- United States

- /

- Banks

- /

- NYSE:RNST

Renasant (RNST): Assessing Valuation as Profitability Pressures and EPS Declines Shape Investor Sentiment

Reviewed by Kshitija Bhandaru

Renasant (RNST) is in the spotlight as recent commentary points to its lower profitability margins and declining earnings per share, even though revenue has continued to grow. This situation has influenced investor sentiment.

See our latest analysis for Renasant.

Despite positive revenue trends, Renasant's share price movement has been a bit choppy lately, with a 1-month share price return of -7.07% and a year-to-date gain of 3.39%. Still, long-term investors have enjoyed an 18.64% total shareholder return over the past year and a solid 56.01% over five years. This shows momentum has held up even through recent ups and downs.

If you want to see where the next opportunity might come from, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst price targets but ongoing concerns about weaker profitability, investors are left to wonder: is Renasant undervalued right now, or is future growth already reflected in the price?

Most Popular Narrative: 12.6% Undervalued

Compared to Renasant's last close of $36.56, the most widely followed narrative suggests a fair value almost $5 higher. The case centers on transformative growth strategies and merger-driven momentum that could change the company's profile.

The merger with The First Bancshares increases scale and provides a larger footprint in regions experiencing strong small business formation. This enables Renasant to capitalize on rising entrepreneurial activity, which should enhance lending opportunities and fee income over time. Ongoing investments in digital banking and technology-driven efficiency, such as back-office automation and treasury management upgrades, are positioned to improve operating efficiency and net margins as integration cost saves are realized throughout the next year.

Eager to uncover what drives analyst optimism? The entire valuation hinges on aggressive growth targets for both revenue and profit margins, plus a deep shift in how Renasant earns its money. Want to glimpse the forecasted numbers powering this narrative and find out what future expectations they’re betting on? Start digging now, the assumptions behind this fair value may surprise you.

Result: Fair Value of $41.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a regional economic downturn or sluggish digital innovation could reduce lending opportunities. This may put pressure on Renasant's future margins and earnings growth.

Find out about the key risks to this Renasant narrative.

Another View: Is the Market Multiple Sending a Different Signal?

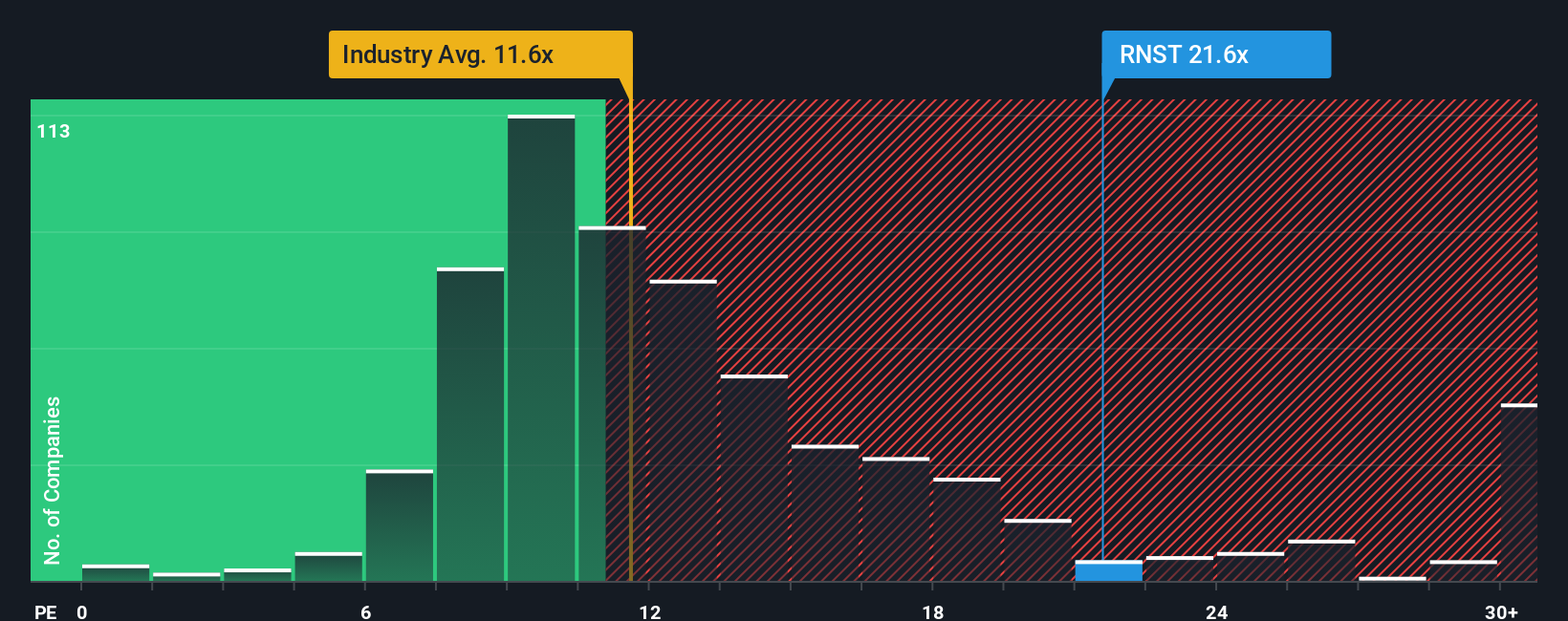

While the analyst narrative points to Renasant being undervalued, its current price-to-earnings ratio of 21.7x is significantly higher than both the US Banks industry average of 11.7x and the peer average of 12.7x. The fair ratio suggests a more reasonable level around 19.7x. This gap hints at valuation risk that could be realized if expectations shift. Could the market be pricing in too much optimism, or is there more upside if growth materializes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Renasant Narrative

If you see things differently, or want to test your own view with the latest data, it only takes a few minutes to build your own perspective. Do it your way

A great starting point for your Renasant research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Broaden your strategy beyond one stock and explore some of the most talked-about trends. Here are three opportunities you may want to consider:

- Unlock overlooked potential by reviewing these 890 undervalued stocks based on cash flows for companies with strong fundamentals trading below their estimated worth.

- Capitalize on future breakthroughs by tracking these 26 quantum computing stocks, featuring innovators at the forefront of quantum computing and next-generation processing technologies.

- Secure reliable income streams by checking out these 19 dividend stocks with yields > 3% with yields over 3% and a track record of consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RNST

Renasant

Operates as a bank holding company for Renasant Bank that provides a range of financial, wealth management, fiduciary, and insurance services to retail and commercial customers.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives