- United States

- /

- Marine and Shipping

- /

- NasdaqGS:SBLK

Top US Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As the U.S. markets experience a tech-driven rally with chip stocks leading gains in the S&P 500 and Nasdaq, investors are keenly observing sectors that promise stability amid such volatility. In this context, dividend stocks stand out as attractive options for those seeking steady income and potential capital appreciation, particularly in a market environment buoyed by technological advancements and economic shifts.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| WesBanco (NasdaqGS:WSBC) | 4.62% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 5.25% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.72% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.63% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.83% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.84% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.73% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.14% | ★★★★★★ |

Click here to see the full list of 155 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

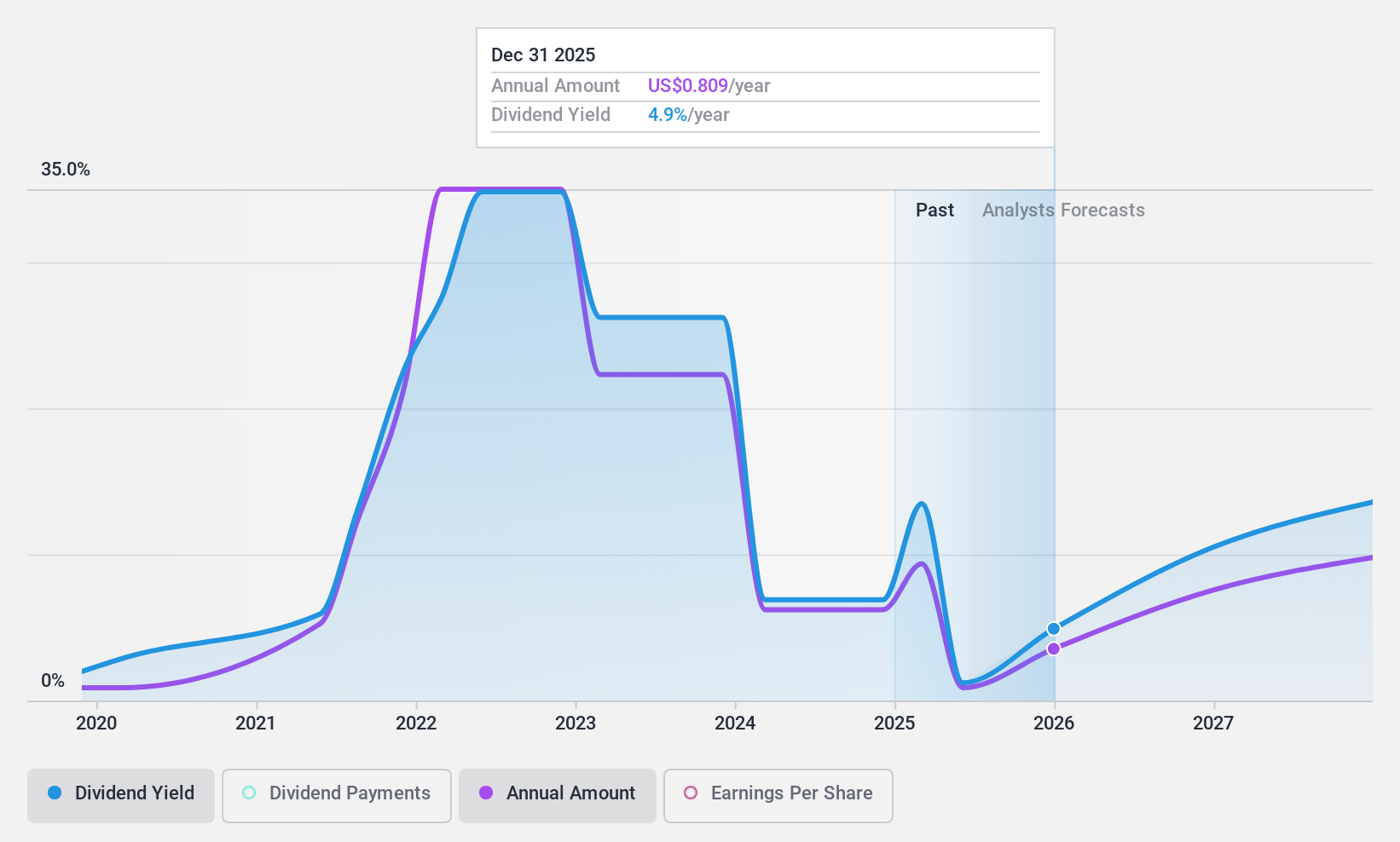

Star Bulk Carriers (NasdaqGS:SBLK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Star Bulk Carriers Corp. is a shipping company involved in the global ocean transportation of dry bulk cargoes, with a market cap of $1.79 billion.

Operations: Star Bulk Carriers Corp. generates its revenue primarily from its dry bulk vessels, amounting to $1.22 billion.

Dividend Yield: 9.7%

Star Bulk Carriers offers an attractive dividend yield, ranking in the top 25% of U.S. dividend payers. However, its track record is unstable with only five years of payments and notable volatility. Despite this, dividends are well-covered by both earnings (82.1% payout ratio) and cash flows (38.9% cash payout ratio). The stock trades significantly below estimated fair value, suggesting potential for capital appreciation alongside income generation from dividends.

- Navigate through the intricacies of Star Bulk Carriers with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Star Bulk Carriers shares in the market.

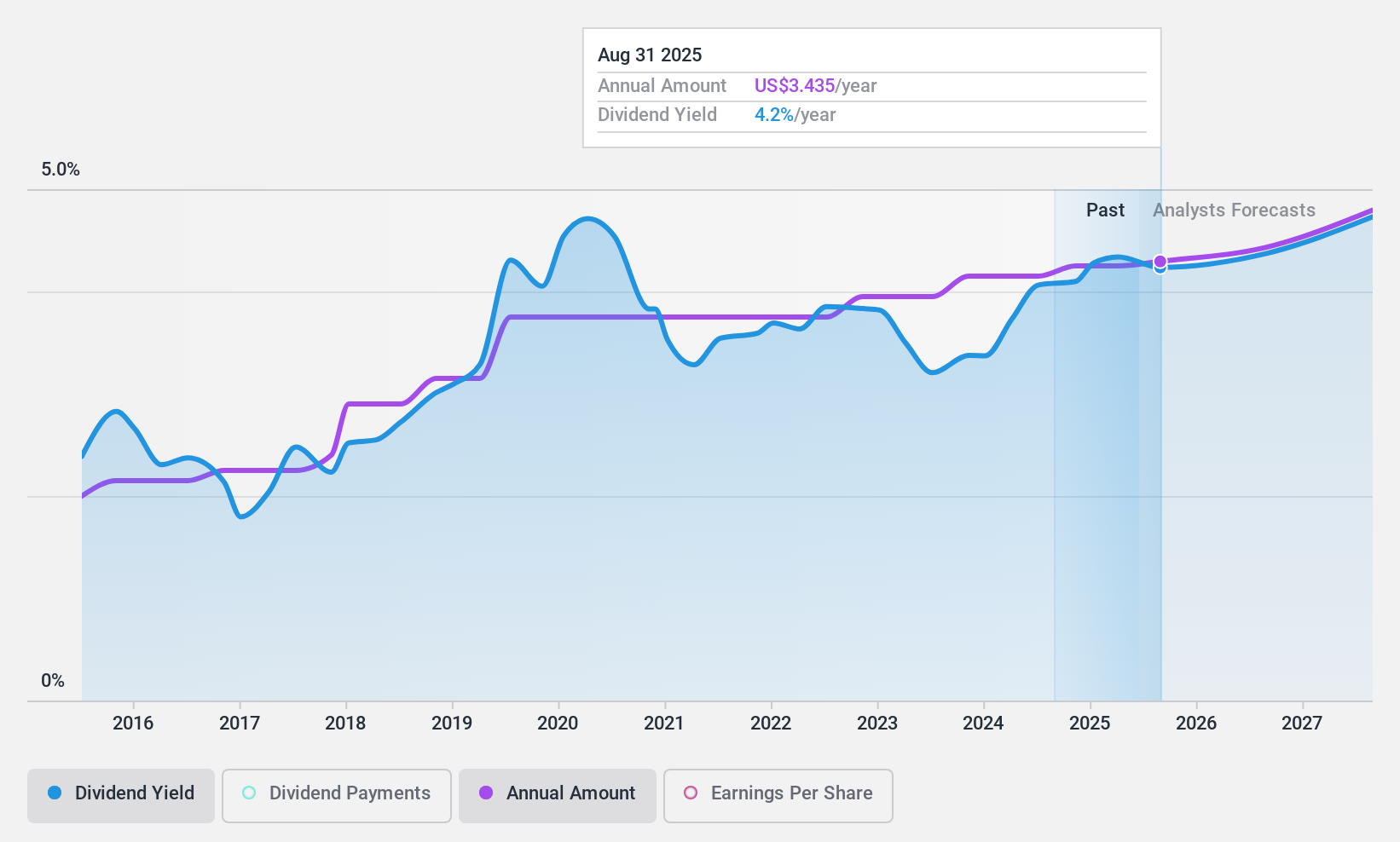

MSC Industrial Direct (NYSE:MSM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MSC Industrial Direct Co., Inc. is a distributor of metalworking and maintenance, repair, and operations (MRO) products and services across the United States, Canada, Mexico, the United Kingdom, and internationally with a market cap of approximately $4.39 billion.

Operations: MSC Industrial Direct generates revenue primarily from its distribution of metalworking, maintenance, repair, and operations (MRO) products and services, amounting to approximately $3.82 billion.

Dividend Yield: 4.3%

MSC Industrial Direct offers a reliable dividend yield of 4.3%, though it falls slightly short of the top 25% in the U.S. market. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 72.7% and 61.1% respectively, indicating sustainability. Dividends have been stable over the past decade despite recent insider selling activity, and there's potential for growth as earnings are forecasted to increase by 10.16% annually.

- Delve into the full analysis dividend report here for a deeper understanding of MSC Industrial Direct.

- According our valuation report, there's an indication that MSC Industrial Direct's share price might be on the cheaper side.

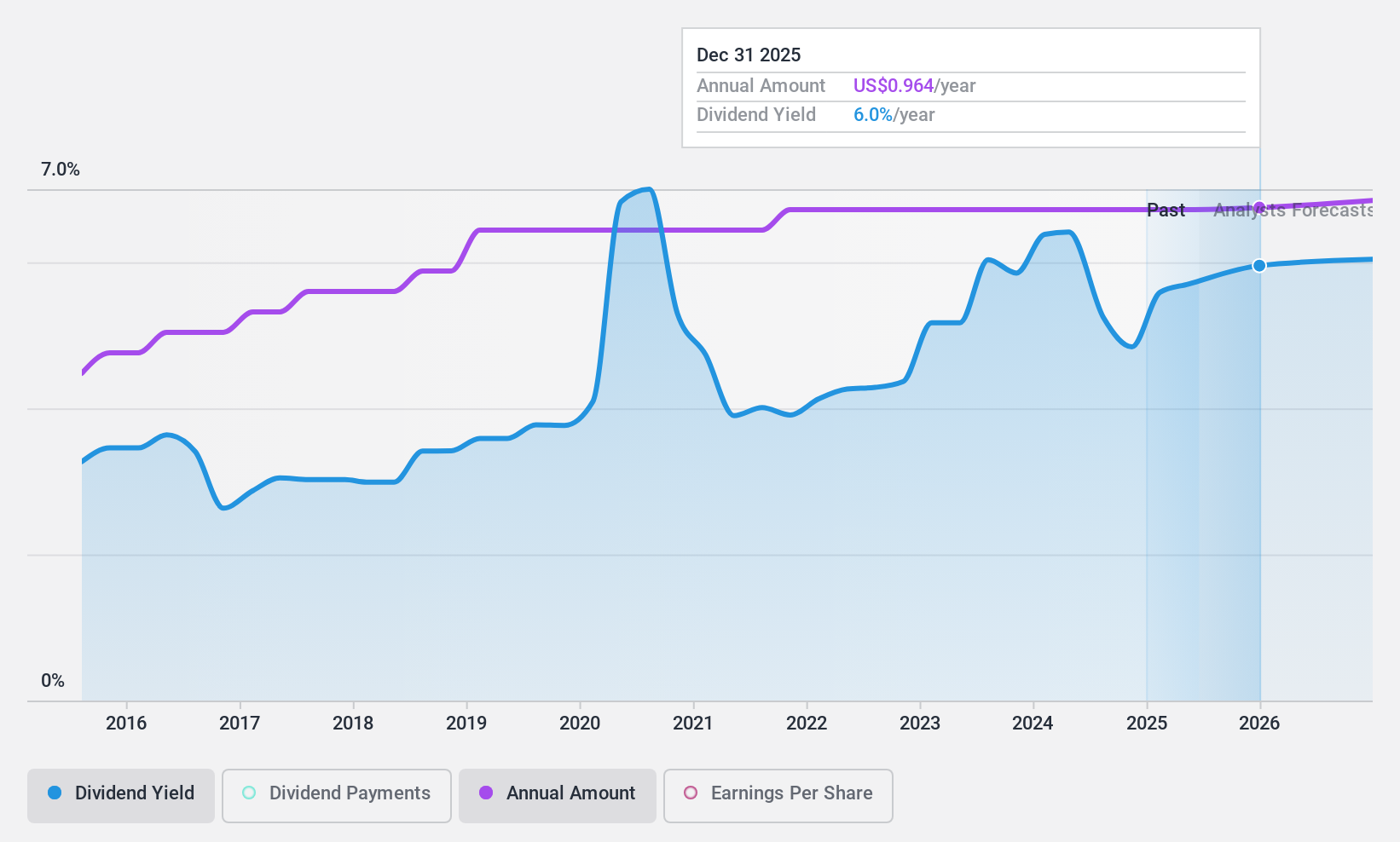

Provident Financial Services (NYSE:PFS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Provident Financial Services, Inc. is a bank holding company for Provident Bank, offering a range of banking products and services to individuals, families, and businesses in the United States with a market cap of approximately $2.47 billion.

Operations: Provident Financial Services, Inc. generates revenue primarily through its Traditional Banking and Other Financial Services segment, which accounted for $526.01 million.

Dividend Yield: 5.1%

Provident Financial Services offers a dividend yield of 5.13%, placing it in the top 25% of U.S. dividend payers, but its high payout ratio of 97.6% raises concerns about sustainability. Although dividends have been stable and growing over the past decade, recent profit margins have decreased significantly from last year, and earnings are impacted by large one-off items. Despite trading below fair value estimates, shareholders experienced substantial dilution recently.

- Unlock comprehensive insights into our analysis of Provident Financial Services stock in this dividend report.

- Our valuation report here indicates Provident Financial Services may be undervalued.

Summing It All Up

- Reveal the 155 hidden gems among our Top US Dividend Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SBLK

Star Bulk Carriers

A shipping company, engages in the ocean transportation of dry bulk cargoes through the ownership and operation of dry bulk carrier vessels worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives