- United States

- /

- Banks

- /

- NYSE:NU

How Recent Nu Holdings Earnings Surprised the Market and What It Means for the Stock

Reviewed by Bailey Pemberton

Thinking about what to do with your Nu Holdings stock? You’re not alone. Whether you’re holding after its meteoric rise, eyeing fresh gains, or weighing up recent pullbacks, it pays to step back and look at the bigger picture. Over the last three years, Nu Holdings has delivered an incredible 238.9% return, far outpacing many well-known financial names and turning plenty of heads along the way. Year-to-date performance is firmly in the green at 40.3%, even though the past 30 days have seen a dip of 5.0%, and the last week alone finished down 1.5%. Those recent declines can look a bit unnerving, but it is not uncommon for high-growth stocks to take breathers as investors digest market shifts and changing risk appetites, especially in fast-evolving financial landscapes like fintech.

What about the company’s valuation? Right now, Nu Holdings scores a 0 out of 6 for traditional undervaluation checks, a result that may surprise investors who have watched its price rally on growing market confidence. That number signals that, by most conventional yardsticks, Nu is not considered undervalued at today’s price of $14.91. But valuation is a nuanced game. Next, we’ll dive into the methods used to judge whether shares are priced right. In addition, by the end of this article, a smarter way to think about valuation that many investors miss will be shared.

Nu Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Nu Holdings Excess Returns Analysis

The Excess Returns model evaluates a company's ability to generate returns above its cost of equity by focusing on how efficiently each dollar of shareholder capital is used. For Nu Holdings, this means analyzing not just profits, but also the value created beyond baseline investor expectations.

According to the model, Nu's current book value sits at $1.98 per share, with a projected stable book value of $3.03 per share, as estimated by six analysts. The company’s stable Earnings Per Share (EPS) is expected to be $0.91, based on consensus forecasts from 10 analysts. Notably, Nu’s cost of equity is $0.36 per share, but its excess return, essentially profit above that hurdle, is $0.55 per share. The firm is also posting an impressive average return on equity of 30.02%, signaling strong ongoing profitability fueled by reinvested earnings.

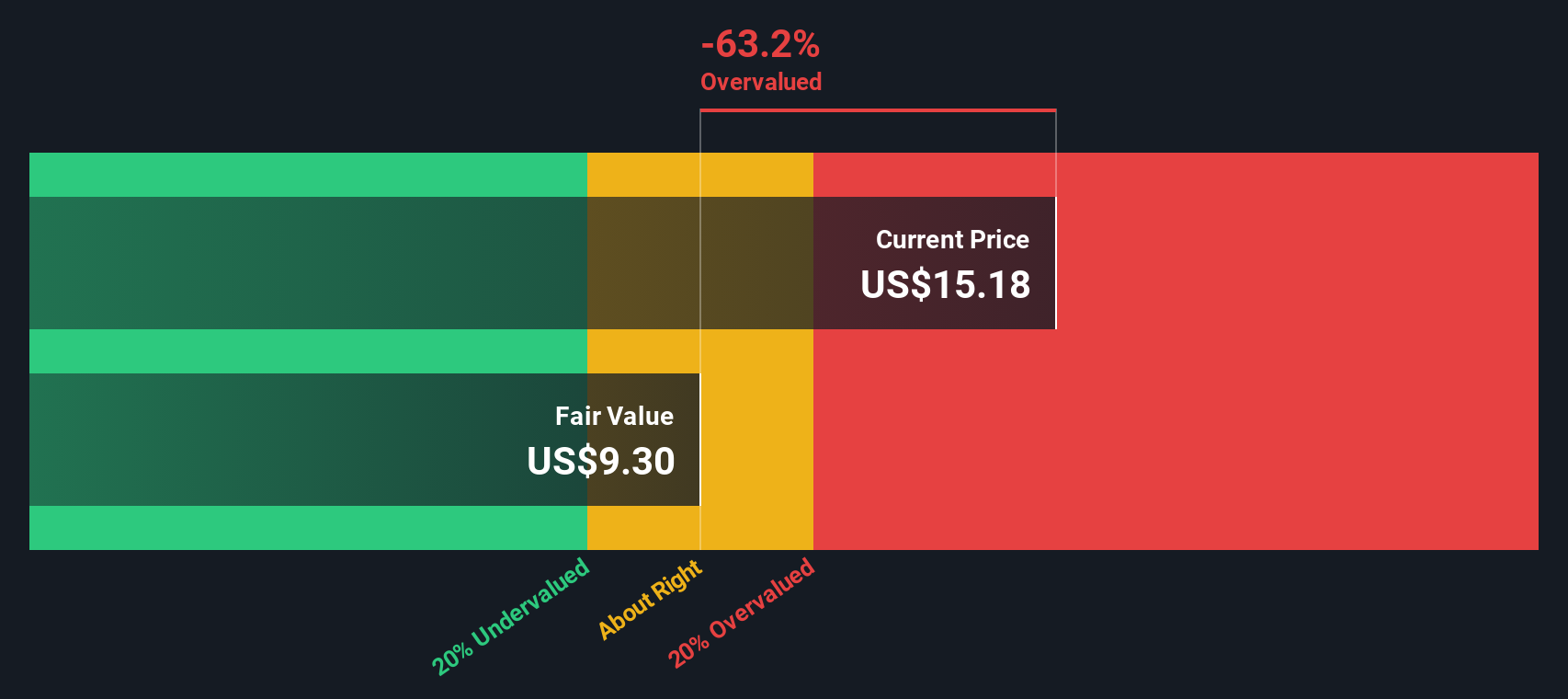

The Excess Returns analysis estimates an intrinsic value that is significantly below Nu's current market price of $14.91. Specifically, the implied discount shows the shares are trading at a 60.3% premium to their modeled worth. This suggests the stock is markedly overvalued according to this method.

Result: OVERVALUED

Our Excess Returns analysis suggests Nu Holdings may be overvalued by 60.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Nu Holdings Price vs Earnings

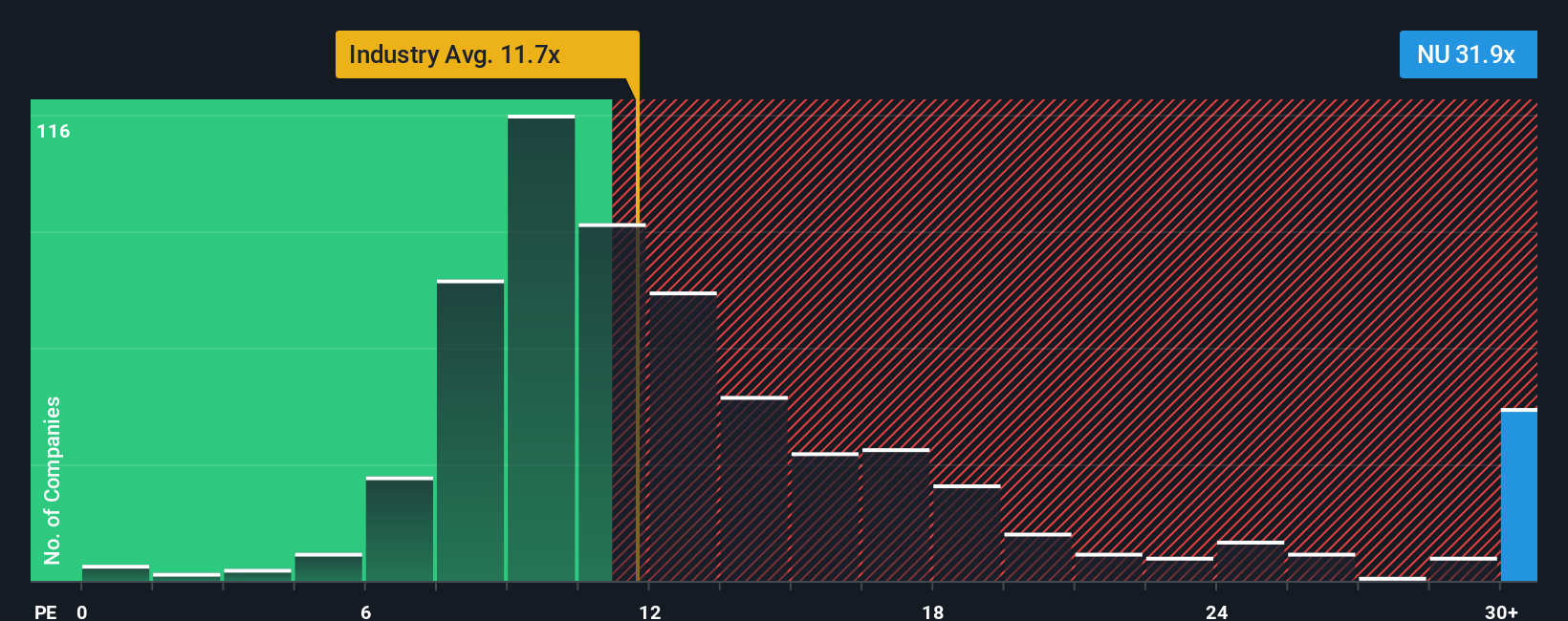

The Price-to-Earnings (PE) ratio is often the go-to valuation metric for profitable companies like Nu Holdings because it tells investors how much they are paying for each dollar of earnings. It is especially relevant in Nu’s case, since strong earnings growth has made profitability a key part of the story.

What is considered a “normal” PE ratio can vary widely, depending on how quickly a company is expected to grow, the risks it faces, and even shifts in market sentiment. High-growth businesses often justify a higher PE ratio, while more mature or riskier companies typically trade at a discount.

Currently, Nu Holdings trades at a PE ratio of 31.33x. That is well above the industry average of 11.71x and the peer average of 12.03x, reflecting the company’s impressive trajectory but also a premium price tag. Simply Wall St’s proprietary Fair Ratio, calculated using a blend of Nu’s earnings growth, profit margins, market cap, risk profile, and industry context, comes in at 22.65x. This fair value estimate gives a more accurate, company-specific benchmark than simply comparing raw PE ratios, as it integrates all the key ingredients that matter most for long-term investors.

With Nu’s PE ratio sitting significantly above its Fair Ratio, the numbers suggest the shares are currently overvalued when accounting for growth, profitability, and risk.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nu Holdings Narrative

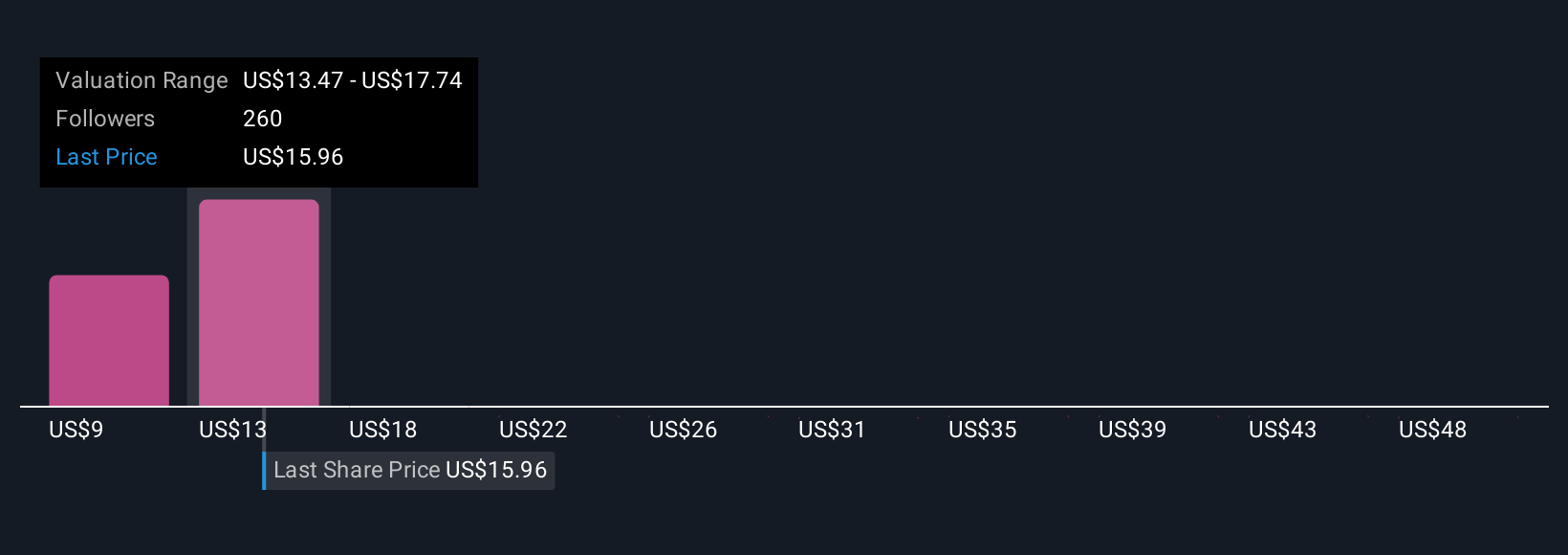

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative goes beyond just the numbers: it’s the story you believe about a company’s future, made transparent by outlining your assumptions for Nu’s revenue, margins, and fair value, all in one place. Narratives connect the “why” (your outlook and reasoning) with the “how much” (your forecasts), then link this story to a fair value, making it easy to see if the current share price matches your expectations.

Simply Wall St’s Community page offers Narratives as a powerful, easy-to-use tool, trusted by millions of investors, which helps you cut through the noise and see whether it's time to buy, sell, or hold based on your own perspective. Because Narratives update dynamically as new facts, news, and earnings arrive, they keep your thesis relevant as the business evolves. Your investment decision-making stays one step ahead.

For example, with Nu Holdings, a bullish Narrative might expect digital adoption to accelerate, driving estimated fair value up toward $20 per share. A bearish Narrative might worry about competition and see fair value closer to $14, showing how different stories lead to different decisions.

Do you think there's more to the story for Nu Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives