- United States

- /

- Banks

- /

- NYSE:MTB

Assessing M&T Bank’s Value After Recent Share Price Drop and Banking Sector Uncertainty

Reviewed by Bailey Pemberton

Trying to decide what to do with M&T Bank stock? You are not alone. Investors have seen M&T’s share price pull back over the past month and quarter, down 7.1% in the last week and 8.7% in the last 30 days. Even with those recent drops, M&T Bank is still up 112.0% over the past five years, showing just how much long-term potential this regional bank has delivered. The mild year-to-date dip of 4.2% makes it clear the market is pausing for breath despite resilient one-year returns of 0.4%.

Much of this movement has tracked the wider financial sector’s jitteriness, as markets digest changing rate expectations and shifting risk appetites. Still, it is the fundamentals and valuation picture that ultimately matter for most long-term shareholders. That is where things get interesting for M&T Bank. Looking at our latest valuation assessments, M&T earns a score of 6 out of 6, meaning it is viewed as undervalued across every key metric we test.

This raises a compelling question: what exactly is going on under the hood with M&T’s valuation? In the next section, we will walk through each valuation approach, and later, I will share the most meaningful perspective on whether this stock really has room to run.

Why M&T Bank is lagging behind its peers

Approach 1: M&T Bank Excess Returns Analysis

The Excess Returns valuation model evaluates a company by examining how much profit it generates above its cost of capital. In other words, it looks at whether M&T Bank is putting its shareholders’ money to work efficiently, earning excess returns over what would be expected for the risk taken.

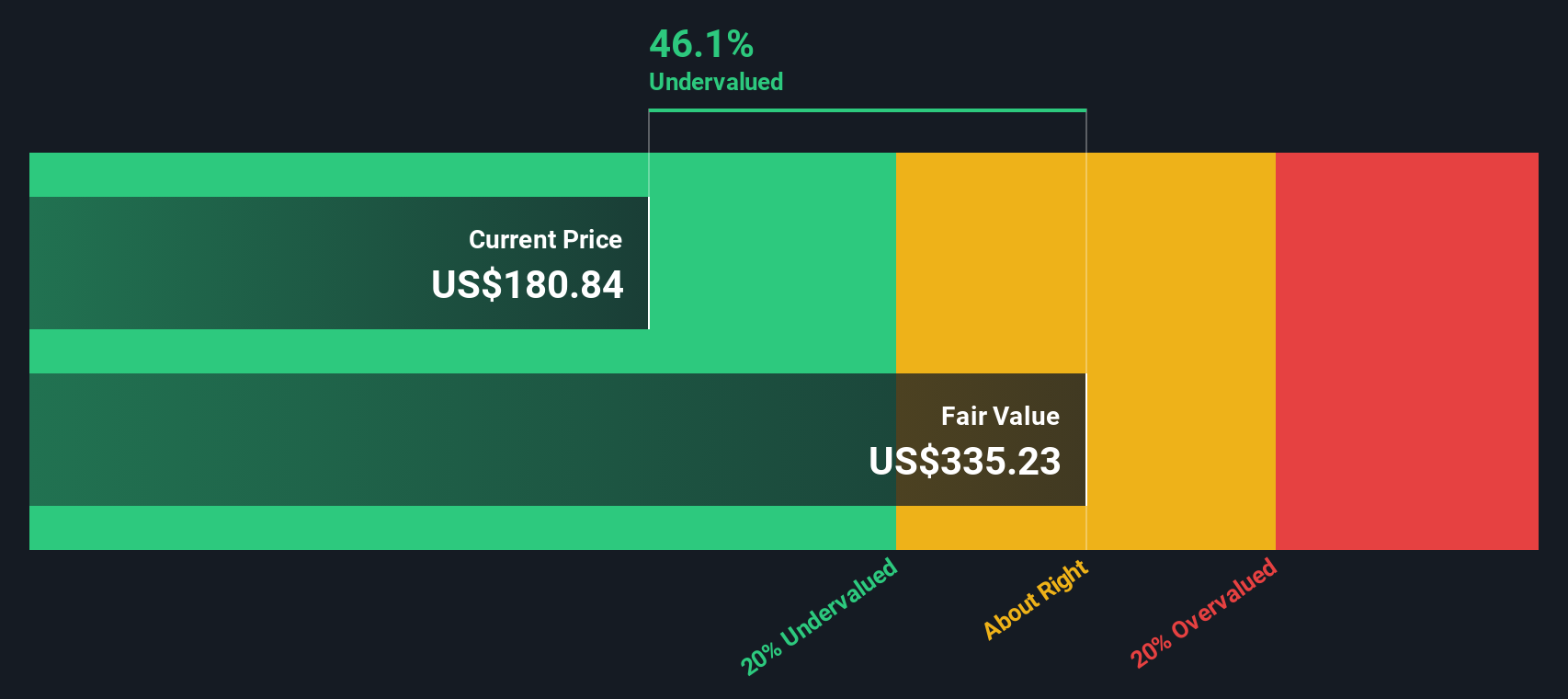

For M&T Bank, the key metrics are strong. The current Book Value stands at $166.95 per share, and analysts estimate a Stable EPS of $18.42 per share based on projected future returns on equity. The average Return on Equity is 10.4%, while the Cost of Equity is $12.30 per share, resulting in an Excess Return of $6.11 per share. Additionally, the Stable Book Value is projected to reach $177.10 per share, according to future estimates.

This model’s findings translate into a compelling estimated intrinsic value that is 46.1% higher than the current share price. In simple terms, the stock is viewed as substantially undervalued by this method. This reflects both M&T Bank’s efficient use of shareholder capital and its robust underlying fundamentals.

Result: UNDERVALUED

Our Excess Returns analysis suggests M&T Bank is undervalued by 46.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: M&T Bank Price vs Earnings

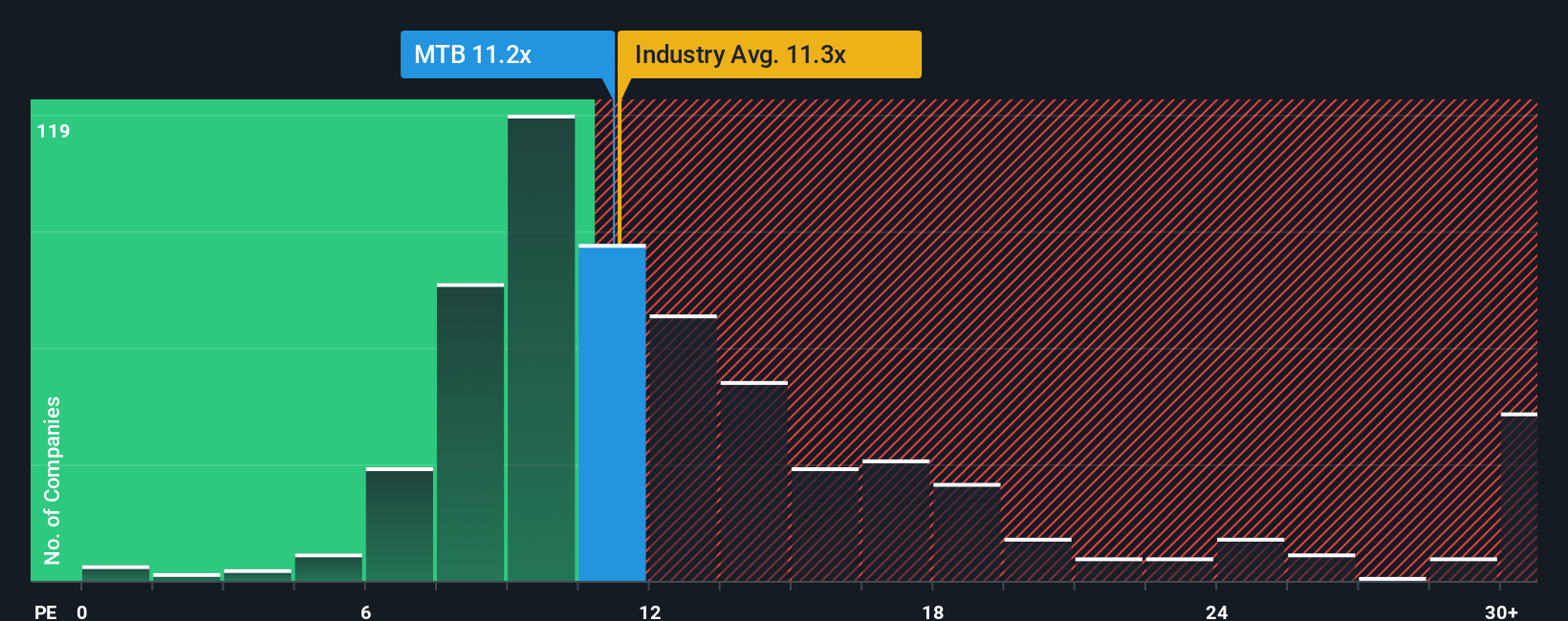

For well-established and profitable companies like M&T Bank, the Price-to-Earnings (PE) ratio is a staple valuation measure. It captures how much investors are willing to pay for each dollar of earnings, making it a sensible yardstick when earnings are steady and the business model is resilient.

Interpreting the PE ratio, however, is not just about comparing numbers. Normal or fair PE ratios can shift meaningfully depending on how quickly a company is expected to grow and how much risk is present. Rapid growers and lower-risk firms generally warrant higher PE ratios, while slower growers or riskier businesses tend to trade at lower multiples.

Right now, M&T Bank trades at a PE of 11.1x, just below the banking industry average of 11.3x and the peer group average of 12.2x. Instead of relying solely on industry or peer comparisons, we turn to Simply Wall St’s proprietary Fair Ratio. This metric is more comprehensive, factoring in M&T’s growth prospects, profit margins, size, industry trends, and risk profile. For M&T, the Fair Ratio comes in at 13.0x, significantly above both its current PE and the industry norm. Because M&T’s PE is meaningfully below its Fair Ratio, this points to the stock being undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your M&T Bank Narrative

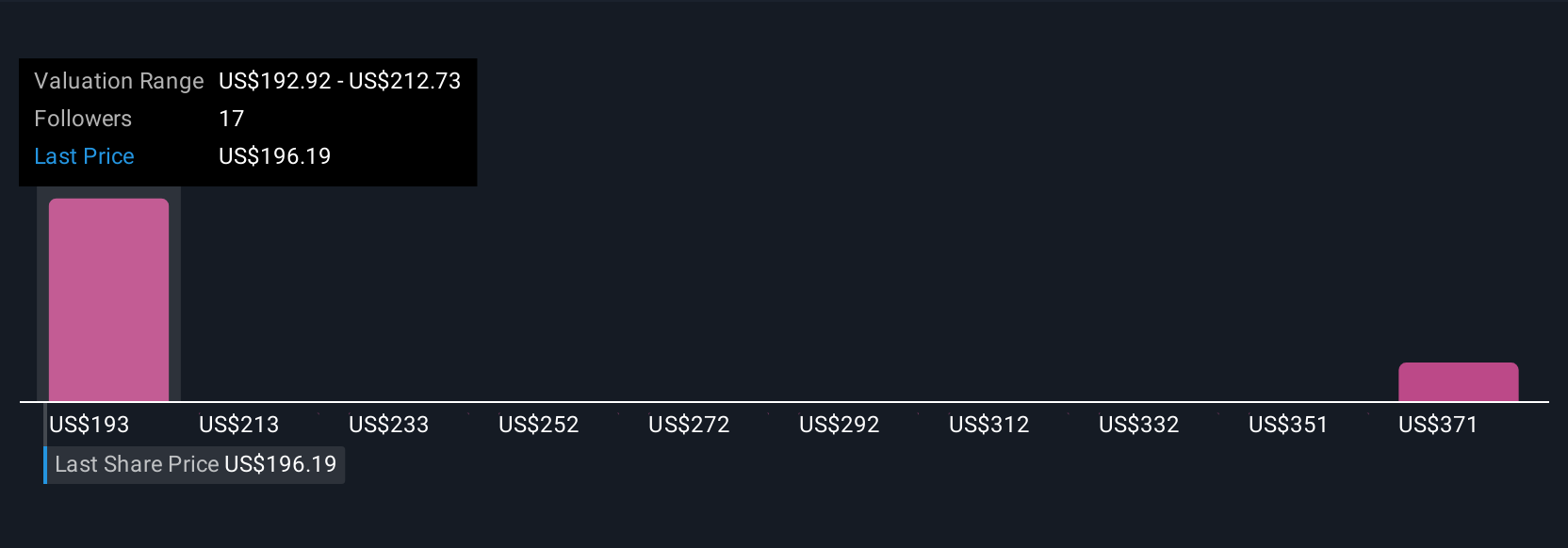

Earlier, we mentioned an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story, a clear, personal perspective that connects a company's business outlook with realistic financial forecasts and your own sense of what it's worth today. Narratives make it easy to turn headlines, forecasts, and market moves into a framework for buy or sell decisions by linking your view of M&T Bank's future growth, margins, or risks directly to fair value, all dynamically updated as new news or earnings arrive.

You can access and create these Narratives right on Simply Wall St’s Community page, a tool used by millions, so you’re never deciding in a vacuum. It lets you compare your fair value to the current price at a glance, helping you decide if M&T Bank is a buy, hold, or sell. For instance, some see M&T Bank’s strong fee growth, share buybacks, and capital discipline driving a price target as high as $240 per share, while those more cautious about deposit and margin pressures see fair value closer to $175. Narratives show these real differences, grounding your decision in the numbers but led by your story.

Do you think there's more to the story for M&T Bank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTB

M&T Bank

Operates as a bank holding company for Manufacturers and Traders Trust Company and Wilmington Trust, National Association that provides retail and commercial banking products and services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.