- United States

- /

- Diversified Financial

- /

- NYSE:ONIT

Is Now The Time To Put Ocwen Financial (NYSE:OCN) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Ocwen Financial (NYSE:OCN). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Ocwen Financial

How Fast Is Ocwen Financial Growing Its Earnings Per Share?

In the last three years Ocwen Financial's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Outstandingly, Ocwen Financial's EPS shot from US$2.00 to US$3.43, over the last year. Year on year growth of 71% is certainly a sight to behold.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Ocwen Financial's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. We note that while EBIT margins have improved from 42% to 44%, the company has actually reported a fall in revenue by 9.2%. While not disastrous, these figures could be better.

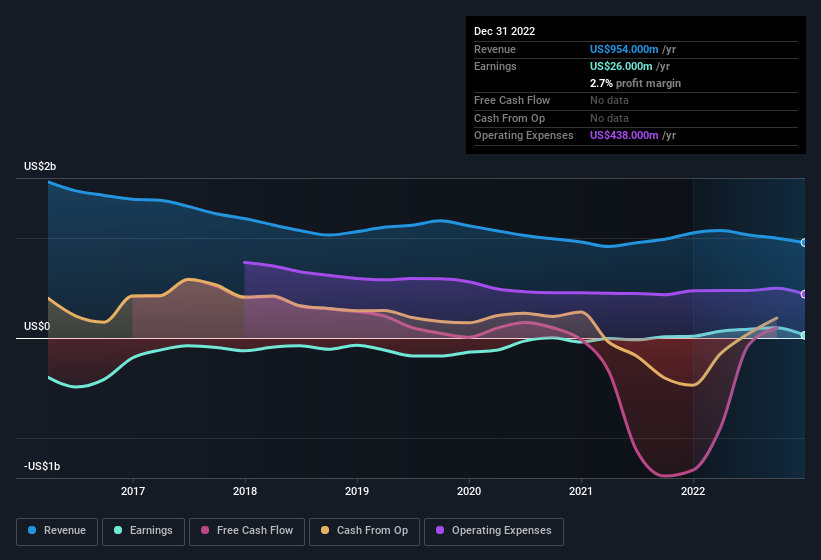

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Ocwen Financial's future EPS 100% free.

Are Ocwen Financial Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news is that Ocwen Financial insiders spent a whopping US$4.0m on stock in just one year, without so much as a single sale. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. It is also worth noting that it was company insider Howard Amster who made the biggest single purchase, worth US$3.8m, paying US$29.03 per share.

Along with the insider buying, another encouraging sign for Ocwen Financial is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$30m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 13% of the company, demonstrating a degree of high-level alignment with shareholders.

Does Ocwen Financial Deserve A Spot On Your Watchlist?

Ocwen Financial's earnings have taken off in quite an impressive fashion. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Ocwen Financial deserves timely attention. Now, you could try to make up your mind on Ocwen Financial by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Ocwen Financial, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ONIT

Onity Group

A financial services company, originates and services forward and reserve mortgage loans in the United States, the United States Virgin Islands, India, and the Philippines.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.