- United States

- /

- Banks

- /

- NYSE:NU

The Bull Case For Nu Holdings (NU) Could Change Following U.S. Bank Charter Application and Board Overhaul

Reviewed by Sasha Jovanovic

- Earlier this month, Nu Holdings announced that it has applied for a national bank charter with the U.S. Office of the Comptroller of the Currency and unveiled a new Board of Directors with prominent U.S. and Latin American financial leaders.

- This bold move marks an ambitious step toward global expansion, underscoring Nu’s intention to leverage its digital banking model beyond Latin America.

- We’ll look at how Nu’s pursuit of a U.S. bank charter may influence its investment case and international growth prospects.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Nu Holdings Investment Narrative Recap

To own shares of Nu Holdings, I need to believe in the digitization of financial services across Latin America and Nu’s ability to export this playbook internationally. The recent announcement of applying for a U.S. national bank charter puts Nu’s global ambitions in the spotlight but does not materially alter the importance of credit quality as the most immediate catalyst, or the regulatory environment as the key risk to watch.

Of the recent developments, the formation of a U.S. Board featuring experienced leaders such as Roberto Campos Neto and Brian Brooks stands out. This move is closely tied to Nu’s regulatory drive in the U.S. and should strengthen governance as Nu seeks to scale new banking products, though shifting rules and heightened scrutiny still pose a significant risk to any expansion plans.

Yet, despite Nu’s expansion moves and robust customer base, heightened regulatory uncertainty in new markets is a factor investors should be acutely aware of...

Read the full narrative on Nu Holdings (it's free!)

Nu Holdings' outlook anticipates $33.0 billion in revenue and $6.1 billion in earnings by 2028. This scenario is based on a projected 78.1% annual revenue growth rate and a $3.8 billion increase in earnings from the current $2.3 billion.

Uncover how Nu Holdings' forecasts yield a $16.99 fair value, a 14% upside to its current price.

Exploring Other Perspectives

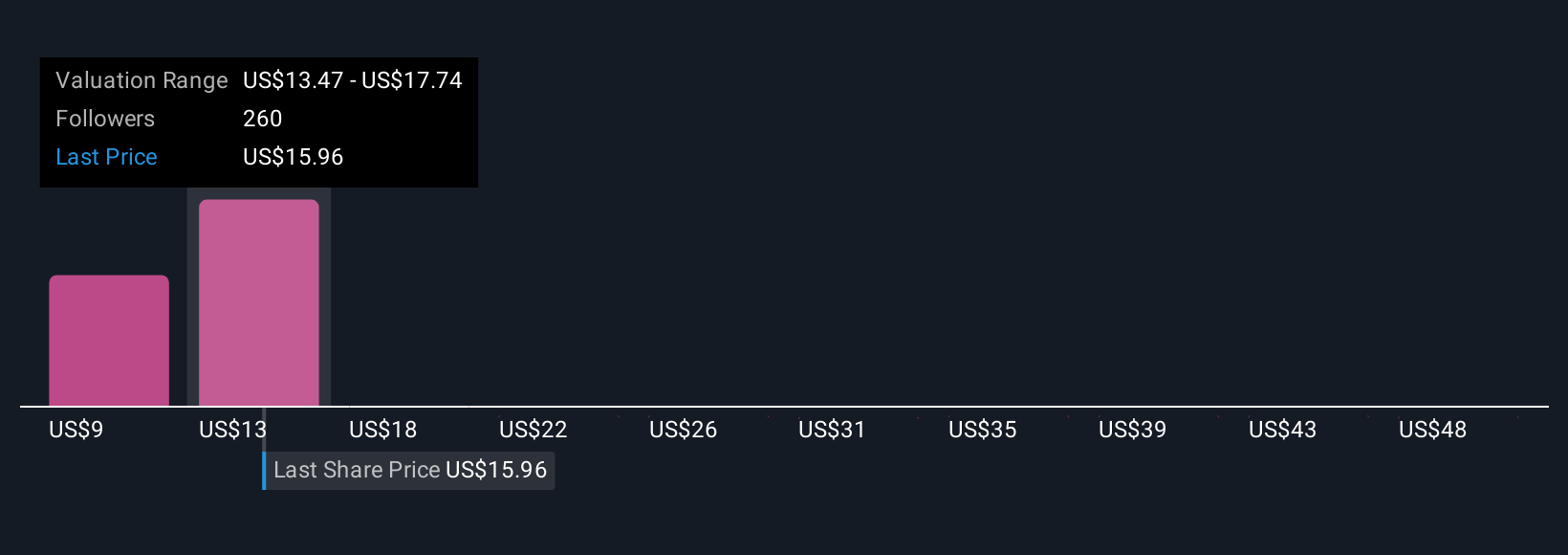

Simply Wall St Community members submitted 46 distinct fair value estimates for Nu Holdings, ranging from US$9.30 to US$59.35 per share. While optimism for long-term revenue growth is common, regulatory risk in the U.S. could impact these projections, so explore several viewpoints before deciding.

Explore 46 other fair value estimates on Nu Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Nu Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nu Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nu Holdings' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives