- United States

- /

- Banks

- /

- NYSE:NPB

3 Stocks Estimated To Be Trading Below Fair Value By Up To 48.5%

Reviewed by Simply Wall St

As U.S. markets navigate the latest labor market data and anticipate potential Federal Reserve interest rate cuts, investors are keenly observing how these developments might influence stock valuations. In this environment, identifying stocks that are trading below their fair value can present opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $6.72 | $13.27 | 49.4% |

| Peapack-Gladstone Financial (PGC) | $28.76 | $56.54 | 49.1% |

| Northwest Bancshares (NWBI) | $12.59 | $24.41 | 48.4% |

| Niagen Bioscience (NAGE) | $9.67 | $18.90 | 48.8% |

| Metropolitan Bank Holding (MCB) | $78.49 | $150.26 | 47.8% |

| Investar Holding (ISTR) | $23.095 | $45.79 | 49.6% |

| Granite Ridge Resources (GRNT) | $5.29 | $10.23 | 48.3% |

| Fiverr International (FVRR) | $23.40 | $45.47 | 48.5% |

| First Commonwealth Financial (FCF) | $17.68 | $32.97 | 46.4% |

| First Busey (BUSE) | $24.42 | $45.41 | 46.2% |

We'll examine a selection from our screener results.

Capital Southwest (CSWC)

Overview: Capital Southwest Corporation is a business development company that focuses on credit, private equity, and venture capital investments in middle market companies across various stages and strategies, with a market cap of approximately $1.27 billion.

Operations: The company's revenue primarily comes from its investment segment, totaling $209.03 million.

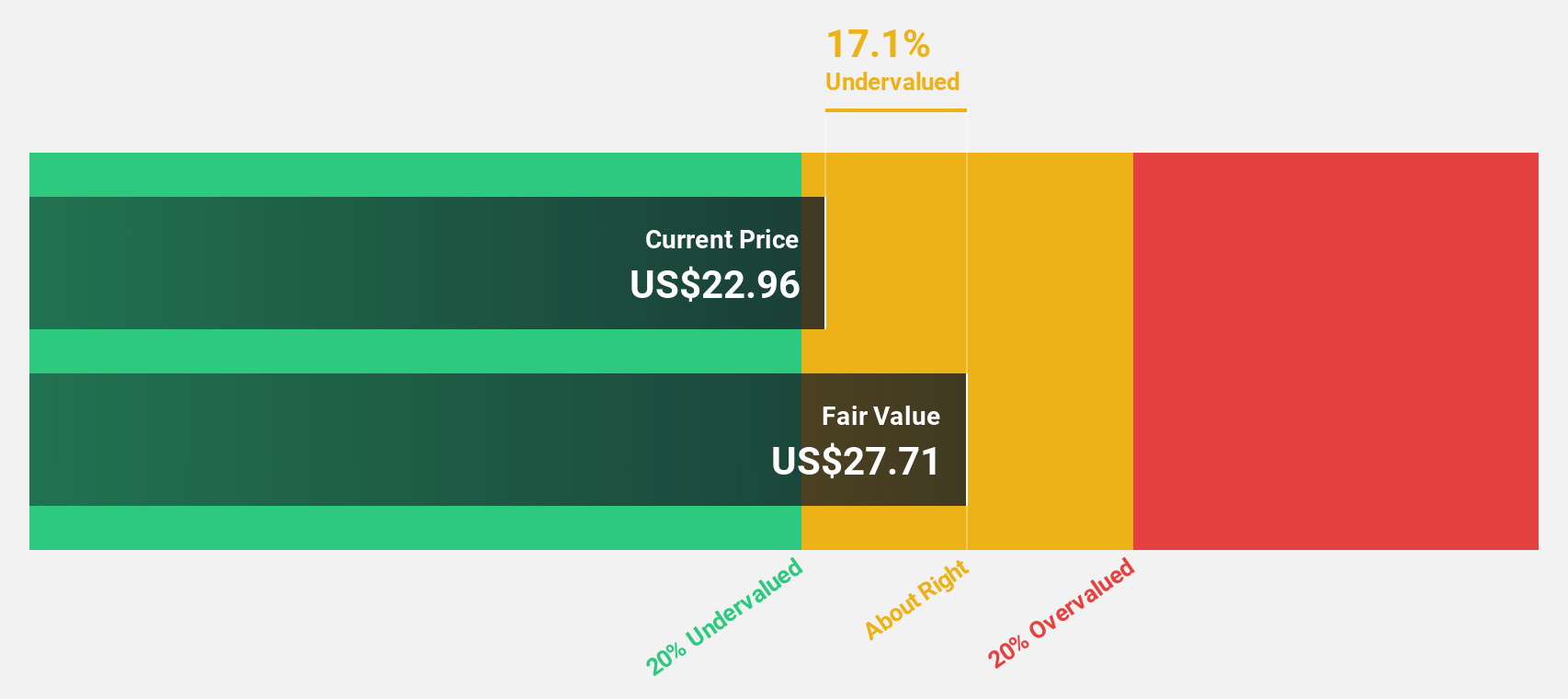

Estimated Discount To Fair Value: 18.8%

Capital Southwest Corporation is trading at US$22.84, approximately 18.8% below its estimated fair value of US$28.12, indicating potential undervaluation based on cash flows despite not being significantly below fair value. The company reported strong earnings growth with net income rising to US$27 million in the recent quarter from US$14.04 million a year ago. However, its dividend sustainability is questionable as it's not well covered by earnings or free cash flows, and debt coverage by operating cash flow remains inadequate.

- Upon reviewing our latest growth report, Capital Southwest's projected financial performance appears quite optimistic.

- Dive into the specifics of Capital Southwest here with our thorough financial health report.

Fiverr International (FVRR)

Overview: Fiverr International Ltd. operates a global online marketplace and has a market cap of approximately $853.52 million.

Operations: The company generates revenue of $419.13 million from its Internet Software & Services segment.

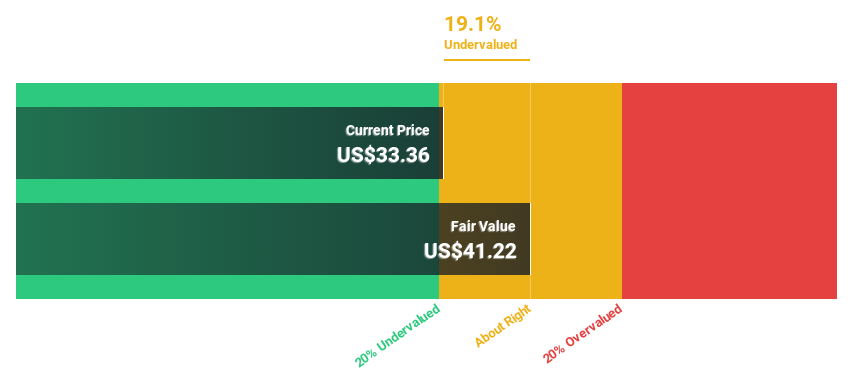

Estimated Discount To Fair Value: 48.5%

Fiverr International, trading at US$23.40, appears undervalued with a fair value estimate of US$45.47, reflecting a significant discount based on cash flows. Despite slower expected revenue growth of 8.2% annually compared to the market's 9.3%, its earnings are forecast to grow significantly at 42.8% per year, outpacing the broader market's 15.1%. Recent initiatives highlight Fiverr's innovative use of AI in creative production, potentially enhancing future cash flow generation and operational efficiency.

- The growth report we've compiled suggests that Fiverr International's future prospects could be on the up.

- Get an in-depth perspective on Fiverr International's balance sheet by reading our health report here.

Northpointe Bancshares (NPB)

Overview: Northpointe Bancshares, Inc. is the bank holding company for Northpointe Bank, offering a range of banking products and services in the United States, with a market cap of $618.56 million.

Operations: The company generates revenue through its Retail Banking segment, which accounts for $155.47 million, and its Mortgage Warehouse (MPP) segment, contributing $52.95 million.

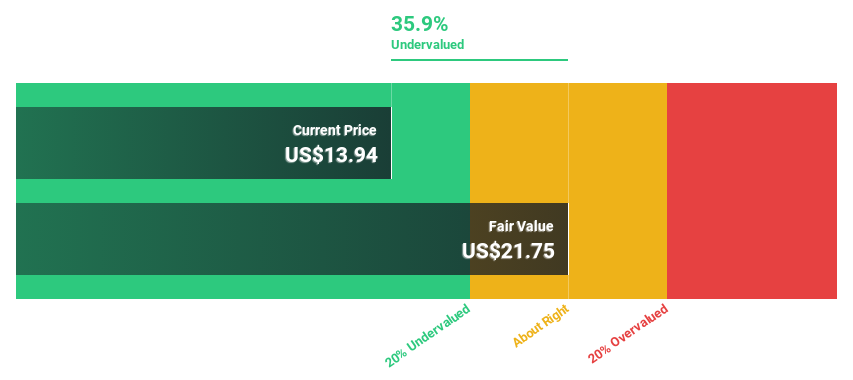

Estimated Discount To Fair Value: 34.1%

Northpointe Bancshares, trading at US$18.08, is undervalued with a fair value estimate of US$27.44, indicating a substantial discount based on cash flows. Its earnings grew by 78.7% over the past year and are forecast to rise significantly at 22.47% annually, surpassing the market's growth rate of 15.1%. Recent board appointments bring extensive industry expertise that may support strategic growth initiatives and operational improvements in the future.

- Our expertly prepared growth report on Northpointe Bancshares implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Northpointe Bancshares with our comprehensive financial health report here.

Next Steps

- Explore the 200 names from our Undervalued US Stocks Based On Cash Flows screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northpointe Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NPB

Northpointe Bancshares

Operates as the bank holding company for Northpointe Bank provides various banking products and services in the United States.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives