- United States

- /

- Banks

- /

- NYSE:RNST

Renasant (RNST): Taking a Fresh Look at Valuation After Recent Sideways Share Price Performance

Reviewed by Simply Wall St

Renasant (RNST) has been grinding through a mixed stretch, with the share price roughly flat over the month but down over the past 3 months, even as fundamentals quietly improved.

See our latest analysis for Renasant.

Over the past year, Renasant has essentially moved sideways, with a modest year to date share price return of 0.57 percent and a slightly negative 1 year total shareholder return of 2.87 percent. This suggests momentum is still rebuilding after the recent 90 day pullback.

If you are weighing where to put fresh capital next, this could be a good moment to compare Renasant with other banks and explore solid balance sheet and fundamentals stocks screener (None results).

With earnings growing faster than revenues and the stock still trading at a notable discount to analyst targets and intrinsic value estimates, is Renasant quietly undervalued or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 15% Undervalued

With Renasant closing at $35.56 versus a most-widely-followed fair value near the low $40s, the narrative frames a meaningful upside driven by aggressive growth assumptions.

The combined company's diversification into mortgage banking, wealth management, and capital markets services is expected to deliver higher non-interest income and reduce earnings volatility, supporting more consistent earnings growth in the long term.

Want to see what powers that upside claim? The story leans on rapid top line expansion, sharply higher margins, and a future earnings multiple that challenges typical regional bank norms. Curious which specific forecasts make those targets add up? Read on to unpack the full narrative and the numbers behind it.

Result: Fair Value of $41.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat view could unravel if growth in the Southeast region stalls, or if merger integration missteps drive higher credit losses and operating costs.

Find out about the key risks to this Renasant narrative.

Another Lens on Value

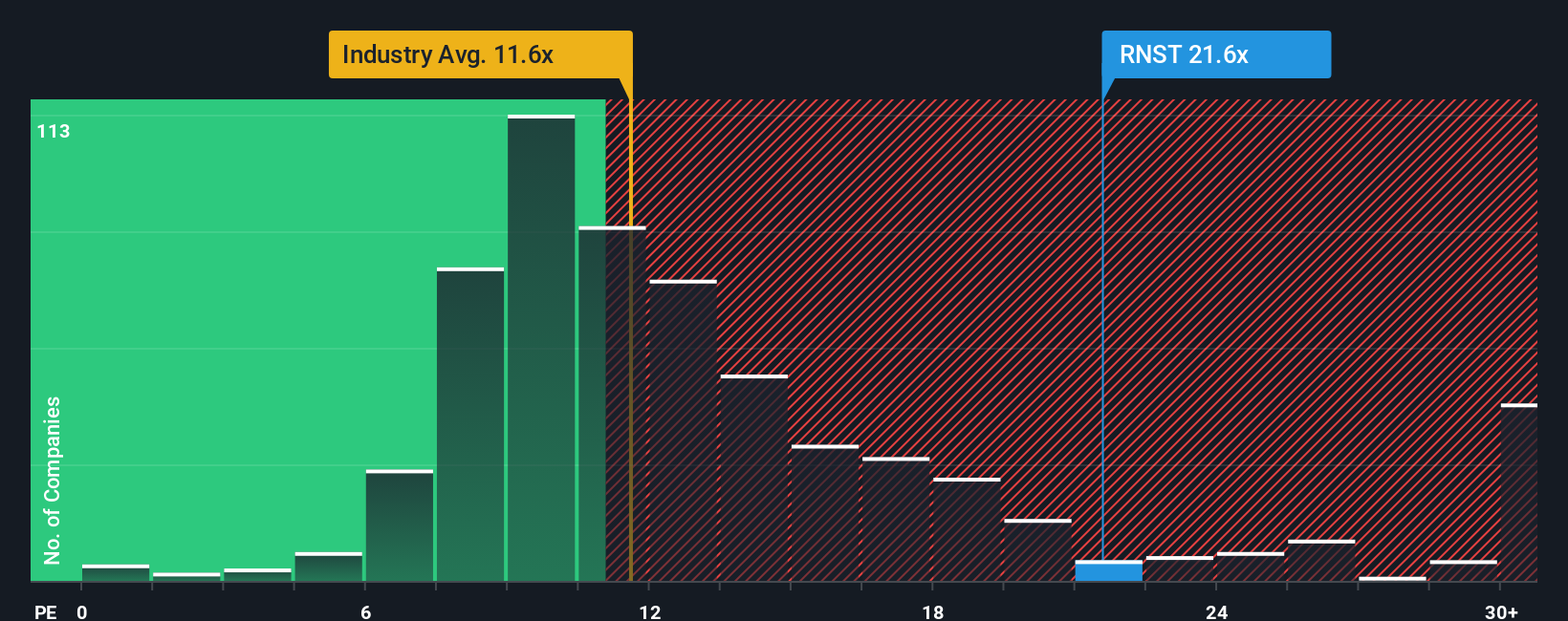

While the narrative leans on future earnings power, today Renasant trades on a price to earnings ratio of about 23 times. This is well above both US banks at roughly 11.5 times and peers near 16.1 times, and even above a fair ratio of 20 times, which points to valuation risk if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Renasant Narrative

If you would rather interrogate the numbers yourself or challenge these assumptions, you can quickly build a personalised Renasant thesis from scratch: Do it your way.

A great starting point for your Renasant research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas that match your style?

Before you move on, lock in your next opportunity by using the Simply Wall Street Screener to uncover high conviction ideas that most investors overlook.

- Target reliable income streams by using these 14 dividend stocks with yields > 3% that can support long term compounding while many investors chase short term stories.

- Capitalize on market mispricings with these 930 undervalued stocks based on cash flows, where solid businesses trade at prices that do not yet reflect their underlying cash flows.

- Position yourself at the frontier of innovation by scanning these 27 quantum computing stocks before these themes become mainstream headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNST

Renasant

Operates as a bank holding company for Renasant Bank that provides a range of financial, wealth management, fiduciary, and insurance services to retail and commercial customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026