compelling. The company boasts a Book Value of $36.61 per share and delivers a Stable EPS of $5.93 per share, based on projections from twelve analysts. With a Cost of Equity of $3.03 per share, Synovus achieves an Excess Return of $2.90 per share, giving it an average Return on Equity of 13.92%. Analysts project the Stable Book Value will reach $42.61 per share, reflecting confidence in the company’s long-term growth potential and stability.

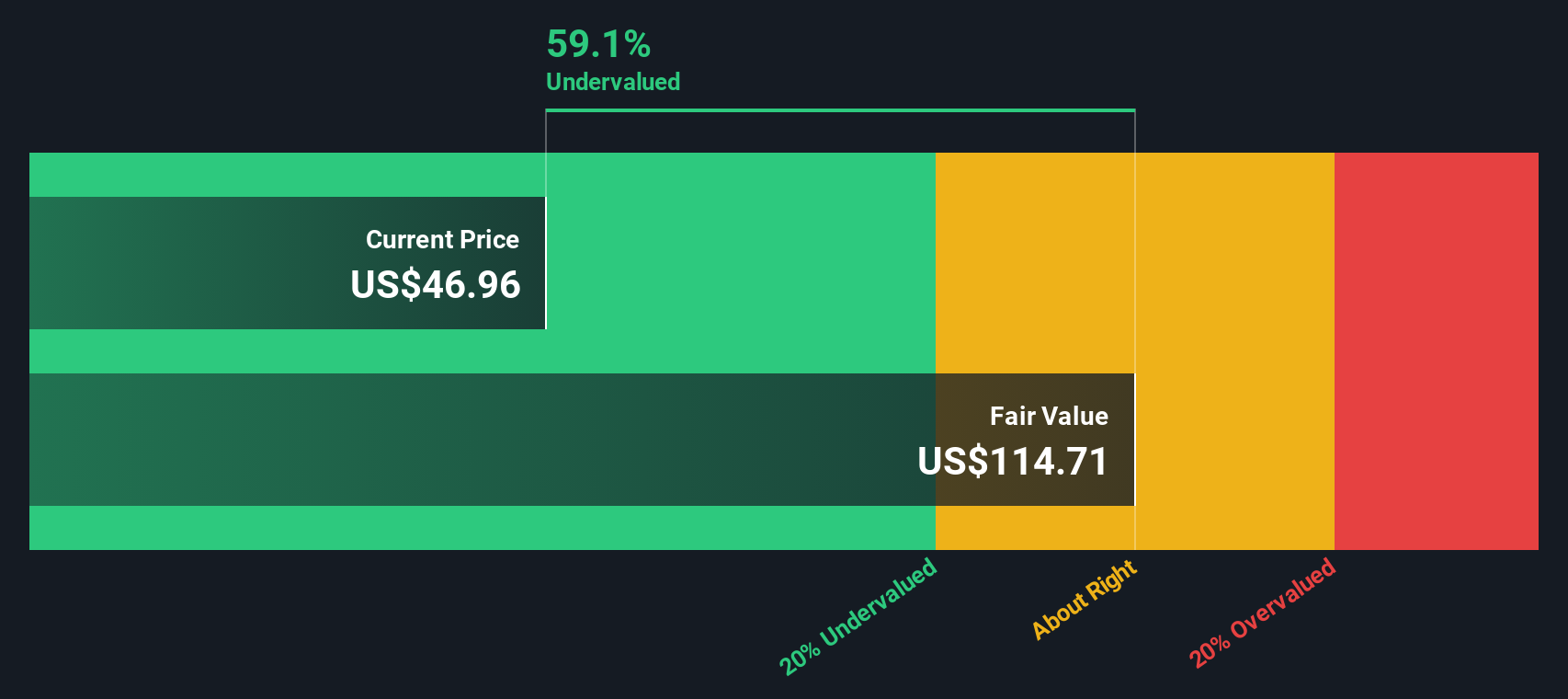

Based on these metrics, the Excess Returns model calculates an intrinsic value of $114.45 per share for Synovus. With the stock currently trading at a significant discount, 59.7% below its estimated fair value, the analysis suggests that Synovus Financial is materially undervalued by the market right now.

Result: UNDERVALUED

Our Excess Returns analysis suggests Synovus Financial is undervalued by 59.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Synovus Financial Price vs Earnings

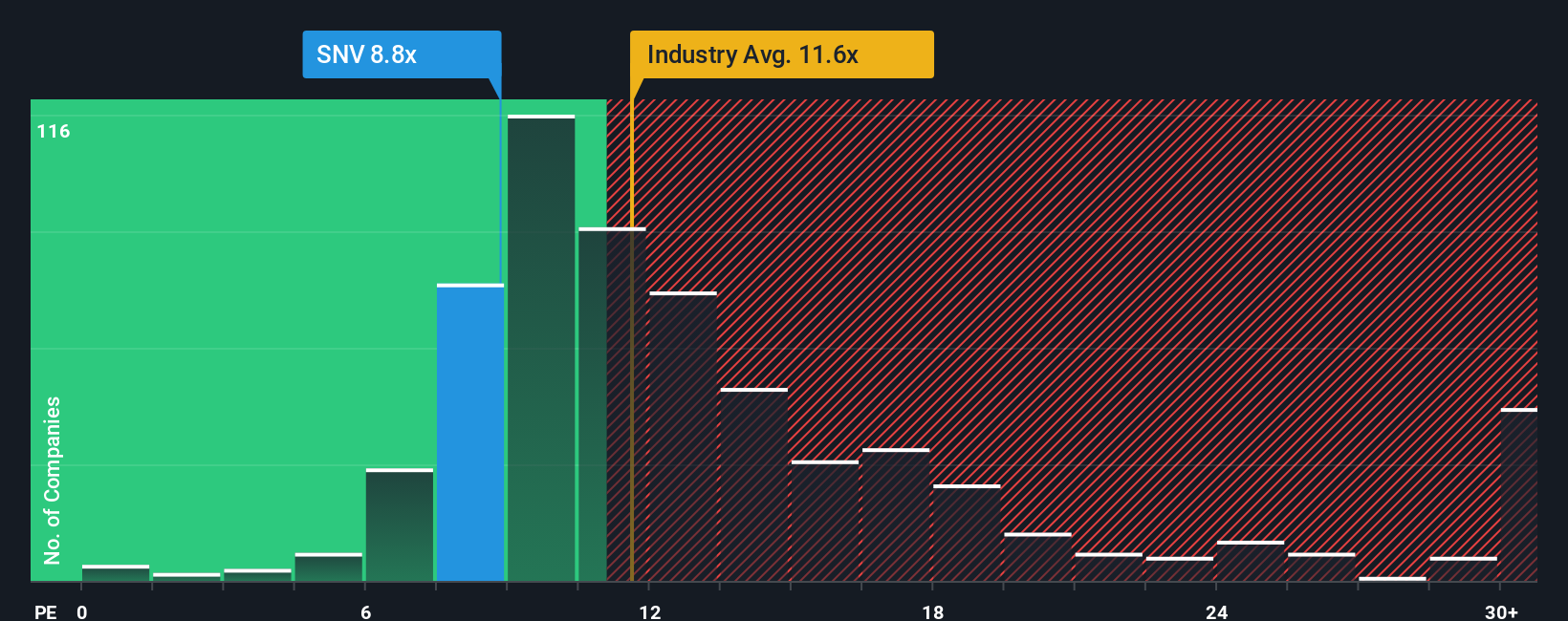

The price-to-earnings (PE) ratio is often the go-to metric for evaluating profitable companies like Synovus Financial. It tells investors how much they are paying for each dollar of a company’s earnings, making it an effective barometer for identifying undervalued or overvalued stocks. Importantly, the “right” PE ratio for a given company depends not just on its current earnings, but also on how quickly its profits are expected to grow, the risks it faces, and how it compares to the rest of its industry.

At present, Synovus trades at a PE ratio of 8.7x. This is noticeably below the industry average of 11.5x, and well under the peer group average of 16.8x. On the surface, that discount might look like a red flag or a big opportunity, depending on what you expect for the company’s future.

To get a more tailored perspective, Simply Wall St uses a “Fair Ratio,” which in Synovus’s case is estimated to be 12.6x. This proprietary benchmark incorporates a range of factors, including the company’s earnings growth potential, risk profile, and profit margins, as well as its industry and market cap. Because it adjusts for these specifics, the Fair Ratio is a more accurate gauge than a simple comparison to peers or the industry average, both of which may overlook key details unique to Synovus.

When comparing Synovus’s current PE of 8.7x to its Fair Ratio of 12.6x, the stock appears meaningfully undervalued based on this measure alone.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Synovus Financial Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are an accessible tool that helps you connect your personal story or perspective on a company, such as your beliefs about Synovus Financial’s future, with actual numbers like fair value, forecasted revenues, and profit margins.

A Narrative is simply your investment thesis in action. It links what you believe about the company’s strategy, strengths, and risks to a concrete financial forecast and then to an estimated fair value. By turning ideas into numbers, Narratives let you clearly see if the current share price offers a buying or selling opportunity.

Available to millions through Simply Wall St’s Community page, Narratives are easy to create and review. They are also dynamically updated whenever new information, such as earnings announcements or industry news, is released, so you always have a living, relevant perspective on your investments.

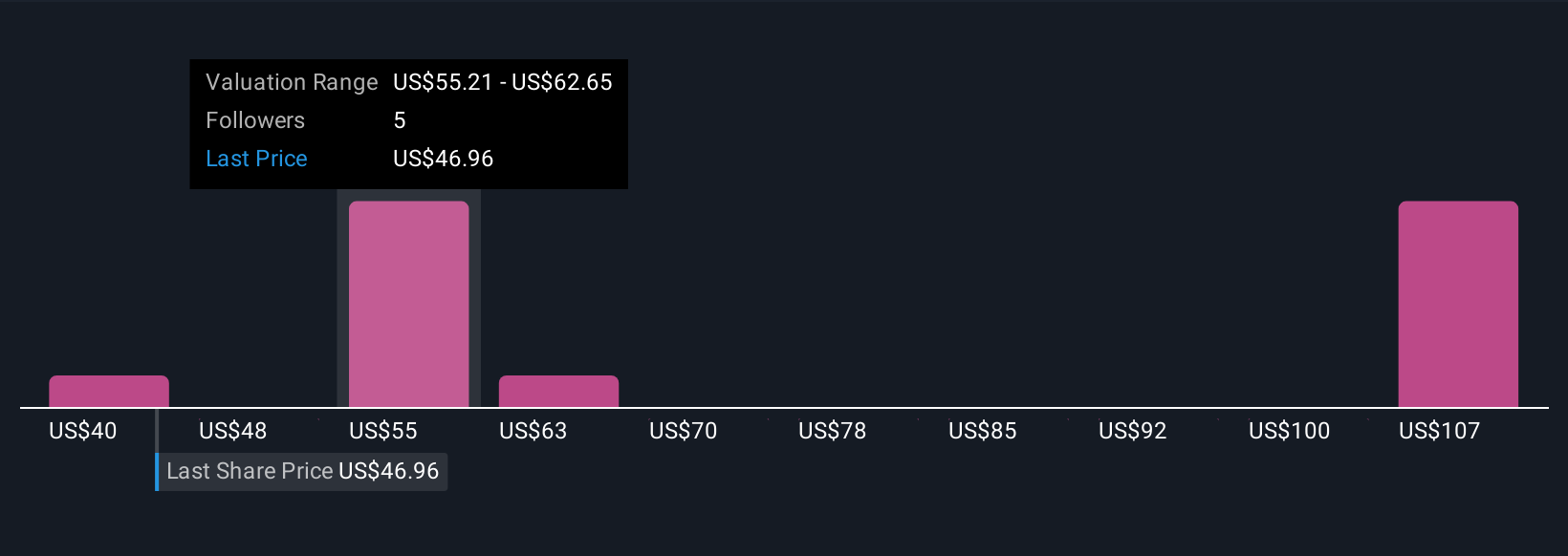

For example, with Synovus Financial, some investors are optimistic and assign a high price target of $65.00 based on robust growth in the bank’s Sun Belt markets and digital expansion, while others take a more cautious stance and see fair value at just $50.00, factoring in merger risks and industry headwinds. Narratives make it simple to compare these perspectives to the current price, helping you decide if Synovus is right for your portfolio at today’s valuation.

Do you think there's more to the story for Synovus Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNV

Synovus Financial

Operates as the bank holding company for Synovus Bank that provides commercial and consumer banking products and services in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives