- United States

- /

- Banks

- /

- NYSE:OBK

Origin Bancorp (OBK): Assessing Valuation Following Regional Bank Loan Quality Concerns

Reviewed by Kshitija Bhandaru

Origin Bancorp (OBK) saw its share price move after fresh concerns emerged across regional banks, as loan quality issues were disclosed by Zions Bancorp and Western Alliance Bancorp. Investors are keeping a close eye on sector-wide credit risks.

See our latest analysis for Origin Bancorp.

It has been a choppy ride for Origin Bancorp, with investor sentiment swaying on shifting sector risks. This past month alone, the share price fell 8.1% before landing at $32.84, and yet its total return over the last year stands at a positive 6.2%. Over the longer term, the company still boasts a remarkable 47.8% total return for shareholders over five years, even as the latest headlines keep volatility in focus.

If sector stress or shifting financial trends have you scanning the horizon for new opportunities, now's a great moment to broaden your search and discover fast growing stocks with high insider ownership

Given Origin Bancorp's solid long-term returns and recent dip, the question now is whether investors are looking at an undervalued stock with room to run, or if the market has already factored in all future growth.

Most Popular Narrative: 25% Undervalued

At a recent close of $32.84, the most watched narrative sees Origin Bancorp as potentially worth $44 per share, setting up a significant upside if the forecasts prove accurate. This valuation hinges on transformative business moves and major efficiency plays.

Targeted investments in digital banking platforms, automation, and data management, including strategic projects leveraging robotics and AI, are set to improve operational efficiency, enhance customer acquisition, and reduce expenses, all of which may contribute to higher net margins over time.

Want to know which bold assumptions are powering this optimistic price? One surprising swing factor is the scale and speed of digital transformation underway. Can this strategy deliver the kind of profit and efficiency jump analysts are betting on? There is more to the math than meets the eye. Explore the full story for the key numbers and scenarios behind this high-stakes forecast.

Result: Fair Value of $44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent deposit declines and heightened commercial real estate exposure could challenge Origin Bancorp's margin expansion and earnings forecasts if market headwinds intensify.

Find out about the key risks to this Origin Bancorp narrative.

Another View: What Do Multiples Say?

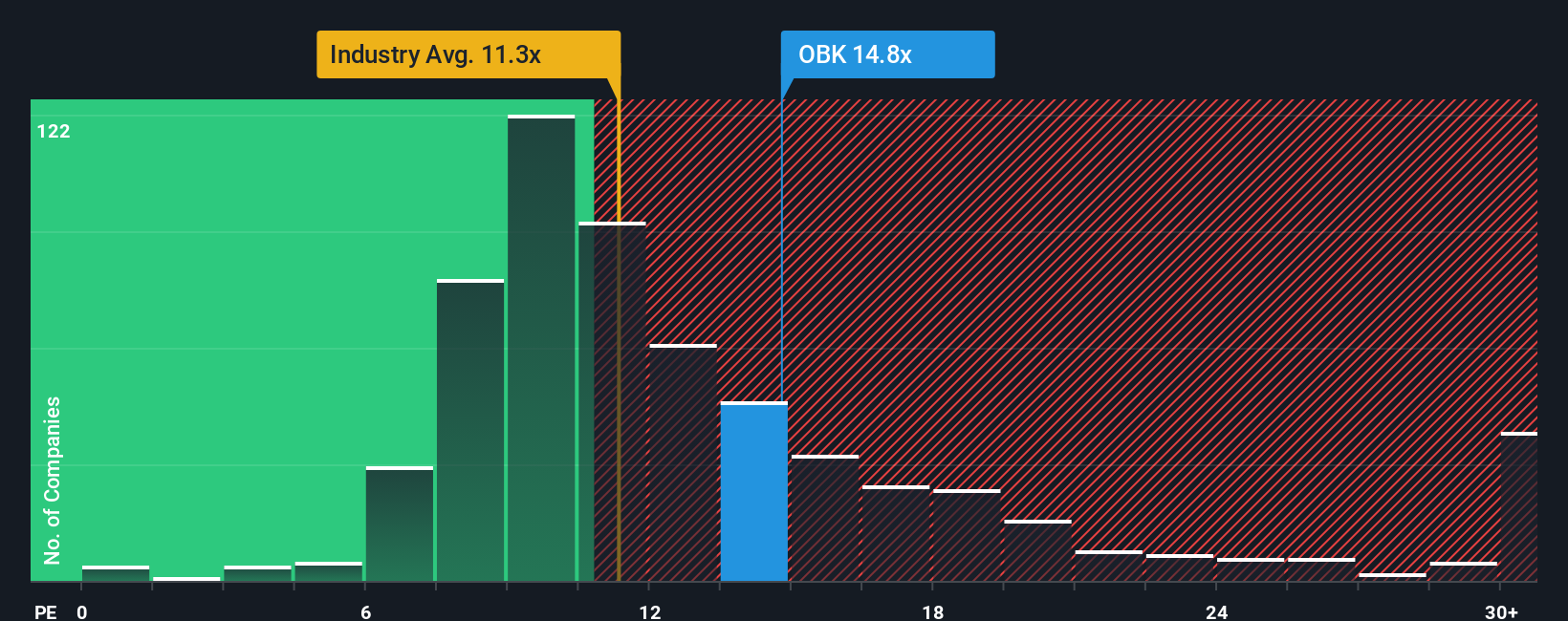

Looking at the company through the lens of the price-to-earnings ratio, Origin Bancorp trades at 14.7x, which is above both the US Banks industry average of 11.2x and its peers at 10.2x. It is also slightly higher than its fair ratio of 14x. In practical terms, this could mean the stock is carrying a valuation premium, so investors should ask: is the market too optimistic, or is there hidden growth others are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Origin Bancorp Narrative

If the current narrative does not align with your perspective or you would rather rely on your own insights, you can dive into the data yourself and shape your own in just a few minutes. Do it your way

A great starting point for your Origin Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit your search to a single opportunity when a world of top stocks is at your fingertips. Let Simply Wall Street's screener help power your smartest moves.

- Unlock rapid portfolio growth by evaluating these 868 undervalued stocks based on cash flows with proven potential based on strong cash flow fundamentals and favorable long-term signals.

- Tap into today's biggest tech breakthroughs by reviewing these 24 AI penny stocks shaping smarter industries and accelerating tomorrow's solutions.

- Boost your investment income by targeting these 18 dividend stocks with yields > 3% offering yields over 3 percent and resilience through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OBK

Origin Bancorp

Operates as a bank holding company for Origin Bank that provides banking and financial services to small and medium-sized businesses, municipalities, and retail clients in Texas, Louisiana, and Mississippi.

Flawless balance sheet and fair value.

Market Insights

Community Narratives