- United States

- /

- Banks

- /

- NYSE:RF

Regions Financial (RF) Net Profit Margin Improvement Reinforces Bullish Narratives on Stable Growth

Reviewed by Simply Wall St

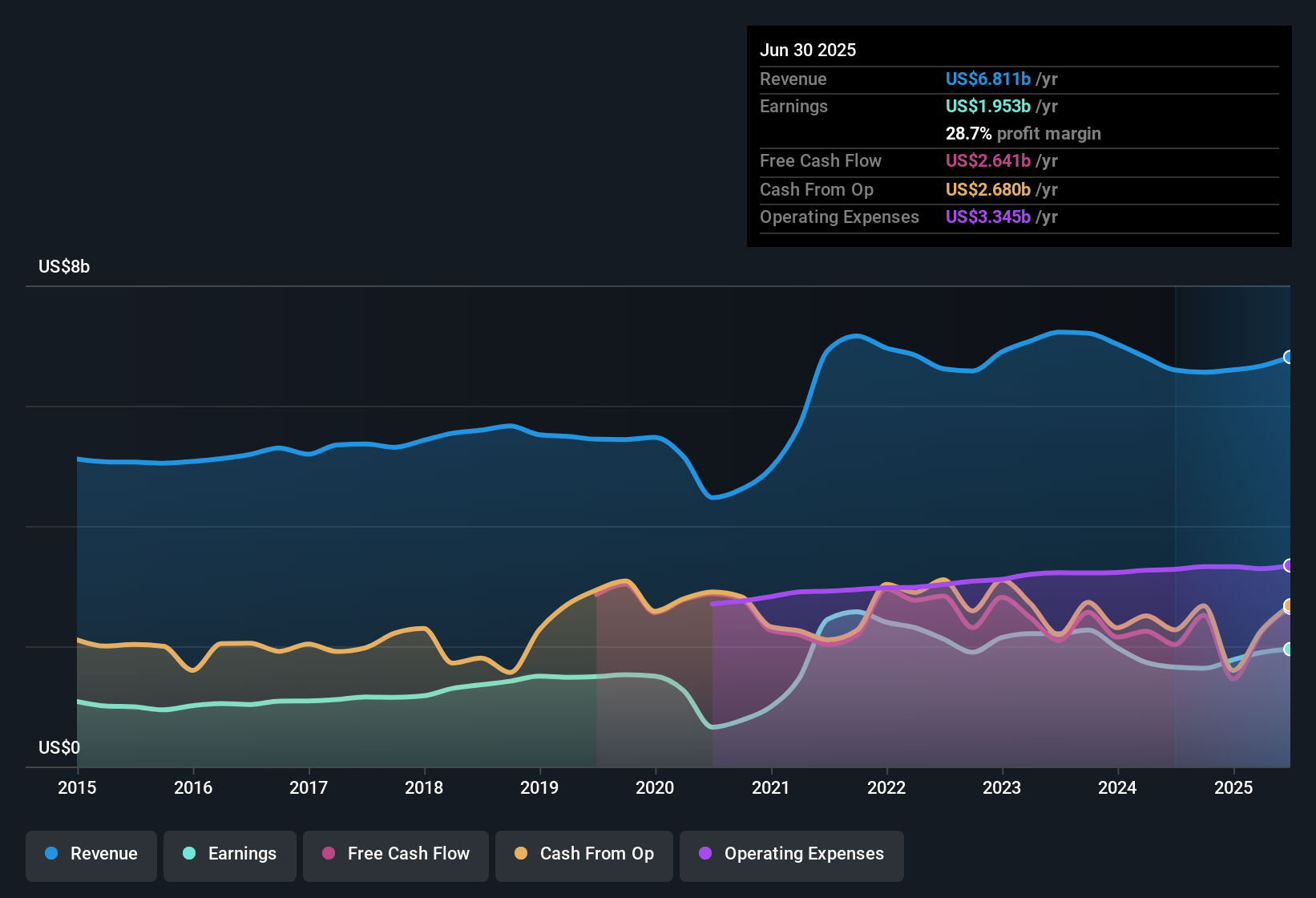

Regions Financial (RF) delivered an 18.2% increase in earnings over the past year, outpacing its 5-year average growth rate of 5.6%. Net profit margins improved to 28.7% compared to 25.1% in the prior period, and profits have grown at an average rate of 5.6% annually over the last five years. Investors are likely to see the consistent earnings momentum and expanding margins as supportive for sentiment, even as forecasts suggest revenue and earnings will grow at a slower clip than the broader US market.

See our full analysis for Regions Financial.Next, we will see how this quarter’s numbers compare to some of the most widely watched market narratives, highlighting where the consensus is confirmed and where fresh surprises emerge.

See what the community is saying about Regions Financial

Wealth Management and Fee Income Hits New High

- Quarterly fee income continued its record streak, while fee-based businesses have grown at over 8% compound annual rate since 2018. This growth helps to reduce the company’s reliance on net interest income.

- Analysts' consensus view points to these diversified fee streams and strong credit risk management as key strengths that are keeping Regions’ earnings more stable than many banks.

- Record fee income bolsters earnings stability and offsets potential volatility in core lending operations.

- Superior credit quality, with an ongoing portfolio shift away from riskier credits, is expected to help control charge-offs and support steady progress even if industry conditions worsen.

- To see the full consensus narrative and how these catalysts fit into the bigger picture for Regions, head to the detailed breakdown here: 📊 Read the full Regions Financial Consensus Narrative.

Sun Belt Growth and Digital Upgrades Drive Expansion

- Regions' significant footprint in the Sun Belt, combined with investments in digital banking and a planned cloud-based core platform, is propelling both deposit and account growth ahead of many peers.

- Analysts' consensus narrative highlights that the company's rapid deposit and account growth, helped by the region’s strong population influx and economic expansion, is a central competitive advantage.

- Digital infrastructure upgrades are expected to drive customer acquisition and cost control, ultimately supporting stronger net margins and operational efficiency over the coming years.

- This operational efficiency, when paired with a granular, low-cost base of deposits, should help maintain a resilient net interest margin as rate environments normalize.

Shares Trade Below Fair Value Despite Risk Factors

- At a share price of $23.58, Regions Financial trades at a price-to-earnings ratio of 10.7x, undercutting both the analysts’ current target of $29.01 and the industry average of 11.9x. The share price is also well below the DCF fair value of $53.20.

- Analysts' consensus view considers these value metrics attractive given the steady growth profile and absence of significant company-specific risks.

- Consensus sees limited upside to the share price in the near term, with a price target just 23% above today’s price and ongoing debate among analysts between higher and more conservative earnings forecasts for 2028.

- These factors suggest that Regions is seen as fairly valued by the market right now, balancing modest growth expectations with a solid risk profile.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Regions Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a fresh angle? Share your vision and build your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 6 key rewards investors are optimistic about regarding Regions Financial.

See What Else Is Out There

While Regions Financial's earnings are steady, its near-term growth outlook lags both analyst targets and the broader market’s more ambitious forecasts.

If you're seeking steadier momentum, use our stable growth stocks screener (2084 results) to focus on companies consistently expanding earnings and revenue, even in changing environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RF

Regions Financial

A financial holding company, provides various banking and related products and services to individual and corporate customers.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives