- United States

- /

- Banks

- /

- NYSE:RF

Will Strong Results and Buybacks Transform Regions Financial's (RF) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent weeks, Regions Financial Corporation reported third-quarter earnings that surpassed expectations, completed a US$1.44 billion share repurchase program, and received industry recognition for innovation and social responsibility, including awards and distinctions highlighting its technology and community support efforts.

- The company’s decision to lower its prime lending rate and active participation in key financial conferences underscore its focus on competitive positioning and stakeholder engagement during a period of elevated interest rate speculation and shifting investor sentiment.

- We'll explore how Regions Financial’s better-than-expected quarterly performance and robust share repurchase plan impact its long-term investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Regions Financial Investment Narrative Recap

To be comfortable owning Regions Financial, you need to believe in the resilience of US regional banks and the long-term benefits of the company’s focused expansion in the Southeast, strong digital banking investments, and prudent credit risk management. Recent news, including better-than-expected third-quarter results and a completed US$1.44 billion share buyback, may encourage near-term confidence in management’s ability to return capital, but the most important short-term catalyst remains interest rate trends, and the biggest risk is intensifying competition for deposits and loan growth, neither of which has materially shifted following this update.

Among the latest announcements, Regions' completion of its US$1.44 billion share repurchase program stands out as most relevant. While this move signals management’s confidence in the company’s financial position and aims to reward shareholders, continued pressure on deposit costs and competition from both traditional banks and fintech entrants still present meaningful risks to sustaining earnings growth and margin expansion.

Yet, while recent optimism may capture investors’ attention, it’s essential to look closely at how increasing competitive pressure on deposit pricing could impact future profitability and...

Read the full narrative on Regions Financial (it's free!)

Regions Financial's narrative projects $8.6 billion revenue and $2.2 billion earnings by 2028. This requires 8.2% annual revenue growth and a $0.2 billion increase in earnings from $2.0 billion currently.

Uncover how Regions Financial's forecasts yield a $28.45 fair value, a 14% upside to its current price.

Exploring Other Perspectives

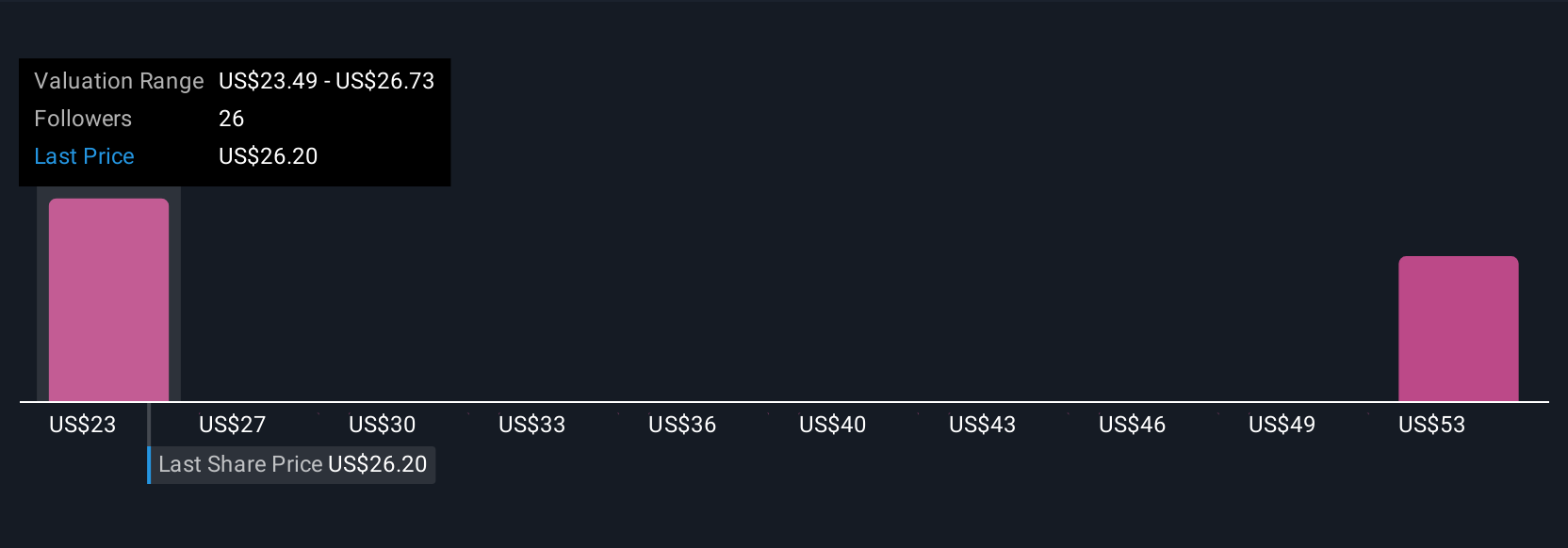

Fair value estimates from three Simply Wall St Community members range from US$28.45 to US$53.49. The group’s projections highlight how perspectives differ, particularly as competition in core Southeastern markets remains a key factor for revenue growth and margin stability.

Explore 3 other fair value estimates on Regions Financial - why the stock might be worth over 2x more than the current price!

Build Your Own Regions Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regions Financial research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Regions Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regions Financial's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RF

Regions Financial

A financial holding company, provides various banking and related products and services to individual and corporate customers.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.