- United States

- /

- Banks

- /

- NYSE:OBK

Will Origin Bancorp's (OBK) Quiet Buyback Approach Reveal a Shift in Capital Strategy?

Reviewed by Sasha Jovanovic

- Origin Bancorp recently announced it will report its third-quarter 2025 results after market close on October 22, 2025, following a quarter where it missed revenue expectations but surpassed earnings-per-share estimates.

- Despite launching a new buyback in July 2025, no shares were repurchased under that program, while 265,248 shares were bought earlier under a previous authorization, indicating limited recent capital return activity.

- With anticipation building around the upcoming earnings report and faint share buyback activity, we’ll explore how these factors influence Origin Bancorp’s investment case.

Find companies with promising cash flow potential yet trading below their fair value.

Origin Bancorp Investment Narrative Recap

To be a shareholder in Origin Bancorp, you need to believe in the company's ability to leverage regional economic growth and digital investments while managing sector-specific pressures. The recent absence of buyback activity under its new share repurchase program does not materially shift the most important short-term catalyst, the outcome of the upcoming earnings release, yet underscores capital allocation discipline as a near-term focus. The most immediate risk remains Origin’s reliance on geographically concentrated markets, which could impact earnings if regional headwinds intensify.

Of the recent announcements, Origin Bancorp’s call for its third-quarter earnings stands out, especially since last quarter’s results saw a revenue miss but an EPS beat. This coming earnings report will likely be viewed as a key checkpoint, particularly since it follows both muted buyback activity and ongoing questions about the strength of loan growth and deposit trends in its core markets.

By contrast, investors should also be aware of ongoing pressures on deposit levels and loan growth projections that could limit...

Read the full narrative on Origin Bancorp (it's free!)

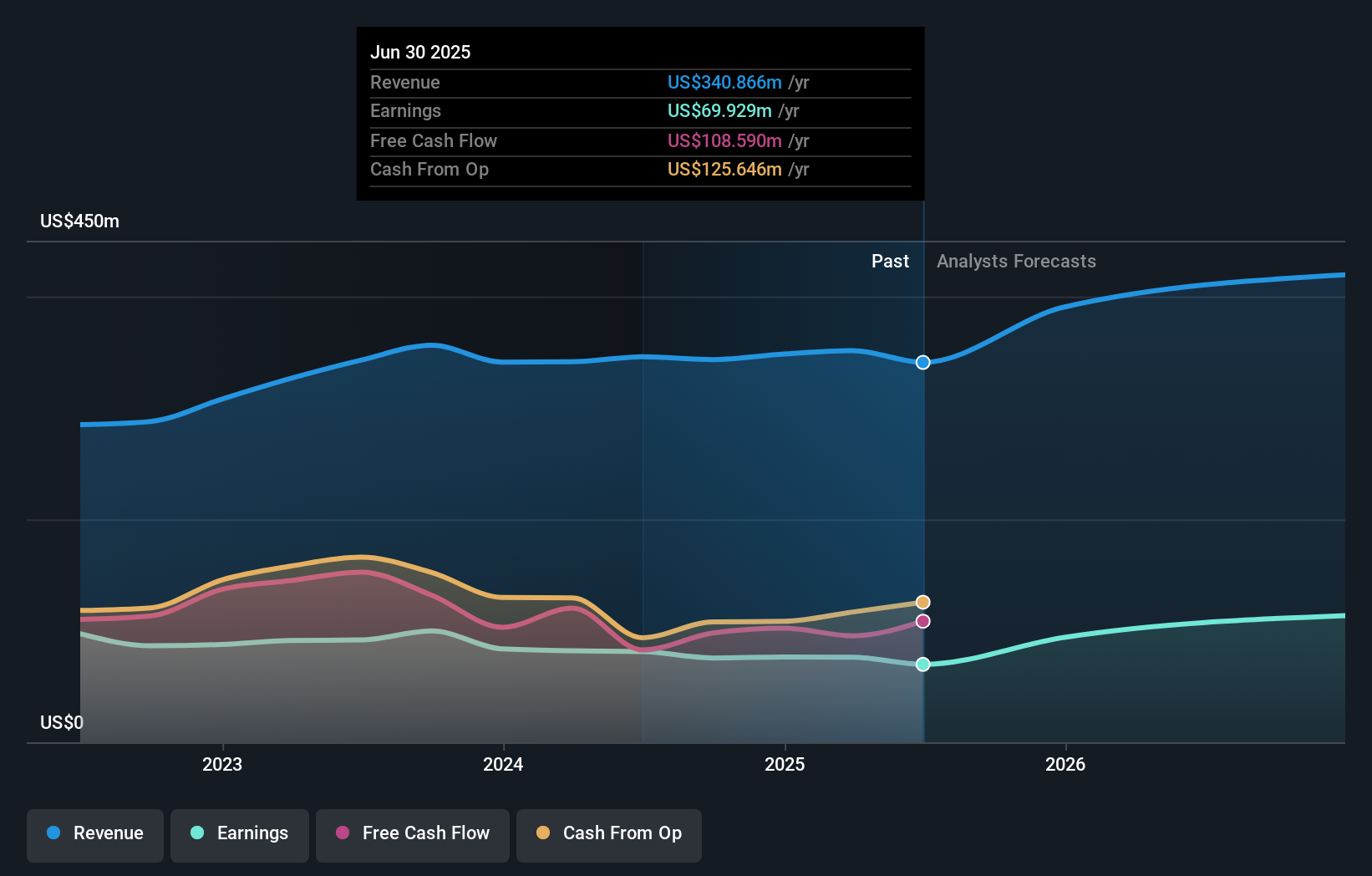

Origin Bancorp's narrative projects $514.9 million in revenue and $175.5 million in earnings by 2028. This requires 14.7% yearly revenue growth and a $105.6 million earnings increase from current earnings of $69.9 million.

Uncover how Origin Bancorp's forecasts yield a $44.00 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community contributors provided 1 fair value estimate, all pinpointing US$59.44, far above recent prices. Meanwhile, slowing deposit and loan trends remain front of mind as you compare these views.

Explore another fair value estimate on Origin Bancorp - why the stock might be worth just $59.44!

Build Your Own Origin Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Origin Bancorp research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Origin Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Origin Bancorp's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OBK

Origin Bancorp

Operates as a bank holding company for Origin Bank that provides banking and financial services to small and medium-sized businesses, municipalities, and retail clients in Texas, Louisiana, and Mississippi.

Flawless balance sheet and fair value.

Market Insights

Community Narratives