- United States

- /

- Banks

- /

- NYSE:MTB

The Bull Case For M&T Bank (MTB) Could Change Following Net Income Gains and Leadership Changes - Learn Why

Reviewed by Simply Wall St

- M&T Bank recently reported higher net income and completed a significant tranche of share repurchases, while also announcing leadership changes with Tracy S. Woodrow appointed as Regional President for Western New York.

- Decreased net charge-offs and the scale of the share buyback program highlight efforts to support both financial stability and shareholder value.

- With robust net income growth and expanded share repurchases, we'll examine how these financial developments shape M&T Bank's investment narrative.

M&T Bank Investment Narrative Recap

To be a shareholder in M&T Bank, you need confidence in the company’s ability to maintain strong capital and liquidity while pursuing disciplined growth and robust shareholder returns. The latest leadership appointment and improved net income support this investment narrative; however, neither appear to materially change the leading short-term catalyst of capital management or the principal risk of deposit outflows raising funding costs.

The announcement of over US$1.1 billion in share repurchases this quarter stands out, reinforcing capital return as a pivotal factor for M&T Bank. These buybacks directly relate to the ongoing priority of earnings per share growth, while also reflecting financial flexibility amid sector competition and evolving regulatory expectations.

Yet, in contrast to these positive signals, investors should not overlook the risk that shifting deposit balances could ...

Read the full narrative on M&T Bank (it's free!)

M&T Bank's narrative projects $10.2 billion revenue and $2.9 billion earnings by 2028. This requires 5.1% yearly revenue growth and a $0.4 billion earnings increase from $2.5 billion currently.

Uncover how M&T Bank's forecasts yield a $193.12 fair value, in line with its current price.

Exploring Other Perspectives

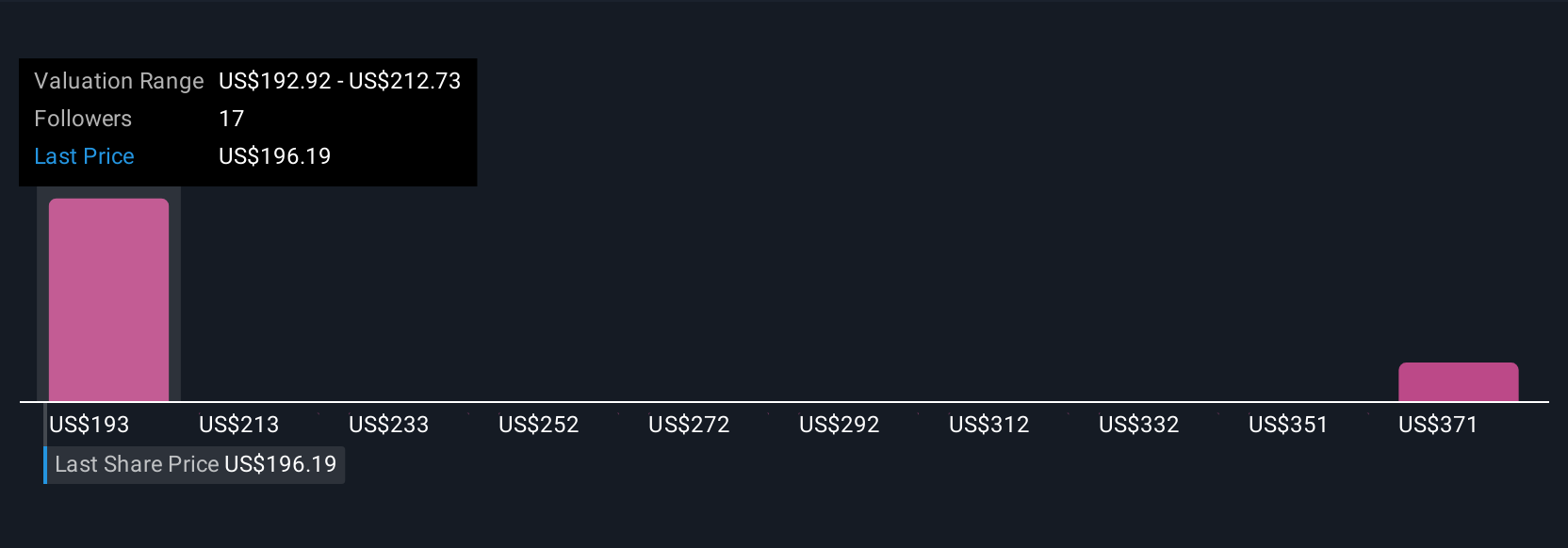

Four individual fair value estimates from the Simply Wall St Community for M&T Bank range from US$192.92 to US$391.04. With varied views on what the company is worth, keep in mind that future deposit trends remain a key uncertainty for performance and returns.

Explore 4 other fair value estimates on M&T Bank - why the stock might be worth just $192.92!

Build Your Own M&T Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your M&T Bank research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free M&T Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate M&T Bank's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTB

M&T Bank

Operates as a bank holding company for Manufacturers and Traders Trust Company and Wilmington Trust, National Association that provides retail and commercial banking products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives