- United States

- /

- Banks

- /

- NYSE:LOB

Can Restatements and Legal Scrutiny Reshape Live Oak Bancshares' (LOB) Management Credibility?

Reviewed by Sasha Jovanovic

- Earlier this month, Live Oak Bancshares announced it will restate its 2024 Annual Report and quarterly reports for 2025 due to a material misclassification of cash flows associated with loan participations, prompting legal investigations by several law firms.

- This development has raised questions about the accuracy of past financial statements and the company's disclosure practices, which may impact investor confidence.

- We'll explore how the need to restate financial statements and the resulting legal scrutiny might impact Live Oak Bancshares' investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Live Oak Bancshares Investment Narrative Recap

Owning Live Oak Bancshares stock is largely about believing in its ability to scale digital banking and SBA lending while navigating regulatory and tech-driven changes. The recent disclosure of a material cash flow misclassification and resulting legal investigations may influence near-term investor confidence, but the biggest catalyst, expanding digital product adoption, remains relevant. The most significant short-term risk now is heightened regulatory and legal scrutiny, which could influence operational costs and management attention, but its full materiality is still being assessed.

Among recent announcements, the company’s November 18, 2025, decision to declare another quarterly dividend despite the restatement news stands out. This move signals a continued effort to assure investors about capital strength and commitment to returning value, factors that can be pivotal as the market digests financial reporting issues and gauges the sustainability of the company’s core lending and digital initiatives.

In contrast, investors should be aware that ongoing regulatory scrutiny and compliance costs could...

Read the full narrative on Live Oak Bancshares (it's free!)

Live Oak Bancshares' outlook anticipates $1.1 billion in revenue and $328 million in earnings by 2028. Achieving this would mean sustaining a 37.6% annual revenue growth rate and increasing earnings by $271.9 million from the current $56.1 million.

Uncover how Live Oak Bancshares' forecasts yield a $42.00 fair value, a 31% upside to its current price.

Exploring Other Perspectives

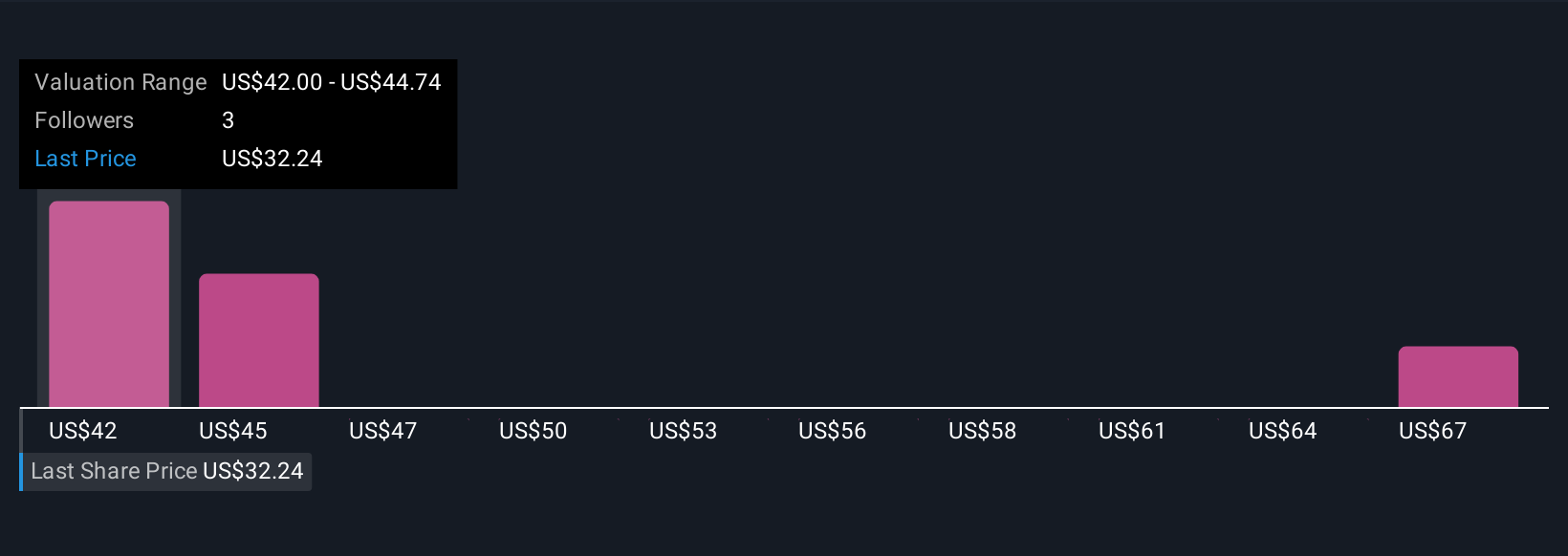

Simply Wall St Community fair value estimates for Live Oak Bancshares range widely from US$42 to US$69.40, with three unique perspectives. As regulatory scrutiny sharpens following recent restatement disclosures, your view on risk management could very well shape how you interpret these valuations and the company’s future.

Explore 3 other fair value estimates on Live Oak Bancshares - why the stock might be worth over 2x more than the current price!

Build Your Own Live Oak Bancshares Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Live Oak Bancshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Live Oak Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Live Oak Bancshares' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOB

Live Oak Bancshares

Operates as the bank holding company for Live Oak Banking Company that provides various banking products and services in the United States.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)