- United States

- /

- Capital Markets

- /

- NYSE:GAM

3 Dividend Stocks With Yields Ranging Up To 8%

Reviewed by Simply Wall St

As the United States markets experience a rebound, with major indexes such as the Nasdaq, Dow Jones Industrial Average, and S&P 500 closing higher amid a resurgence in tech and crypto-related stocks, investors are keenly observing opportunities for stable returns. In this environment of fluctuating market dynamics, dividend stocks offer potential appeal by providing consistent income streams; here we explore three dividend stocks with yields ranging up to 8%.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.93% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.50% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.82% | ★★★★★★ |

| Heritage Commerce (HTBK) | 4.68% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.74% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.02% | ★★★★★★ |

| Ennis (EBF) | 5.68% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.20% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.56% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.56% | ★★★★★☆ |

Click here to see the full list of 123 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

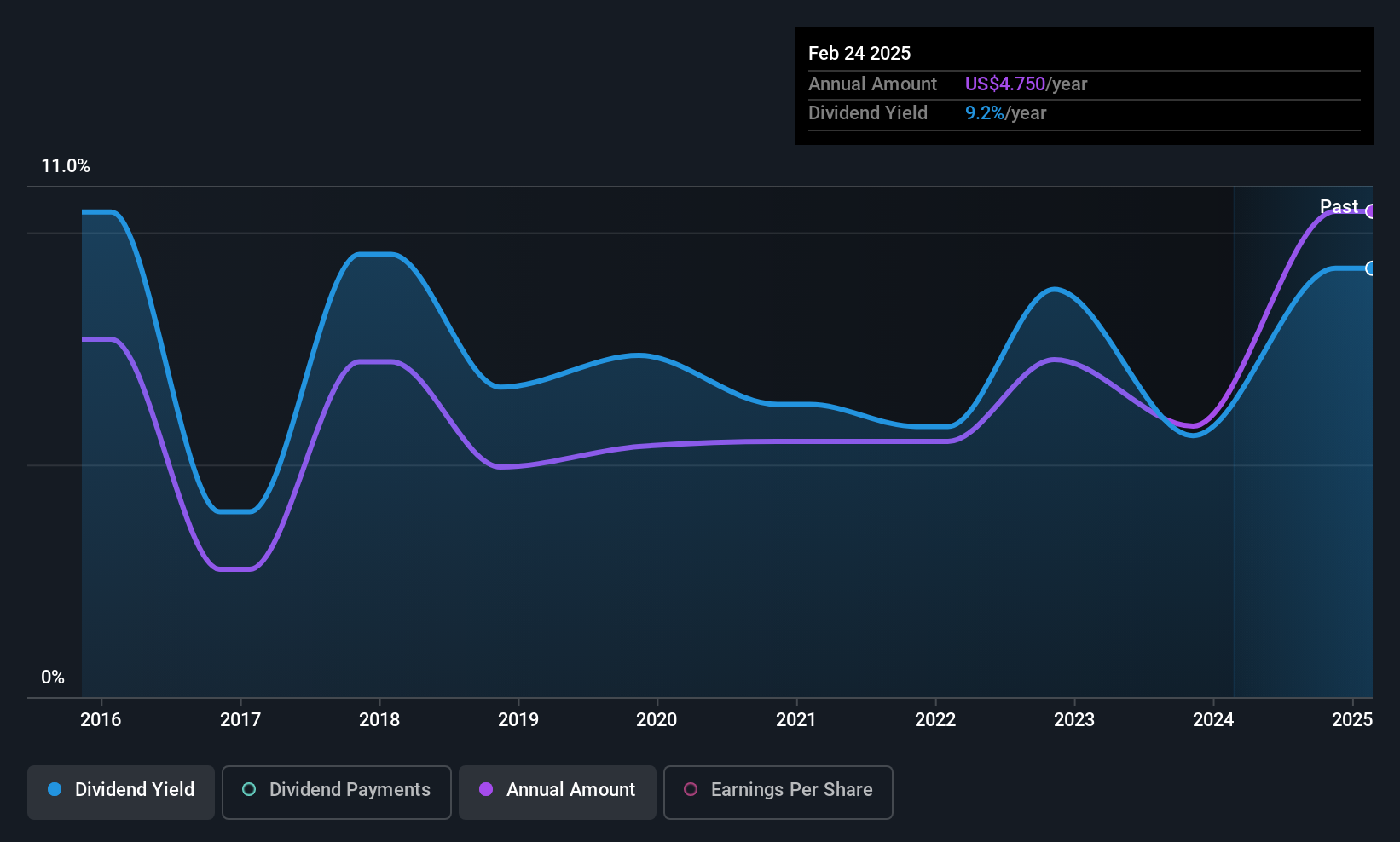

General American Investors Company (GAM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: General American Investors Company, Inc. is a publicly owned investment manager with a market cap of approximately $1.36 billion.

Operations: General American Investors Company, Inc. generates revenue from its Financial Services segment, specifically through Closed End Funds, amounting to $27.65 million.

Dividend Yield: 8.1%

General American Investors Company offers a mixed dividend profile. While its 8.1% yield places it among the top 25% of US dividend payers, the track record is marked by volatility and unreliability over the past decade. The recent announcement includes a $0.45 regular dividend and a significant $5.95 special distribution from capital gains, payable in December 2025. Despite an unstable history, its payout ratio of 58% suggests dividends are currently covered by earnings, though cash flow coverage remains unclear.

- Unlock comprehensive insights into our analysis of General American Investors Company stock in this dividend report.

- In light of our recent valuation report, it seems possible that General American Investors Company is trading behind its estimated value.

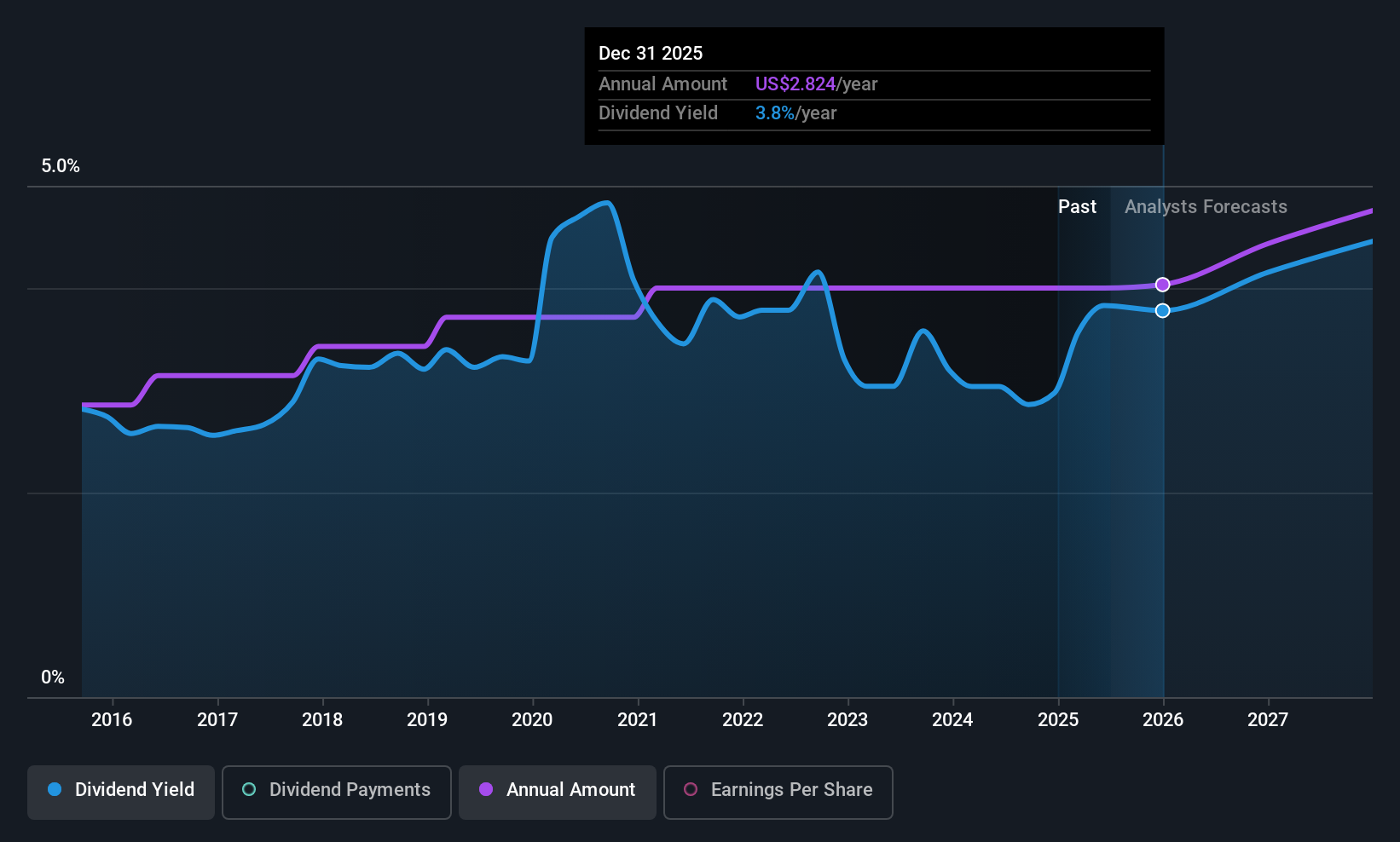

Omnicom Group (OMC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Omnicom Group Inc., along with its subsidiaries, provides advertising, marketing, and corporate communications services and has a market cap of approximately $13.99 billion.

Operations: Omnicom Group Inc. generates $16.07 billion from its advertising, marketing, and corporate communications services industry.

Dividend Yield: 3.9%

Omnicom Group's recent merger with The Interpublic Group and subsequent debt restructuring highlight its strategic efforts to manage financial obligations while maintaining dividend reliability. The company's increased annual dividend of US$3.20 per share, covered by a 41% payout ratio, underscores its commitment to shareholder returns. With stable dividends over the past decade and a cash payout ratio of 32.4%, Omnicom demonstrates strong cash flow coverage despite high debt levels, offering an attractive yield for investors prioritizing income stability.

- Take a closer look at Omnicom Group's potential here in our dividend report.

- The analysis detailed in our Omnicom Group valuation report hints at an deflated share price compared to its estimated value.

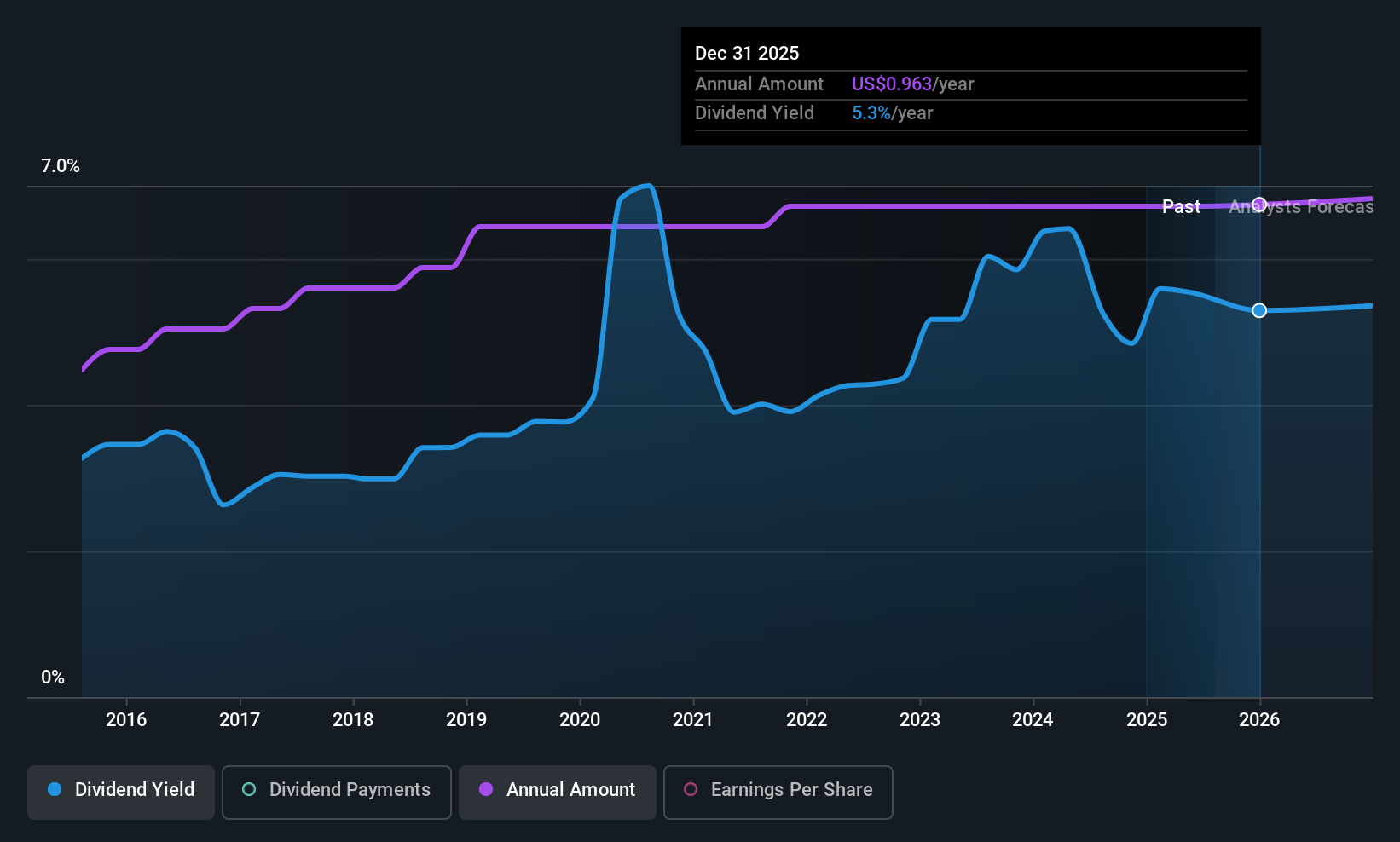

Provident Financial Services (PFS)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Provident Financial Services, Inc. is the bank holding company for Provident Bank, offering a range of banking products and services to individuals, families, and businesses in the United States with a market cap of $2.54 billion.

Operations: Provident Financial Services, Inc. generates revenue primarily through its Traditional Banking and Other Financial Services segment, which amounted to $836.92 million.

Dividend Yield: 4.9%

Provident Financial Services recently declared a quarterly dividend of $0.24 per share, demonstrating consistent shareholder returns with a stable payout history over the past decade. The dividend yield is attractive at 4.93%, placing it among the top 25% in the US market. Despite recent insider selling, dividends remain well-covered by earnings with a payout ratio of 48.8%. The company also reported significant earnings growth, enhancing its capacity for sustained dividend payments.

- Click here to discover the nuances of Provident Financial Services with our detailed analytical dividend report.

- Our valuation report unveils the possibility Provident Financial Services' shares may be trading at a discount.

Taking Advantage

- Dive into all 123 of the Top US Dividend Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GAM

Good value with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026